All Asset All Access: Long-Term Return Expectations, Near-Term Outlook, and the Inverted Yield Curve

Summary

- Research Affiliates’ long-term return estimates for all asset classes have increased meaningfully since the end of 2021 – meaning investors may be better positioned today to meet their portfolio objectives, even if they consider increased allocations to lower-risk, more defensive assets.

- Research Affiliates’ models estimate a high probability of economic slowdown in the U.S. The inverted yield curve is one signal of likely recession to come; the banking and financial sectors may feel significant stress.

- Within the All Asset portfolios, these heightened expectations of economic slowdown are prompting a preference for lower-risk assets, including bonds.

Jim Masturzo, CIO for multi-asset strategies at Research Affiliates, discusses the shift higher in their capital market assumptions as well as their outlook for slowing U.S. growth. Campbell Harvey, partner and director of research at Research Affiliates, explains how a key indicator of coming recession is flashing red, and what this may mean for the banking sector. As always, their insights represent Research Affiliates’ views in the context of the PIMCO All Asset and All Asset All Authority funds. All Asset All Access is published quarterly.

Views expressed here are from Research Affiliates as of 6 July 2023.

Q: How has recent market volatility influenced Research Affiliates’ capital market assumptions, which serve as the core analysis informing portfolio decisions within the All Asset strategies?

Masturzo: Over the past year and a half, our long-term (10-year) asset class return expectations have shifted significantly. If we think back to the end of 2021, assets were facing three strong headwinds: a rising global interest rate environment, increasing global inflation, and expensive valuations across most major asset classes. At that time, our long-term capital market forecasts showed an average expected return of 3.3% across 15 different asset classes.Footnote1 Today, for the same mix of assets, our average expected return is almost double, at 6.4%. Furthermore, this increase isn’t tied to a few assets, as every one of the 15 asset classes has a higher return expectation today than at the end of 2021, according to our research.

This across-the-board increase in expectations translates into a projected rise in the efficient frontier (i.e., the hypothetical set of investments that capture the highest returns relative to risk). When realized asset returns are negative – as they were in 2022 for all major asset classes except commodities – expected returns normally tend to rise. This can be good news for investors who focused on positioning portfolios in light of improving future opportunities. Even better news: A strict parallel rise in the efficient frontier may also allow investors to maintain their return per unit of risk with lower-volatility assets. This is a potential benefit of tactical asset allocation over strictly targeting a level of volatility for one’s portfolio.

