I graduated with an MBA from Columbia University twenty years ago this month. The economy was in a nasty recession, a modern day depression, really. Inflation was running at double digit levels. In large part, both of these outcomes were a consequence of the preceding tripling of oil prices, which had peaked near $40 a barrel earlier in 1981. What a time to be looking for my first real job! But I found one, in the oil business, naturally, with Conoco Inc., laboring as an economist in the Coordinating and Planning Department.

I didn't do much coordinating and planning of anything, actually, as I was assigned to the US Economic Policy Analysis Group, which was a de facto in-house think tank and speech writing unit for Conoco's CEO, Ralph Bailey. I held the job for two years, before moving to Wall Street in 1983. Basically, I was paid to spin clever rhetoric 'round the conventional (Republican) wisdom of the time; even got to write over my own byline sometimes!

The two big questions on my plate for most of my time at Conoco were: (1) what could/should the government do to promote faster productivity growth; and (2) what should the government do to "save" Social Security. These topics were offered up for different reasons. On the productivity front, Mr. Bailey had a deep personal interest, as he had successfully made enhanced productivity his mantra while running Conoco's coal subsidiary, Consol, which catapulted his career to the top of Conoco. And since he had made productivity growth hum through turbo-charged investment at the cutting edge of technology, his natural instinct was to assume that what had worked in the coal business just might work in the economy at large.

Therefore, most of my writing on the productivity matter inevitably built to the conclusion that the government should take steps to promote business investment. And no surprise (remember, Ronald Reagan had just been elected), the punch line was always that tax cuts for business were the best way to promote business investment to promote productivity! My favorite ghostwritten one-liner went something like this: "It is not reasonable for government and business to ask labor to lean a heavier shoulder to the wheel unless government and business are willing to commit to constantly improving that wheel." Some variant of that slogan was always good for a press quote for the boss! Heady stuff for a twenty-four year old kid, whose biggest investment decision was whether to buy beer by the six- or the twelve-pack.

I was tasked to the Social Security issue for a different reason: Conoco had an intense interest in the work of the on-going National Commission on Social Security Reform, headed by none other than Alan Greenspan. With a large work force and a comprehensive defined-benefit retirement plan, which included a Social Security "offset" (most all such plans have one, did you know that?), structural changes in Social Security would have a direct impact on the company. So I spent a huge amount of time studying the entrails of Social Security, learning all about "bend points"(know what they are?) that make Social Security payouts progressive, mitigating the sting of the regressive nature of Social Security taxes.

I wrote a big paper on it all, which was distributed all over the place, and became a feature article for the company magazine, Conoco World. Conoco even commissioned artwork for the article (remember, oil companies were gushing profits at the time), which they gave me and which hangs to this day in my home. The bottom line of all that research was really quite simple: Americans need a three-legged stool of retirement income: government savings (Social Security), business savings (defined benefit plans and/or defined contributions), and personal savings (defined contribution plans and other savings). No surprise, my advocacy position was that government needed to temper the burden on Social Security while incenting more personal savings via, you guessed it, tax cuts and tax shields.

A fun two years I had at Conoco (a PIMCO client, by the way). And twenty years latter, I'm still studying the same two things! The connections between (1) investment and productivity on the one hand, and (2) savings and investment on the other hand are still the two public policy linkages that really matter. Indeed, the Fed is fretting at the moment about whether it fostered a bubble in investment that created a bubble in measured productivity, while President Bush has just appointed another Social Security Commission. De ja vu all over again. If only I could still fit into that 40-long suit that I wore twenty years ago. But not to be, as what is is, regardless of what your definition of is is.

In fact, the dominant macroeconomic risk back then was hyperinflation borne of deficient global aggregate supply, while the dominant macroeconomic risk of today is deflation borne of deficient global aggregate demand. Back then, super tight monetary policy was needed to throttle aggregate demand, while business tax cuts were needed to goose aggregate supply (yes, that was the Reagan program and it was the right economics for the time, even if the Democratic Party, with which I'm affiliated, disagreed). Now, the right policy mix is both super easy monetary policy and household tax cuts to goose aggregate demand, with tighter regulatory constraints to curb moral hazard in the supply of speculative financial capital. A very different world.

