All Asset All Access: Positioning Portfolios for Ongoing Inflationary Pressures

Summary

- U.S. inflation is already at multi-decade highs. At Research Affiliates, we believe it could rise further before it recedes as we worry Fed policy can rein in this inflation, but only by crushing demand, and always with a lag.

- An uptick in inflation expectations likely bodes well for the diversifying and inflation-sensitive “Third Pillar” markets (real assets, high yield bonds, and emerging markets) emphasized by the All Asset funds.

- In 2022, dramatic headline inflation and hawkish Fed moves helped spur dramatic drawdowns across most risk markets. At Research Affiliates, we’ve sought to mitigate much of the broad market damage as we’ve tactically repositioned the All Asset portfolios into what we believe are increasingly attractive areas.

Rob Arnott, chairman of Research Affiliates, explains their inflation outlook and why they are cautious about conventional views on inflation. Brandon Kunz, head of multi-asset solution distribution at Research Affiliates, discusses how the All Asset strategies have historically performed well after notable periods of drawdown. As always, their insights represent Research Affiliates’ views in the context of the PIMCO All Asset and All Asset All Authority funds. All Asset All Access is published quarterly.

Views expressed here are from Research Affiliates as of 24 June 2022. U.S. inflation data discussed is through 31 May 2022.

Q: With consumer prices recently hitting a fresh 40-year high, what is Research Affiliates’ near-term outlook on U.S. inflation?

Arnott: As we have discussed in past editions of All Asset All Access,Footnote1 Research Affiliates is on the record stating our forecast that inflation will surge. To the shock of many, the U.S. CPI (Consumer Price Index) headline reading hit a new 40-year high in May 2022, topping economists’ estimates. Even from these high levels, we expect near-term annualized inflation to rise further before it recedes. We see two reasons for this. Firstly, as we at Research Affiliates have argued for months, shelter – which constitutes roughly one-third of CPI – has to rise sharply to catch up with soaring property values. Secondly, during the summer months, incoming CPI data will replace relatively low inflation months from 2021, so inflation readings will almost certainly rise further.

Digging deeper into Research Affiliates’ view: Shelter has two main components, owners’ equivalent rent (OER) and rent of primary residence (RPR). Both are smoothed and lagged, by design. In May 2022, shelter was the single largest contributor to the CPI increase, climbing 5.5% from a year earlier, the greatest annual increase since 1987. With 8.6% headline inflation, why is 5.5% a problem? OER is based on survey data, and homeowners are generally behind the curve on the rental value of their homes – they tend to anchor on previous estimates. So, when home prices soar or tank, it can take years for OER to catch up.

To a lesser extent, RPR is smoothed and lagged. Surveyors ask renters how much they are paying, and what the change has been in the prior 6–12 months. But only renters who have renewed their leases recently will have experienced the recent surge in rental pricing. Many leases were priced in past years; these renters are probably in for a rude awakening when they renew.

We expect it to get worse. Research Affiliates forecasts OER to rise over the next three years by 6% to 9% per year, and RPR to play catch-up, rising as much as 10% in the next 12 months. As shelter determines about one-third of U.S. CPI, and current year-over-year (YOY) home price appreciation tends to drive subsequent three-year rises in the OER, we expect shelter to show high-single-digit overall inflation for the balance of this year and next, possibly continuing into 2024. Only a deep recession would – in Research Affiliates’ view – rein this in.