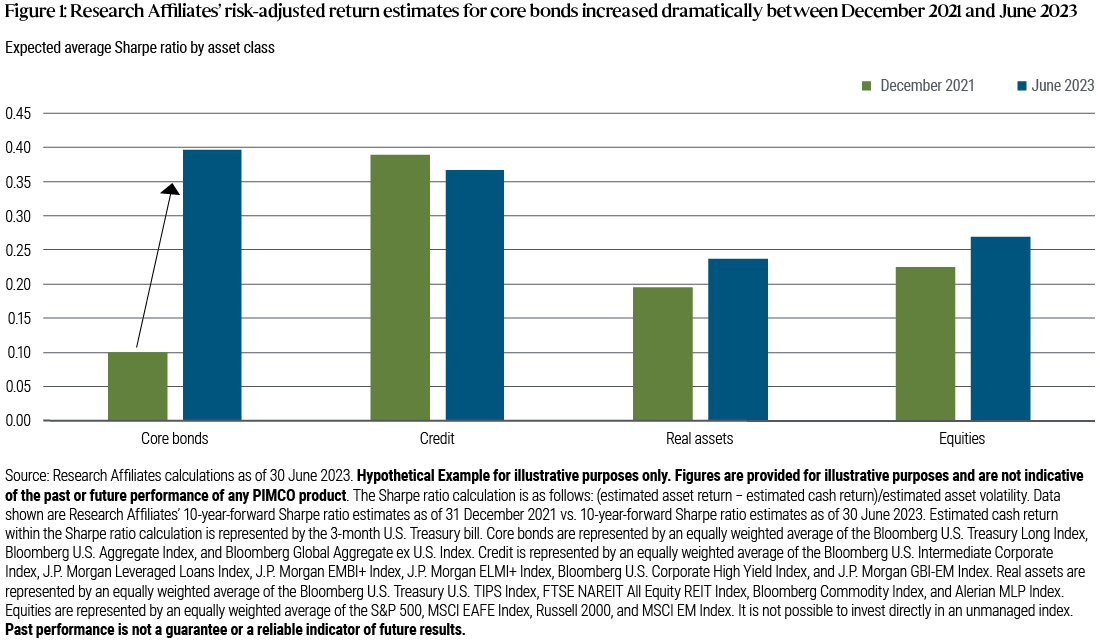

Taking this simple model of a parallel shift in the efficient frontier a step further, from December 2021 to June 2023 we’ve also seen a flattening of the yield curve, which means that the risk/return trade-off of lower-volatility assets appears more attractive than it did 18 months ago. Consider, for example, our expected increase in the Sharpe ratio (a measure of risk-adjusted return) for core bonds over that time frame (see Figure 1). Rising yields in bonds not only improved income potential but tended to improve bond valuations via reduced risk of future central bank rate increases. This flattening also led many investors to look to lower-risk assets over higher-risk assets, all else equal.

Q: Does Research Affiliates have views on the near-term environment that complement this long-term outlook?

Masturzo: Positioning in the All Asset strategies is not just informed by long-term expectations; we also consider our shorter-term forecasts for the global economy and markets within a business cycle. Whereas some business cycle models focus specifically on recessionary periods, at Research Affiliates we instead focus on economic growth relative to past trend. Historically, past trend has tended to provide a good indication of market expectations going forward, so any deviation from that trend can be thought of as a surprise – which in turn would affect how the market prices assets.

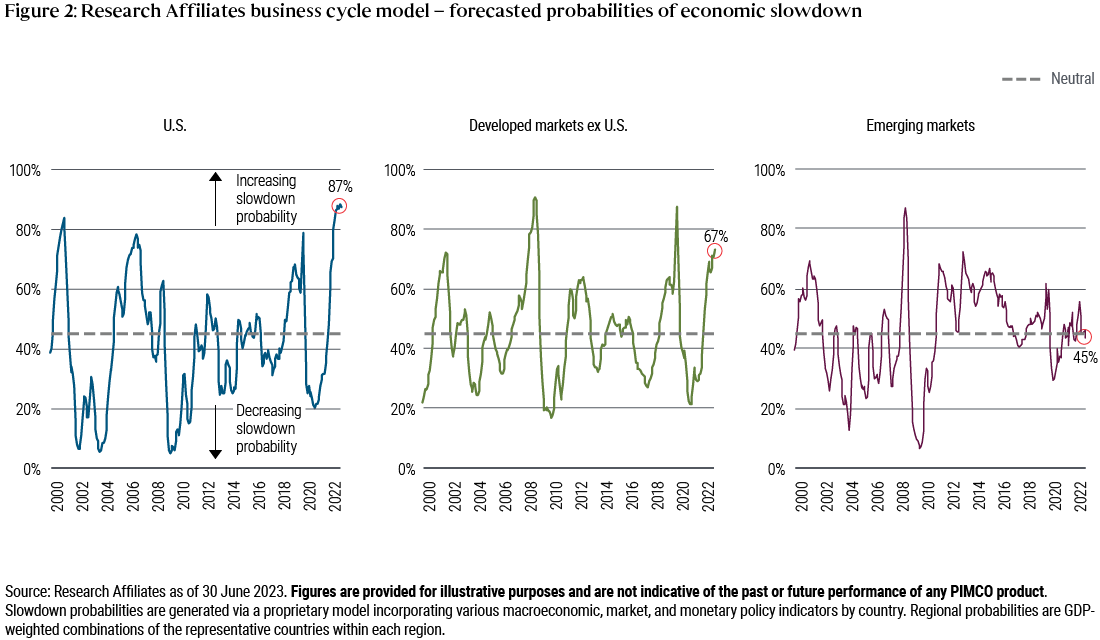

In the U.S., our models currently estimate the probability of economic slowdown – i.e., growth below trend – to be 87%, our highest estimate on record going back to the start of the millennium (see Figure 2). This means our models likewise show only a 13% probability of economic growth above trend. Although we see an extremely high probability that a slowdown will happen, it should not be misinterpreted as an indication of the expected magnitude of that slowdown. For example, the 87% we estimate today is higher than our estimate just prior to the global financial crisis, which means the economic indicators of slowdown are more aligned today; however, we don’t expect the coming slowdown will be more severe than the recession in 2008–2009. Additionally, we see heightened slowdown probability in other developed markets at 67% and about neutral odds of growth or slowdown in emerging markets.