Figure 1

Source: Book of Governors, Bureau of Economic Analysis

That Was Then

The predominant secular economic risk twenty years ago was hyperinflation, defined as expectations of accelerating inflation that have become so ingrained in the household, business, and government decision-making process as to become self-fulfilling in an ever-accelerating way. I stress this definition of "hyper" inflation, rather than as some number for inflation. Indeed, perhaps "hyper" is the wrong suffix, as it conjures up the notion of people pushing 'round wheelbarrows of paper money to buy a loaf of bread. America never faced such a prospect twenty years ago. What it did face was a widespread, and increasingly self-fulfilling effort by all economic agents to (1) protect themselves from accelerating inflation, or (2) to benefit from accelerating inflation. Both contractual and informal indexation of future income streams to the rate of inflation were becoming ever more pervasive, including in the payment of government benefits.

One notably exception was the tax code, which because of the lack of indexation, became ever more arbitrary and nefarious: (1) pushing households into ever higher marginal income tax brackets, effectively increasing real tax burdens; and (2) undermining the real value of depreciation deductions against business tax obligations, effectively forcing businesses to "send their seed corn to Washington" (or something like that, if I remember correctly from my ghost writing youth!). Equally important at the time, perhaps, the household sector had no real way of protecting itself from "the ravages inflation and taxation" except to speculate, in houses: a shelter from (1) current taxes via interest deductions and (2) future taxes via perpetual deferral of capital gains taxes, as long the winnings were deployed into, you guessed it, houses.

It really was a sad time for capitalism, as the entrepreneurial spirit was consumed by arbitraging around the unholy alliance of self-feeding inflation and noxious, capricious taxation. And the right policy mix to breaking that alliance was indeed draconically tight monetary policy, and supply side tax cuts — to wit, Volcker + Reagan! As it happens, of course, Mr. Volcker and Mr. Reagan didn't exactly coordinate their policies. Quite to the contrary, the two men played a massive game of chicken with each other.

Volcker pursued a scorched-earth policy of bankrupting anybody who had borrowed money on expectations of ever-rising inflation, including thrifts and banks at home, and sovereign borrowers abroad. And Reagan pursued a policy of de facto subsidizing business investment, effectively eliminating corporate taxes via aggressively accelerated deprecation on massively shortened useful life assumptions for business investment. Both monetary and fiscal policies authorities seemed to be employing Mae West as an advisor, deploying the adage that if a little of something is good and more is better, then way too much is just about right. It wasn't, and Mr. Volcker was forced to relent and ease massively in 1982, so as to avoid ripping the fabric of the global financial system; and Mr. Reagan was forced into a mid-course correction in 1983, stiffening the tax code for businesses so that businesses actually paid some taxes.

In retrospect, none of this policy maneuvering is surprising, although it was to those of us who experienced it at the time (and I'm not just talking about the young bucks; the graybeards were bewildered and befuddled, too!). At a major secular turning point away from accelerating inflation, monetary and fiscal policy are inherently in conflict, as monetary policy, which is one-step removed from the democratic process, will seek to induce a recession/depression, while fiscal policy, which is the sinew of democracy, will seek to relieve the pain of a recession/depression.

And indeed, that inherent conflict was not just evident in business cycle management policies, but financial regulatory matters. Before accelerating inflation gripped the system, one simple regulation, known as Regulation Q, brought tranquility to the system. Deposit rates were capped at "reasonable" levels (below 5%), while savings and loans were legally permitted to pay one-quarter percentage point more than banks.

As long as inflation stayed below the Regulation Q limits, this regulatory set-up provided for stability in the system: (1) the Fed could impose restraint simply by driving open market interest rates slight above the "reasonable" levels that banks and thrifts could legally pay, inducing a shortage of credit for new borrowers without simultaneously bankrupting existing borrowers; and (2) housing was assured of credit availability during "normal" times, as savings and loans could attract funding via their twenty-five basis point "competitive" advantage over banks. Indeed, this regulatory setup gave birth to the concept of 3-6-3 banking: take in deposits at 3%, lending them out at 6%, and be on the golf course by 3 p.m.

But alas, accelerating inflation to many, many percentage points above Regulation Q ceilings, incentivized the development of liquidity markets unstrained by Regulation Q, notably the euro deposit market and the money market mutual fund. And that was all she wrote for the solvency of the banking and thrift industries, particularly when Volcker set about to bankrupt their borrowers who had bet on accelerating inflation. In response, the Reagan Administration and Congress (together!) took bank and thrift de facto insolvency on to Uncle Sam's balance sheet, (1) hiking the deposit insurance ceiling from $40 thousand to $100 thousand per account, while (2) removing deposit interest rate ceilings, and (3) dramatically relaxing restrictions on permitted assets.

