U.S. Energy Sector Poised to Regain Dominance

Russia’s invasion of Ukraine has triggered plans by many oil and natural gas importing countries to curtail Russian imports and transition to what may be perceived as more reliable, less unsavory sources of supply, while accelerating their transitions to green energy – opening the door for the U.S. to re-emerge as the world’s dominant oil and gas provider.

Reducing dependency on Russian energy will be onerous, particularly for Europe, which imports about 30% of its natural gas and 25% of its oil from Russia. So far, the U.S. and some EU countries have curtailed imports of Russian crude oil and if more countries follow suit, there will be strains in the global markets to adjust to accommodate a reconfiguration of the 5 million Bbl/d (barrels per day) of waterborne exports from Russia. Indeed, Russia’s oil tanker exports are being offered at a significant discount of roughly $30/Bbl to Brent, indicating that new buyers aren’t fully absorbing demand lost in the boycott.

Recent releases from the U.S. Strategic Petroleum Reserve (SPR) (30 million Bbl) and from international partners (30 million Bbl) provide minimal relief. Potential deals – if they could even be reached – with Iran (1 million to 1.5 million Bbl/d) and Venezuela (less than 1 million Bbl/d) would still not be enough to fill the void. If anything, the recently announced historic SPR release (1 million Bbl/d for six months) suggests that these deals are unlikely to be completed soon and emergency responses are needed to meet demand.