Within the All Asset portfolios, the net effect of Research Affiliates’ heighted expectations of economic slowdown are a preference for lower-risk assets – namely bonds – over stocks, as bonds have historically performed better under similar circumstances.

Q: Why does Research Affiliates believe the odds of a U.S. recession have increased?

Harvey: Back in early January, I believed that a soft landing was possible for the U.S. economy due to excess demand for labor and stable consumer balance sheets. Unfortunately, a soft landing is looking less likely now. After waiting too long (in my view) to begin raising rates, the U.S. Federal Reserve compounded that mistake by subsequently waiting too long to pause after it began rate hikes. The yield curve inversion largely driven by these rate hikes has opened two causal paths to U.S. recession.

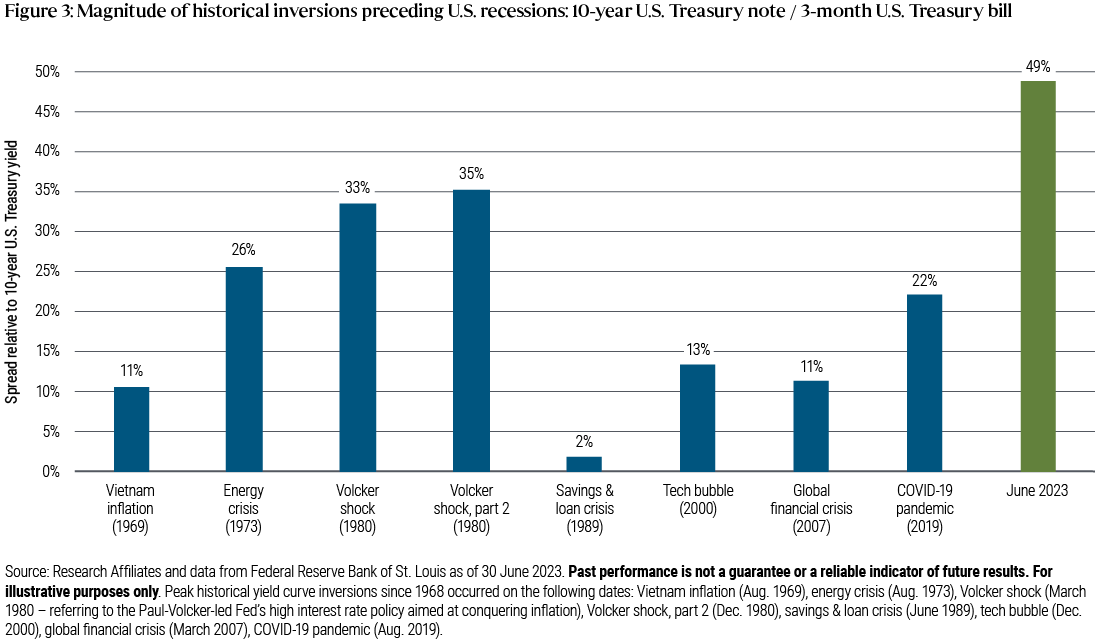

First, the track record of my inverted yield-curve signalFootnote2 tends to create a self-fulfilling prophesy. Prior such inversions have an eight-for-eight success rate in forecasting recessions since 1968 and no false signals yet, so we believe the current inversion serves as a warning to consumers and businesses alike to be cautious ahead of a likely recession. We expect the combination of increased saving and postponed investment will likely lead to slower growth. Note also that the magnitude of the current inversion exceeds what we experienced during any of the preceding eight instances (see Figure 3).

Second, rate inversions also apply stress directly to our banking system. Banks’ business model is based on a positively sloped yield curve, as they invest long (via loan issuance and bond purchases) and borrow short (via customer deposits). Bank weakness tends to drive credit contraction that in turn leads to slower growth.

It is my view that the Fed’s hawkish stance in 2023 (including several policy rate hikes) is compounding the risk to the financial system and increasing the probability of a dreaded – and possibly unnecessary – hard landing.

Q: How does the magnitude of the yield curve inversion affect banks?