Simply and bluntly put, the fiscal authority "recapitalized" the de facto defunct depository system with an injection of taxpayer-financed moral hazard (heads, depositories' shareholders win; tails, the taxpayer picks up the tab!). And as with the case of extreme monetary and fiscal policy reactions to "hyper" inflation, this financial deregulatory reaction went too far, setting the stage for a bubble and then deflationary bust in intermediaries' assets (notably real estate) by the beginning of the 1990s. And that result required both an explicit tax-payer bailout of the thrift industry, a de facto re-instatement of Regulation Q, in the form of Fed "legislated" flat-to-negative real short term interest rates.

So, with the benefit of twenty-year twenty-twenty hindsight, it is obvious that (1) disinflationary monetary policy, (2) supply side-oriented fiscal policy, and (3) de-regulatory financial policy were a logical policy trinity in wake of "hyper" inflation. And they worked. Expectations of ever-accelerating inflation in the 1970s gave way to expectations of ever-decelerating inflation during the 1990s. Capitalism triumphed!

From Triumph To Hubris

Celebrating capitalism's triumph against "hyper" inflation, the nation's leaders embraced what I call "brute force" capitalism: (1) the total surrender of fiscal policy to monetary policy in the counter cyclical aggregate demand management; (2) the total devotion of fiscal policy to secular "crowding in" of private investment via budget surpluses; and (3) the unalloyed embrace of capital markets as the conduit for intermediation of capital between savers and users of savings, with the banking system relegated to backstop liquidity support role.

For me, nothing so memorialized the transformation of capitalism from a secular disinflationary mission to a secular pro-investment mission as President Clinton's first address before Congress in February 1993. He announced that the Democratic Party would become the party of root canal fiscal policy, aiming for a lower budget deficit with tax hikes and spending restraint. On the face of it, such a policy could be reasonably expected to restrain aggregate demand, but President Clinton had made a pact with the capitalistic gods and their man on earth, Mr. Greenspan, who was seated right next to First Lady Hillary Clinton for all the world to see. Mr. Clinton would stake his career on Mr. Greenspan's thesis that fiscal austerity would actually be virtuous for aggregate demand, as bond and stock markets would rejoice, goosing investment demand. Mr. Clinton staked his career on that pact with Mr. Greenspan. It was a good wager, for both him and the nation.

And nothing proved to be so sweet as the journey to capitalism: higher than expected growth, lower than expected inflation, and everybody getting rich, all at the same time! But as is the wont of the human condition, journeys beget hubris, as the joy of the journey comes to be viewed as the bliss of the destination. Such was the case as the 1990s drew to a close. Contrary to popular opinion of the time, the dalliance of destiny was not in the Oval Office study. Rather, it was a national love affair with investment, as the immediate growth-promoting effect of capital deepening was mistakenly taken to be one and the same as an enduring productivity miracle. The thrill of investment came to be viewed as the one and the same as the return on investment. It is not.

But what the hey, a bubble is fun while it is bubbling. Especially if the maven of the bubble machine, in this case Mr. Greenspan, maintains "plausible deniability" about the existence of bubbles! Indeed, Mr. Greenspan went even further than that and by the late 1990s, became a cheerleader for paying down the national government debt, so as to "crowd in" ever more private sector investment. More specifically, he forcefully argued that the first best use of fiscal surpluses was to pay down the national debt, and if that was not "politically feasible," the second best use of those taxpayers' monies was to return them to the taxpayers, rather than spend/invest them on the behalf of those very same taxpayers. Beyond that, he proselytized that marginal income tax rate cuts were the "best" way to return those tax dollars to the taxpayer (or the elimination of the capital gains tax, which he openly admitted he's always thought was a lousy way for the government to "raise revenue"). The third best, or worst outcome, Mr. Greenspan argued, would be for increase government spending, particularly for expanding or creating entitlement programs, which are invitations to "open ended" spending.

Fiscal authorities, having totally surrendered to the proposition that monetary policy was the straw that stirred the policy kool-aid, and that no fiscal action could be taken without Mr. Greenspan's approval. Indeed, President Clinton upped Greenspan's ante and declared in January 1998, in his first address to Congress after public exposure that he had been carnally fishing off the Oval Office dock, that the nation must "save Society Security first."

