Agency MBS: Opportunities for Alpha in a Post-QE World

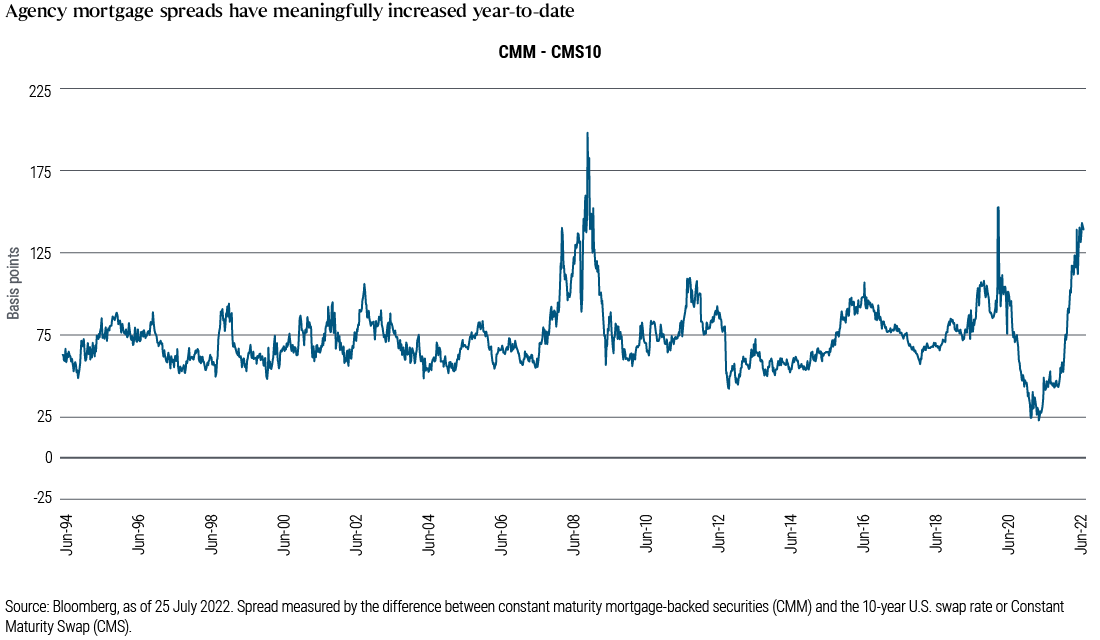

Mortgage rates have climbed this year at one of the fastest paces on record. Yields on agency mortgage-backed securities (MBS) have soared to 4.17% in July 2022 from 1.98% in January. Spreads of MBS have widened amid macroeconomic uncertainty, spikes in interest rate volatility, and, most importantly, concerns over the Fed’s runoff and eventual sale of MBS. The spreadFootnotei on agency MBS has surged since last November when the Fed indicated it would stop MBS purchasesFootnoteii, from a low of 37 bpsFootnoteiii before the announcement to 139 basis points (bps)Footnoteiv today.

This environment, while unnerving, provides compelling opportunities in a portion of the MBS universe. The Fed’s involvement in the agency MBS market is not uniform, and certain pockets of the sector will likely be less impacted than others. We believe by avoiding bonds that are more exposed to the volatility wrought by Fed policy and focusing instead on bonds trading at more attractive valuations and less exposed to the Fed, active managers can generate meaningful alpha in a post-Fed-tightening world.

Lower-coupon MBS will likely feel the brunt of the Fed exiting the market. Lower-coupon MBS (2.5% and below) have slid to about 10 points below par (or 90% of face value)Footnotev as of July 2022 – and we see further downside potential ahead. The Fed’s MBS holdings consist disproportionately of lower-coupon securities, which it purchased during the most recent quantitative easing (QE) period in 2020 and 2021. As the Fed reduces the MBS on its balance sheet, we believe prices of lower-coupon securities will be much more pressured than the rest of the agency MBS market. Moreover, bonds with lower coupons have more sensitivity to rising interest rates and the resulting slowdown of home sales. This is because the lower coupons receive a substantial amount of their return from prepayments or the turning over of homes, and investors receive 100-00 back (i.e., par value). A slowing housing market reduces turnover and we expect its impact on lower coupons to be materially high. We prefer to own bonds where more of the return is driven by a larger fixed-rate coupon rather than a less predictable and likely slowing turnover speed. Further, lower coupons do not offer enough current income (carry) advantage to cushion from further potential interest rate rises or from spread duration (i.e., a change in price caused by a change in spread). In short, although prices have fallen to considerably low levels, the Fed’s balance sheet reduction plan, coupled with lower spreads than higher-coupon MBS, continue to make lower-coupon mortgages relatively unattractive.

Higher-coupon MBS will likely be less affected by the Fed, and are currently trading at more attractive valuations. Prices of higher-coupon MBS have also dropped precipitously this yearFootnotevi, but due to the recent rapid decline in mortgage refinancings, they offer a much more attractive risk/return profile than lower-coupon MBS. To be sure, investors can take advantage of increased current income and spread in higher coupons while avoiding the risk of heavier Fed sales in lower coupons. The Fed owns nearly 70% of lower-coupon agency MBS in circulation and when the Fed begins to sell its holdings, we expect it to focus on selling its largest position, which will adversely affect lower-coupon bonds, while higher-coupon bonds will likely incur less of a direct impact. This bolsters the compelling case for investing in higher-coupon MBS over lower-coupon MBS today.

While passive managers will be compelled by index composition to be over-exposed to the Fed and to weaker-valued lower-coupon agency MBS, active managers can focus on the more attractive higher-coupon investments.