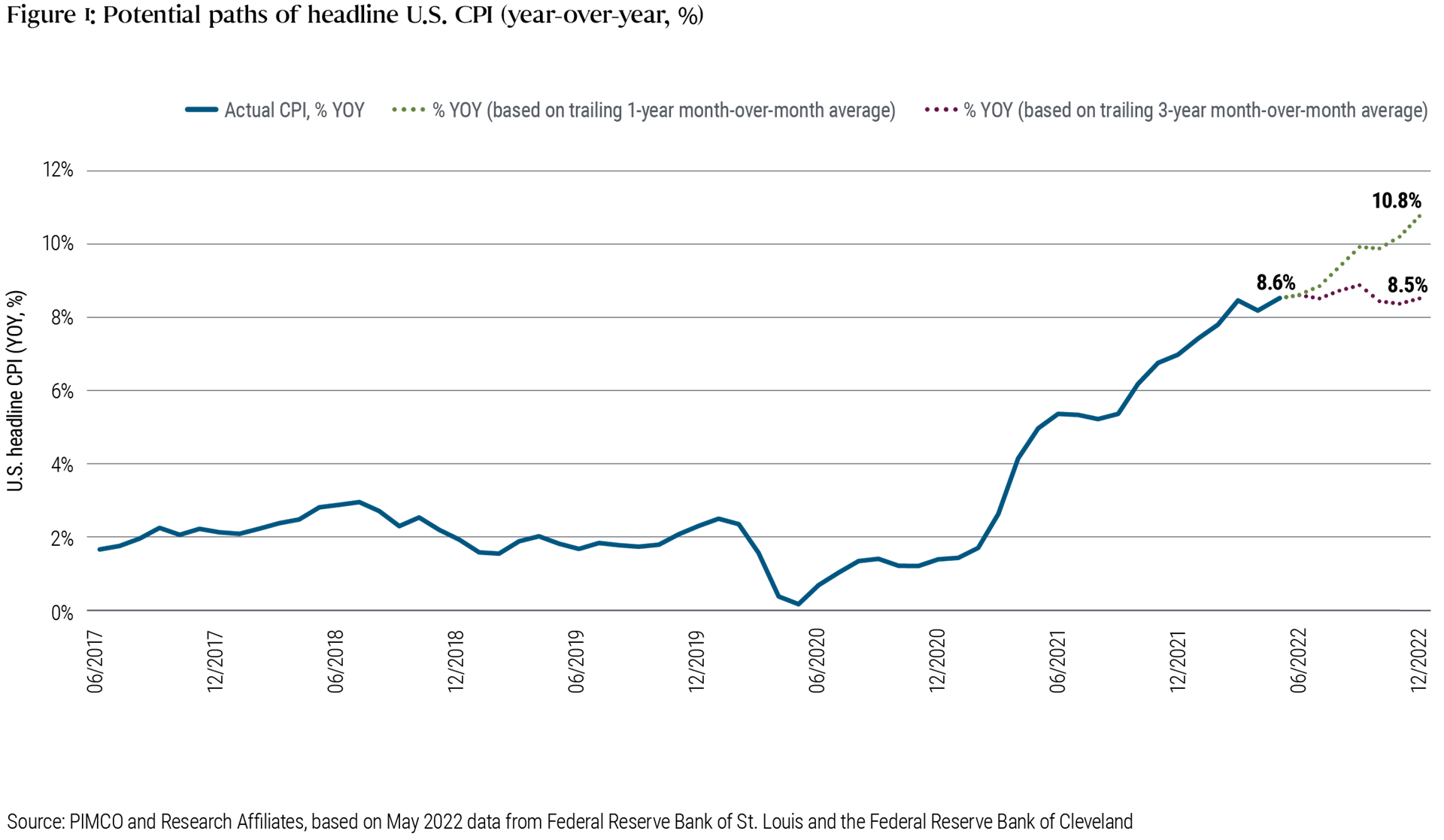

It bears mention that the rate of reported inflation is affected by what’s called the “base effect,” as changes are measured against the year-ago number or base. Even so, when we apply various assumptions to forecast potential paths of U.S. CPI (i.e., 1-, 3-, and 10-year historical trailing month-over-month averages), we find the projected range of CPI outcomes by year-end 2022 remains worryingly high. Cast your eyes on Figure 1, and you will notice that a trailing 3-year assumption suggests that by year-end CPI may rise by 8.5% YOY, and a trailing 1-year assumption implies a YOY increase of 10.8%!

Note also that each monthly CPI report adds a new month, and drops an old month. We cannot know with any precision what the new month is going to look like, but we know exactly what’s about to be dropped. June 2022 (reported in early July) will replace a high-inflation month from June 2021, of 0.93%. The good news is that anything less than 0.93% (equivalent to well over 11% per annum) may create an illusion that inflation is moderating. The bad news is that the Cleveland Fed’s “nowcasting” tool is currently (as of this writing) projecting June 2022 inflation at 0.98%, which would mean that YOY inflation through June would hit another new high. Then in the ensuing months of July, August, and September – the third quarter – we will replace three relatively low-inflation months from 2021 (0.48%, 0.21% and 0.27%, respectively). If inflation in those months is anything above 4% on an annualized basis (1% for the third quarter), it may create an illusion that inflation is breaking out to the upside, even if the monthly figures are lower than they’ve averaged in the last year.

Suppose inflation stabilizes in the coming months, with each monthly inflation rate matching the average of the prior 12 months. Figure 1 shows that – because we’re replacing milder inflation months from 2021 – headline inflation would still reach 9.9% by end-September and 10.8% by year-end. If this happens, then we can reasonably surmise that inflation could be the utterly dominant issue in the November election.

Q: How do you reconcile the disconnect between market-based forecasts for expected inflation and Research Affiliates’ inflation outlook?

Arnott: A prevailing narrative is that inflation will abate and then remain under control. As measured by breakeven inflation rates,Footnote2 the market’s expectation for annualized inflation over the next five years is roughly 2.6%, having fallen from its 3.7% peak in March 2022. Similarly, the market’s 10-year inflation expectation, as measured by breakeven inflation rates, registers at 2.3%.