Harvey: The Fed’s interest rate policy has magnified the gap between the handful of “too big to fail” (TBTF) U.S. banks and the thousands of smaller banks that are not individually viewed as systemically important. The asset/liability mismatch created by yield curve inversion reduces the value of assets and increases the cost of liabilities across banks, but non-TBTF banks are hit particularly hard. While TBTF banks have increased the interest they pay on deposits, their increases have been relatively modest. Meanwhile, many non-TBTF banks are offering sub-4% interest on savings accounts and CDs, rates exceeding what they are earning on many of the U.S. Treasuries on their balance sheets.

The challenges the non-TBTF banks face ripple through the economy in the form of reduced credit availability. For example, challenges to commercial lending are increasing: Demand for commercial real estate remains weak due to work-from-home policies reducing the need for office space. Credit contraction may well increase not just the likelihood of a U.S. recession, but also the severity.

The All Asset strategies, including All Asset Fund and All Asset All Authority Fund, represent a joint effort between PIMCO and Research Affiliates. PIMCO provides the broad range of underlying strategies – spanning global stocks, global bonds, commodities, real estate, and liquid alternative strategies – each actively managed to maximize potential alpha. Research Affiliates, an investment advisory firm founded in 2002 by Rob Arnott and a global leader in asset allocation, serves as the subadvisor responsible for the asset allocation decisions. Research Affiliates uses their deep research focus to develop a series of value-oriented, contrarian models that determine the appropriate mix of underlying PIMCO strategies in seeking All Asset’s return and risk goals.

1 Estimate is an equally weighted average across assets classes. The asset classes included in these forecasts are represented by the following indexes: U.S. large-cap equities represented by the S&P 500; U.S. small-cap equities represented by the Russell 2000 Index; developed market ex U.S. equities represented by the MSCI EAFE Index; long U.S. Treasuries represented by the Bloomberg U.S. Treasury Long Index; U.S. core bonds represented by the Bloomberg U.S. Aggregate Index; U.S. investment grade credit represented by the Bloomberg U.S. Intermediate Credit Index; U.S. high yield represented by the Bloomberg High Yield Corporate Index; bank loans represented by the J.P. Morgan Leveraged Loan BB Index; U.S. Treasury Inflation-Protected Securities (TIPS) represented by the Bloomberg U.S. TIPS Index; U.S. real estate investment trusts (REITs) represented by the FTSE NAREIT Index; emerging market (EM) local bonds represented by the J.P. Morgan GBI-EM Global Diversified Index; EM non-local bonds represented by the J.P. Morgan EMBI+ Index; EM equities represented by the MSCI EM Index; commodities represented by the Bloomberg Commodity Index; global bonds represented by the Bloomberg Global Aggregate ex USD (USD Hedged) Index. Return to content

2 Specifically, an inversion lasting a full quarter in the 10-year/3-month U.S. Treasury yield curve has preceded and signaled all eight of the past eight U.S. recessions since 1968, and has not had a false signal during that time frame. Dr. Harvey developed this recession indicator in his dissertation at the University of Chicago. Return to content

Featured Participants

Disclosures

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting www.pimco.com. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: The funds invest in other PIMCO funds and performance is subject to underlying investment weightings which will vary. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. The cost of investing in the Fund will generally be higher than the cost of investing in a fund that invests directly in individual stocks and bonds. The Fund is non-diversified, which means that it may invest its assets in a smaller number of issuers than a diversified fund.

The analysis contained in this paper is based on hypothetical modeling. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Because of limitations of these modeling techniques, we make no representation that use of these models will actually reflect future results, or that any investment actually will achieve results similar to those shown. Hypothetical or simulated performance modeling techniques have inherent limitations. These techniques do not predict future actual performance and are limited by assumptions that future market events will behave similarly to historical time periods or theoretical models. Future events very often occur to causal relationships not anticipated by such models, and it should be expected that sharp differences will often occur between the results of these models and actual investment results.

Return assumptions for indices are for illustrative purposes only and are not a prediction or a projection of return. Return assumption is an estimate of what investments may earn on average over a 10 year period. Actual returns may be higher or lower than those shown and may vary substantially over shorter time periods. Return assumptions are subject to change without notice.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

The Sharpe Ratio measures the risk-adjusted performance. The risk-free rate is subtracted from the rate of return for a portfolio and the result is divided by the standard deviation of the portfolio returns.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2023-0719-3012871