What you will learn

- How a bond works

- The evolution of the market and the key categories of bonds

What is a bond?

At the most basic level, a bond is a fixed income investment representing a loan made by an investor to a borrower, which includes governments, companies, and other entities issuing bonds to raise money from investors when they need new sources of capital to fund their activities.

When investors purchase a government bond, they are effectively lending the government money. When investors buy a corporate bond, they are lending a company money.

Like a loan, a bond pays a periodic interest payment known as a coupon to the bondholder. At the end of the bond's life – called maturity – the principal is paid back to the investor.

Bond investing example

A company wants to build a new manufacturing plant that will cost $1 million. To raise the money needed, company executives decide to issue a corporate bond. Each bond will be issued at $1,000 – this is known as the face value of the bond.

The company – or bond issuer – offers a coupon of 5% per year to be paid quarterly. The bonds will mature after five years, at which time the company will repay the $1,000 face value to each bondholder.

Are bonds and fixed income the same?

Basically, yes. The term fixed income is often used interchangeably with the term bonds. This is because bonds are the most commonly known type of fixed income security.

Technically, “fixed income” covers any security where the issuer is obligated to pay the lender fixed payments at fixed times. What can be confusing for investors is that fixed income does not always mean the bond pays a fixed dollar amount as bonds can have a fixed rate or floating rate. The word 'fixed' in fixed income refers to the obligation to make payments at set times.