As contrarian investors, we at Research Affiliates always ask where conventional thinking may be amiss. Inflation has many moving parts, and assessing its sources and their impact is complex. To put it simply, prices are a function of supply and demand, and inflation is a function of falling supply and/or rising demand. We see several causes of this round of inflation: unprecedented deficit spending, supply chain disruptions, the Ukraine war, and fiscal stimulus putting money directly into consumers’ bank accounts. In our view, demand for goods and services is increased by the first and last of these; supply is constricted by all but the first – and the Federal Reserve can influence none of these. To a person with a hammer, everything looks like a nail. The Fed’s tools are loosening or tightening short-term rates, and quantitative easing or tightening. Neither addresses any of what we see as the direct causes of the surge in inflation.

At Research Affiliates, we worry that the Fed can indeed rein in this inflation, but only by crushing demand, and always with a lag. We do not believe the Fed’s hammer will work until and unless it creates a serious recession. So, our outlook is that either market inflation expectations will rise or inflation will recede because of a Fed-initiated recession. An uptick in inflation expectations, in turn, likely bodes well for the diversifying and inflation-sensitive “Third Pillar” markets (real assets, high yield bonds, and emerging markets) emphasized by the All Asset funds. As we’ve discussed many times in All Asset All Access, returns of these Third Pillar markets historically have tended to be strikingly correlated with changes in inflation expectations.

Q: Why haven’t All Asset investors profited from elevated U.S. inflation in 2022?