Democrats have, of course, always been pro-Social Security, for the simple reason that it is the most successful social program ever devised in a democratic society. And Mr. Clinton very cravenly, but cleverly, used the success of Social Security to thwart right-of-center Republicans' tax-cutting lust for federal surpluses. He declared "off limits" that portion of the surplus that was arising from "excess" Social Security taxes over Social Security payouts; only the surplus above and beyond the Social Security surplus should be made for discretionary political disposal. And since the Republican monetary god Mr. Greenspan was preaching the same thing, Republicans had little choice but to go along.

Clever dude, that Clinton, as surely he knew (and still knows!) that Uncle Sam works on a consolidated cash flow basis: every penny that comes in, regardless of the tax label on it, is either spent or used to retire/pay down marketable Treasury debt. Social Security has always been a welfare program transferring current income from the young to the old, always under a political umbrella of denial. There is not, and never has been, a "kitty" of legal claims on "real assets" to pay Social Security benefits, unlike the case in defined-benefit ERISA plans. The surplus accruable to "excess" payroll taxes is used to retire/pay down the marketable federal debt, and in return, the so-called Social Security trust funds receive non-marketable claims on the federal government's future cash flow from taxes of all types. Social Security cannot be "saved" by accounting, but only by the continued willingness of the electorate to grant the government tax command over private sector resources. There is, I want to stress, absolutely nothing wrong with this.

Social Security has always been a progressive welfare program, paying a progressively higher percentage of working income to the relative poor in retirement age (remember those "bend points" in the payout structure!). It is, and has always been, a safety net against abject poverty in old age, not an ERISA-style annuity. As a macroeconomic matter, future benefits are, and always been, a societal wager on continued macroeconomic success. Social Security is, and always has been, "secured" by simply the democratic (small D!) willingness of those paying to taxes to continue paying taxes.

On a twenty year horizon, when the baby boom generation starts nursing at the Social Security benefit trough (including massively-improved medical services at the hands of technology), it will not matter as wit as to how Uncle Sam accounts for today's tax revenues, with some monies earmarked for Social Security and some monies earmarked for general government services. Uncle Sam works on a cash flow budget. Twenty years from now, Uncle Sam will be paying out cash from all sources to the baby boomers. And Uncle Sam's ability to generate that cash will be the same as it is today: (1) the power to tax all things moving and not moving; (2) the power to print money; and (3) the power to borrow money "collateralized" by those first two powers. It's that simple.

The notion of "saving Social Security" by using "excess" Social Security taxes to reduce marketable Treasury debt has always been about de-levering Uncle Sam, so he can re-lever when the baby boom retires. At that time, the Treasury will need to start issuing marketable debt again, so as to "take out" the non-marketable debt (accounting entries!) in the Social Security trust funds. The key issue between now and then is how the nation uses the cash flow savings that Uncle Sam is supplying to the capital markets. Theoretically, those savings should "crowd in" productivity-enhancing capital investment, thereby increasing the real GDP "base" upon which Uncle Sam will have to re-lever when the baby boomers retire. Indeed, that was precisely the theoretical argument behind Mr. Clinton's Greenspan-endorsed advocacy of using surpluses to "save Social Security first.

What Mr. Greenspan never explained, however, is that all this "crowding in" via de-levering of Uncle Sam's balance sheet implies increased levering of the private sector's balanced sheet. To wit, the private sector must borrow back Uncle Sam's "excess" cash flow (after having sent it to him in the first place!). Thus, "crowding in" of private investment definitionally implies "crowding in" of private sector default risk (see Figure 2). Nothing wrong with that per se, as long as one believes that the secular return on private sector capital formation is greater than that for public sector investment. All "good" capitalists believe that as a religious matter; and I guess I do, too, though not so religiously as many perhaps.

Figure 2

Source: Book of Governors, Bureau of Economic Analysis

Figure 3

Source: B ook of Governors, Bureau of Economic Analysis

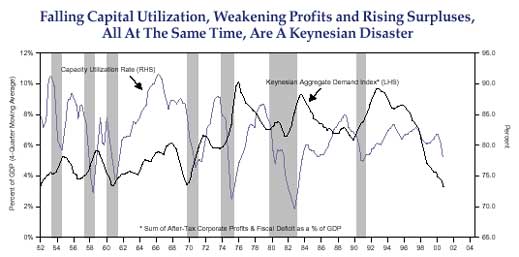

History teaches, however, that capitalist economies are inherently prone to cyclical booms and busts, as the thrill of investment victory gives way to the agony of profit defeat. That reality does not undermine capitalism's secular superiority over socialism. It does, however, scream for counter-cyclical fiscal policy. When innovation and new technologies are raising the return to private investment, a policy of fiscal surpluses is beneficial, thereby "crowding in" investment. When there is an excess of investment, however, manifesting in falling utilization of the nation's capital stock and plummeting profits, a policy of fiscal surpluses is not only irrational, but also noxious to the nation's economic health – "crowding in" investment that is not needed, and "forcing" the private sector to increase leverage, when logic implies it should actually be de-levering.