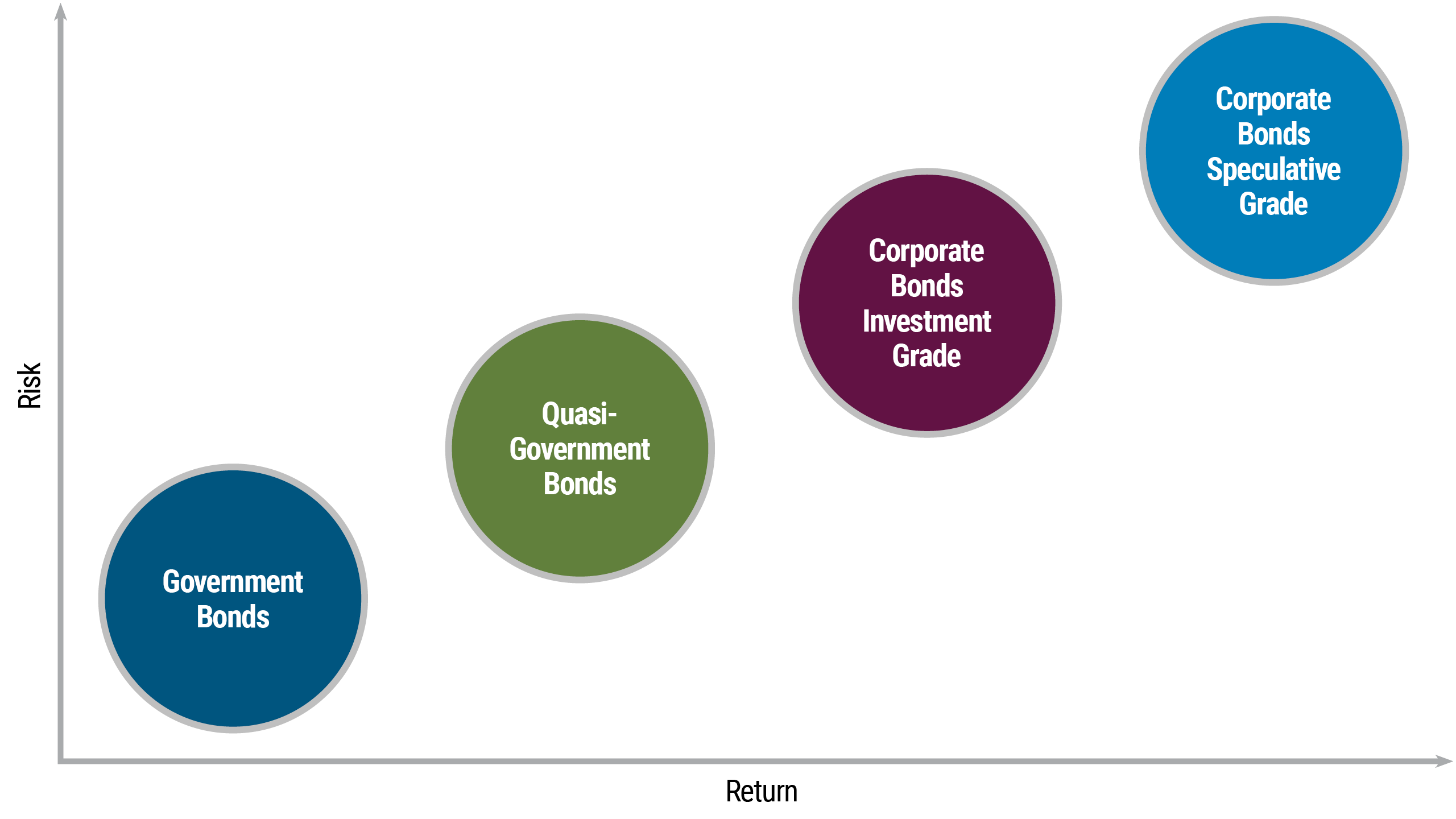

Various bond types

Broadly speaking, government bonds and corporate bonds remain the largest sectors of the market. The chart below provides an overview of the key categories of bonds through a potential risk/return lens.

In developed market economies, government bonds are generally considered low- risk investments. However, this is not true for all markets, and investors need to be aware that some government bonds, for example those issued in emerging markets, may carry higher levels of risk. On the flipside, such bonds can provide investors with access to investments offering different income and growth profiles.

Corporate bonds fall into two broad categories – investment grade and speculative grade (also known as high yield or junk bonds). Speculative grade bonds are issued by companies perceived to have lower credit quality and higher default risk than more highly rated or investment grade companies. Ratings can be downgraded if the credit quality of the issuer deteriorates. Conversely, they can be upgraded if fundamentals improve.

Government bonds: Sovereign bonds issued and generally backed by a central government. Examples include:

- Treasury Bonds

- UK Gilts

- U.S. Treasuries

- GoCs (Government of Canada Bonds)

- German Bunds

- JGBs (Japanese Government Bonds)

Several governments also issue sovereign bonds that are linked to inflation known as inflation-linked bonds, such as TIPS (Treasury Inflation-Protected Securities) in the United States.

Government agency bonds: Government agencies and quasi government agencies issue bonds to fund their projects and programs. Some agency bonds are guaranteed by the central government while others are not. Supranational organizations like the World Bank and European Investment Bank also borrow in the bond market to finance public projects and other development.

Local government bonds: Local governments – whether territories, states or cities – issue bonds to fund new developments as well as general operations. In the United States, these bonds are known as municipal bonds. The market for local government bonds is well established in the United States and has grown significantly in Europe in recent years.

Emerging market bonds: Sovereign and corporate bonds issued by developing countries are also known as emerging market (EM) bonds. Since the 1990s, the EM bond market has developed and matured to include a wide variety of government and corporate bonds. They are issued in major external currencies including the U.S. dollar and the euro, as well as local currencies (often referred to as emerging market local bonds).

Mortgage-backed securities (MBS): Mortgage-backed securities are bonds that are created through the securitization of the mortgage payments of property owners. The loan repayments from these mortgages are bundled together into a security that pays an interest rate similar to the mortgage rate being paid by the property owner.

Agency MBS: Issued by government agencies Fannie Mae, Freddie Mac, and Ginnie Mae, MBS are typically issued as either 30-year or 15-year fixed-rate securities (with 30-year being by far the most common). These bonds have coupon rates that are broadly reflective of the average mortgage rate of the underlying mortgage in the agencies’ pools. Fannie Mae, Freddie Mac, and Ginnie Mae make up the nearly $8-trillion agency MBS market, the world’s second largest bond market outside of U.S. Treasuries. Nearly $200 billion agency mortgage bonds trade daily, making these the second most liquid market in the world after U.S. Treasuries. Principal Only (PO) CMOs: These bonds only receive principal from a mortgage, not interest. Because they are not receiving any interest and are only looking to receive principal back, investors are hoping mortgages prepay as quickly as possible to maximize their return on these assets.

Asset-backed securities: These bonds are created from car payments, credit card payments, and other loans. As with mortgage-backed securities, similar loans are bundled together and packaged as a security that pays interest to investors. Special entities are created to administer asset-backed securities, allowing credit card companies and other lenders to move loans off their balance sheets. Asset-backed securities are usually offered in tranches, meaning the loans are bundled together into higher-quality and lower-quality classes of securities.

Pfandbriefe and covered bonds: Pfandbriefe are a type of covered bonds issued by German mortgage banks that is collateralized by long-term assets. These types of bonds represent the largest segment of the German private debt market and are considered to be the safest debt instruments in the private market. German securities secured by mortgages are known as Pfandbriefe. The key difference between Pfandbriefe and mortgage-backed or asset-backed securities is that the banks keep the loans on their balance sheets. Because of this feature, Pfandbriefe are sometimes classified as corporate bonds. Other countries in Europe are increasingly issuing Pfandbriefe-like securities known as covered bonds.