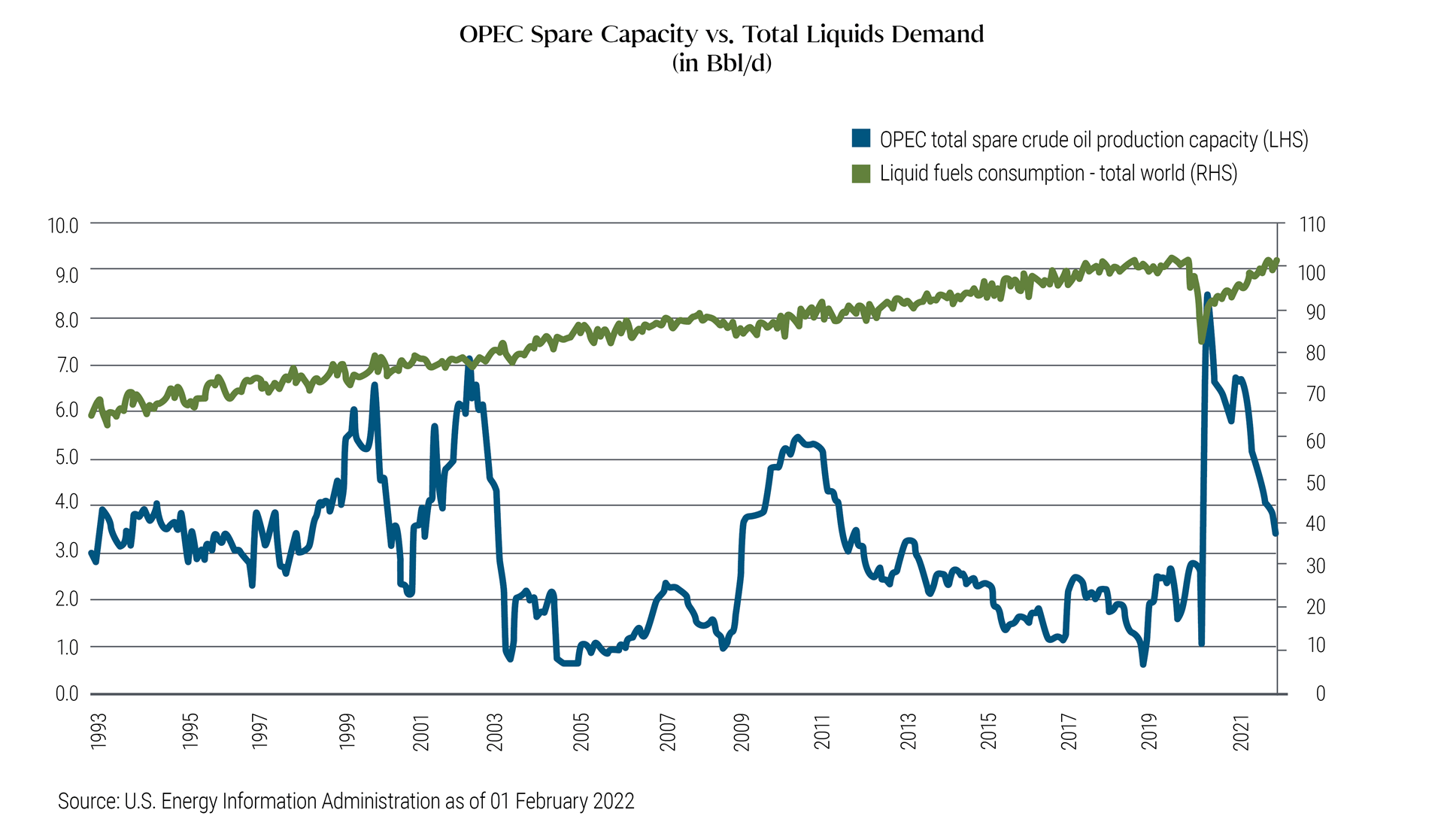

The war in Ukraine comes at a particularly vulnerable time of tight inventory and a low backlog of oil wells, with little room for disruption. According to the U.S. Energy Information Agency, prior to Russian sanctions, OPEC+ excess capacity stood at only 3%-3.5%, or roughly 3-3.5 Bbl/d, down from about 8% to 9% in 2002. However, from recent discussions with energy officials in the Middle East, true spare capacity could be even lower at just 2.5%.

We believe OPEC+ will likely stick to its current plan and not increase output further, despite higher oil prices. This is because if the cartel decided to bring more volumes online, the investment community might react to the prospect of little-to-no spare capacity by sending oil prices even higher. Moreover, Russia is joint chair of OPEC+, leaving it unclear whether it will be able to fulfill its share of the cartel’s production.

U.S. shale oil production positioned to regain dominance

The U.S shale industry – which produces both crude oil and natural gas – is well-positioned to increase production in the lower 48 states, but it will take time. During the last few years, energy producers curbed spending on new wells, following two mini U.S. shale boom and bust cycles, the latest causing roughly $55 billion of defaults. Responding to shareholder demands for strong investment returns, producers pivoted from a focus on production growth (“drill baby drill”) to one of capital discipline – maintaining modest leverage metrics and consistent cash returns on volume growth of just 0% to 5%.

As a result, exploration and production (E&P) operators face shortages in oil rigs (utilization is approaching 90%), frac fleetsFootnote[i] (which are completely sold out), and labor. E&P executives have indicated they could deploy more capital and maintain high profitability levels – thanks to improvements in drilling and completion technology – but estimate it will take them up to 12 months to increase current production volumes. In our view, the U.S. Shale “3.0 model” (e.g., spending within cash flow) of reliable production volumes and consistent cash returns could make U.S. energy attractive to countries overseas over the medium- to long-term.

Rising oil prices set to accelerate green energy investments

Along with growth in U.S. shale production, we expect recent geopolitical events and consequent rise in oil and gas prices to accelerate investments in green energy. As green energy becomes a larger component of the overall global supply, traditional U.S. oil and gas will likely remain a dependable baseload power source in the overall market.

Investment implications

The global energy shortage and consequent elevated price levels seem likely to persist in the medium term, sparking a resurgence in U.S. shale oil and natural gas production. Yet, history has shown that energy investing is fraught with risks and bouts of elevated volatility. A new COVID-19-related global lockdown or a Fed overshoot in the current hiking cycle could start a global recession, diminishing demand and prices for hydrocarbons. We approach this sector carefully by leveraging deep expertise across the entire energy value chain and maintaining appropriate risk mitigation.

OPEC’s spare crude oil production capacity is only about 3% of total demand

For more insights on commodities and inflation, please visit our Inflation and Interest Rates page.