Fiscal prudence does not imply perpetual surplus. Indeed, Mr. Greenspan himself finally acknowledged this in January, when he counseled Congress that fiscal policy was on a secular path of excessive restraint, in that existing tax policy implied continued cash flow surpluses after the stock of marketable debt was reduced to an irreducible level. This concerned Mr. Greenspan from a capitalistic perspective, in that it implied a secular crossover from "crowding in" of private investment to Uncle Sam actually owning private sector obligations. Thus, Mr. Greenspan urged Congress to cut taxes, so as to put the nation on a "glide path" to un-levered government sector. This was a road-to-Damascus conversion for Mr. Greenspan, as he previously had never seen a surplus that he didn't like or that was too big. President Bush was, of course, the direct beneficiary of Mr. Greenspan's change of heart, putting octane into his campaign gas to cut taxes.

But the nation will be the greater beneficiary, if the just-passed tax cut is the beginning of a rational discussion about the need for counter-cyclical fiscal policy and debt management. There is no earthly or heavenly reason for Uncle Sam to be debt free. Fiscal prudence is about sustainable leverage, not no leverage. Indeed, the notion that the custodian of the global reserve currency should be debt free at the government level is a truly peculiar idea, with no support in any known economic theory. And when the economy is cyclically suffering from Post Bubble Disorder, the notion that Uncle Sam should be brute forcing increased private sector leverage is uniquely boneheaded proposition. What is needed is actually increased government leverage; yes, a fiscal deficit!

Which brings us back to the matter of "saving Social Security." I believe the political ruse of billing Social Security as a "paid in" retirement program, so as to camouflage the reality that it is a cash flow-driven welfare program, is the biggest macroeconomic policy problem of today. As fiscal authorities limit fiscal stimulus to Uncle Sam's cash flow surplus that is in excess of that which is generated by Social Security taxes, Uncle Sam will be de-levering his balance sheet and in the process, brute forcing increased leverage in the private sector. In my opinion, and in stark contrast to most Democrats who swallowed Greenspan's Calvinist fiscal kool-aid (which he has himself now un-swallowed), I see President Bush's just-passed tax package as too small, not too big. What is more, the tax cuts are exclusively income tax cuts. Nothing wrong with income tax cuts, I hasten to add, particularly if income tax credits are refundable to those who pay no income taxes, effectively creating a negative income tax rate for the poor. To their credit, principled populists of both parties forced President Bush to accept this provision.

But the fact remains that some 80% of Americans pay more in Social Security taxes than in income taxes: 7.65% themselves, and 7.65% on their behalf by their employers. From a Keynesian perspective, the incidence of the Social Security tax is particularly noxious in a cyclical downturn: (1) it falls disproportionately on low and middle class wage earners, who have a high marginal propensity to consume (income above $80,400 is exempt from Social Security taxes, except for the 1.45% Medicare portion); and (2) since Social Security taxes are a non-variable labor cost for business, the tax hammers unit corporate profits (margins) at a time when they are already under the hammer.

Bottom LineA Keynesian fiscal stimulus worthy of the name would include a cut in Social Security taxes. It really is that simple. Accordingly, as long fiscal authorities continue to drink the "save Social Security" kool-aid, the economy will suffer from not just Post Bubble Disorder, but Mae West Fiscal Calvinism. I wish it weren't so, but wishing is a lousy basis for forecasting change.

Thus, the Fed will remain the Keynesian of last resort in Washington, with no choice but to attempt to reflate deflating bubbles, accommodating levering of the private sector that is forced by the de-levering of the government sector. Whether that means fed funds at 3 ½% or 3%, I don't know. What I do feel strongly about is that once the Fed finishes easing, it will stay easy for a very, very long time – an "L" bottom for fed funds. Irrational exuberance, once the object of Mr. Greenspan's derision, has now become the objective of his fondest affection.

We have become prisoners of our own domain.

Paul A. McCulley

Managing Director

June 4, 2001