A brief history

Prior to the 1970s, the bond market was primarily a place for governments and large companies to borrow money. The main investors in these bonds were insurance companies, pension funds and individual investors.

The modern bond market began to evolve in the 1970s, when bond supply increased and investors learned there was money to be made buying and selling bonds in the secondary market.

As investor interest grew, and faster computers made bond mathematics easier, so did the appetite to create innovative ways for borrowers to tap into the bond market for funding, and for bond investors to tailor their risk/return potential. The result: Today’s bond market consists of a diverse range of issuers and bond types.

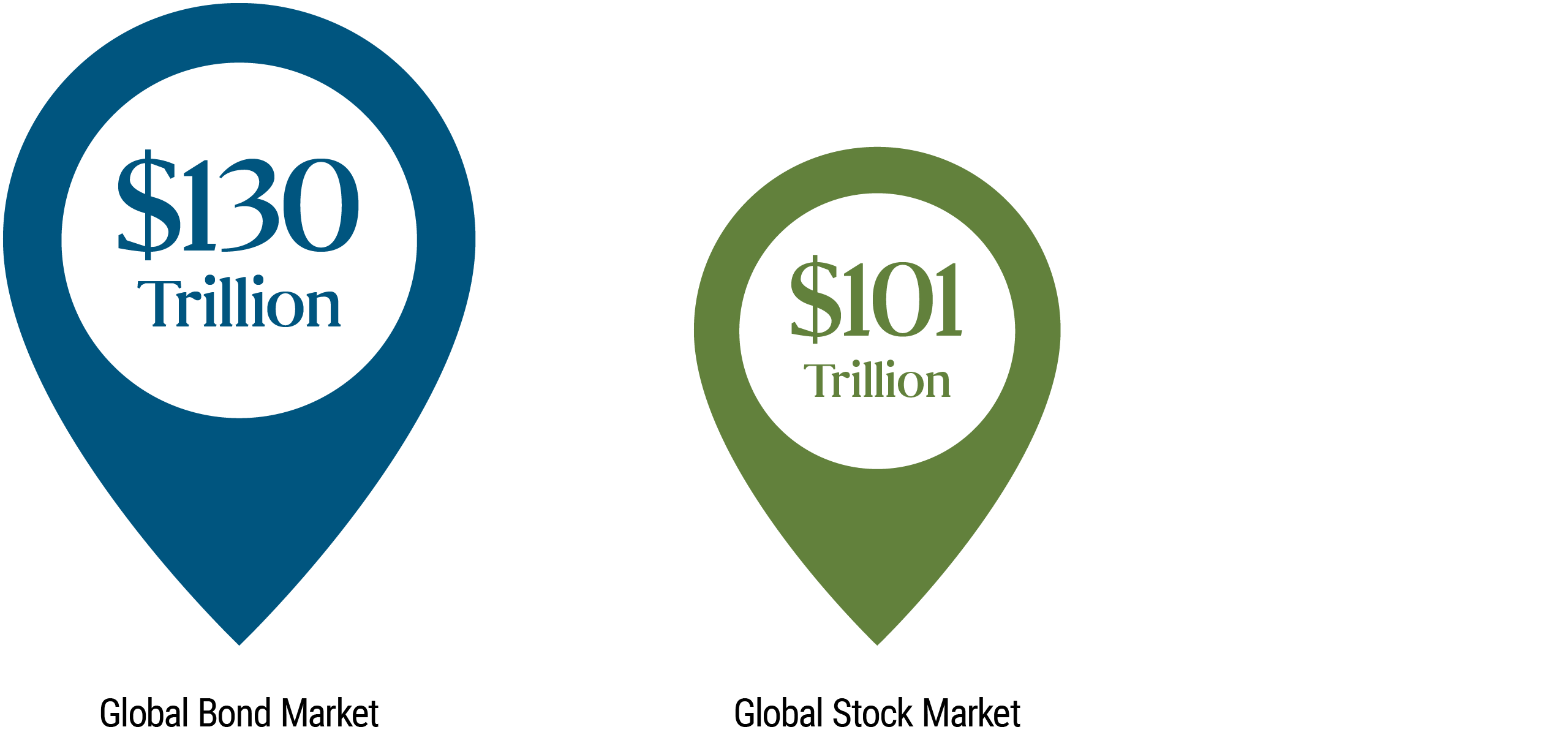

Historically, the United States has had the deepest bond market, but in more recent years, other markets have developed. There is now a large and healthy global market valued at approximately $130 trillion, compared to the global stock market valued at approximately $101 trillion.

Download 5 Things You Need to Know About: Bonds for more information.