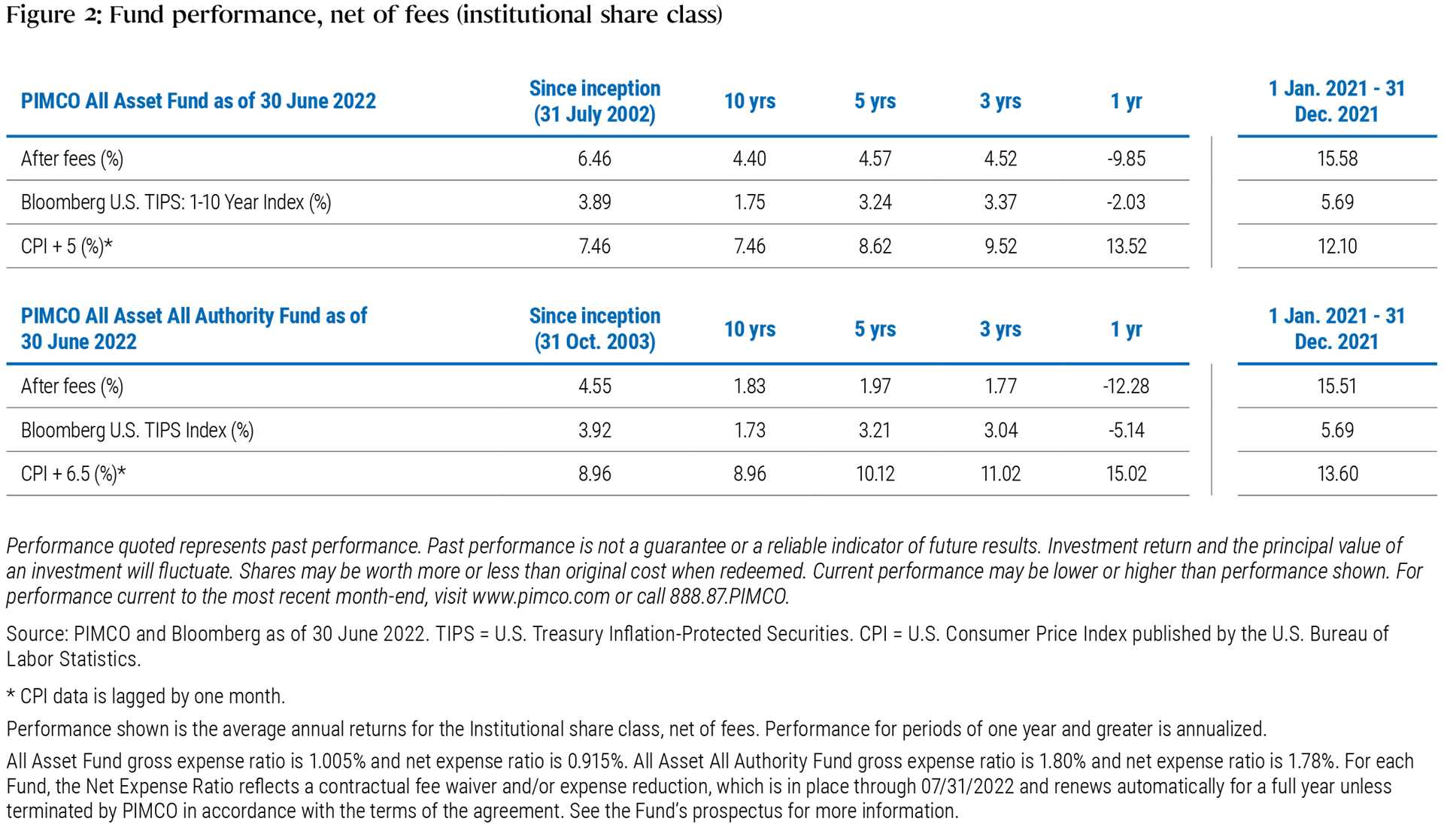

Kunz: As U.S. headline CPI inflation rose from 1.4% to 7.0% over the course of 2021, the All Asset and All Asset All Authority funds delivered one-year returns for 2021 of a respective 15.58% and 15.51% (net of fees, institutional share class). On a risk-adjusted basis, this placed each fund in the top decile of competitor funds within Morningstar’s U.S. Tactical Allocation category. (See Figure 2 for fund performance through 30 June 2022.)

For the most recent quarter-end performance data for the All Asset and All Asset All Authority funds, please click on the links below:

In 2022, headline inflation’s incremental rise to a 40-year high of 8.6% (as of May) has led to increasingly hawkish rhetoric from the Fed, which has us witnessing a movie we’ve seen many times: Almost every risk asset class has suffered a drawdown roughly proportional to its trailing volatility. This year’s movie comes with a painful plot twist; bond markets are in the midst of their worst calendar year on record. The result? A global 60/40 stock/bond portfolio has seen losses of −15.98% (and −16.11% for a U.S. 60/40 portfolio) year to date through 30 June 2022.Footnote3 The All Asset Fund hasn’t been immune from this “take no prisoners” sell-off, but its return of −12.13% (−14.23% for All Authority; returns are net of fees for the institutional share class) outpaced mainstream U.S. stock and bond markets over the same time frame. We’ve sought to mitigate much of the broad market damage as we’ve tactically repositioned the All Asset portfolios into what we believe are increasingly attractive areas.

As this largely indiscriminate sell-off subsides, market participants will review the carnage and look to disentangle the asset classes that remain overvalued from those that have been oversold. As this sorting-out process ensues, and with history as a guide, we believe the All Asset strategies stand poised for attractive potential returns in the coming year.

Q: What gives you confidence in the prospects of a performance rebound in the All Asset strategies?

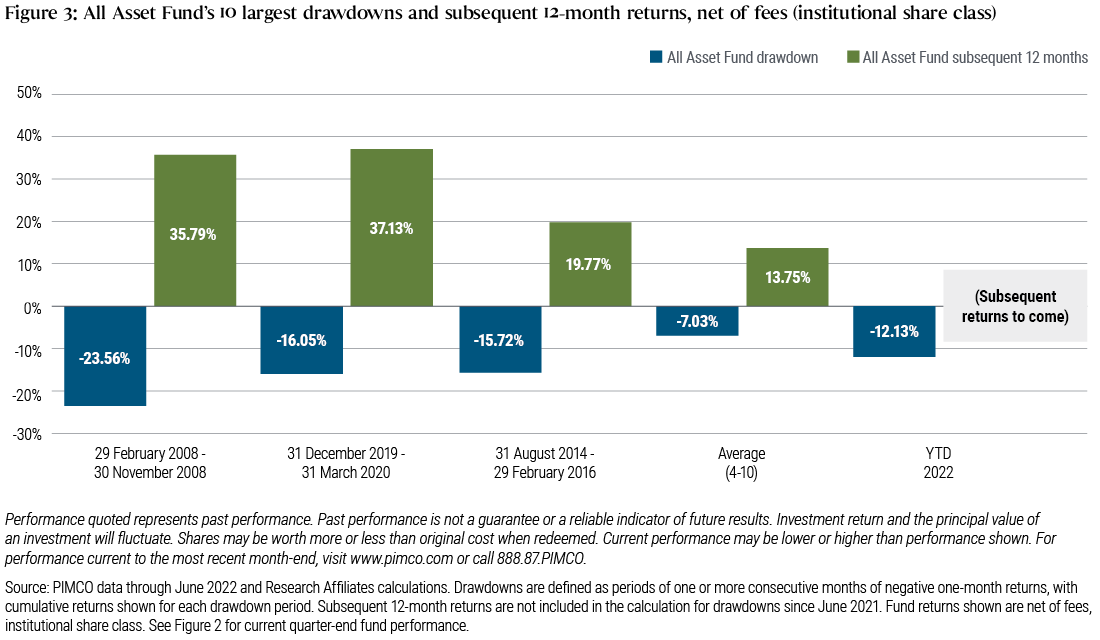

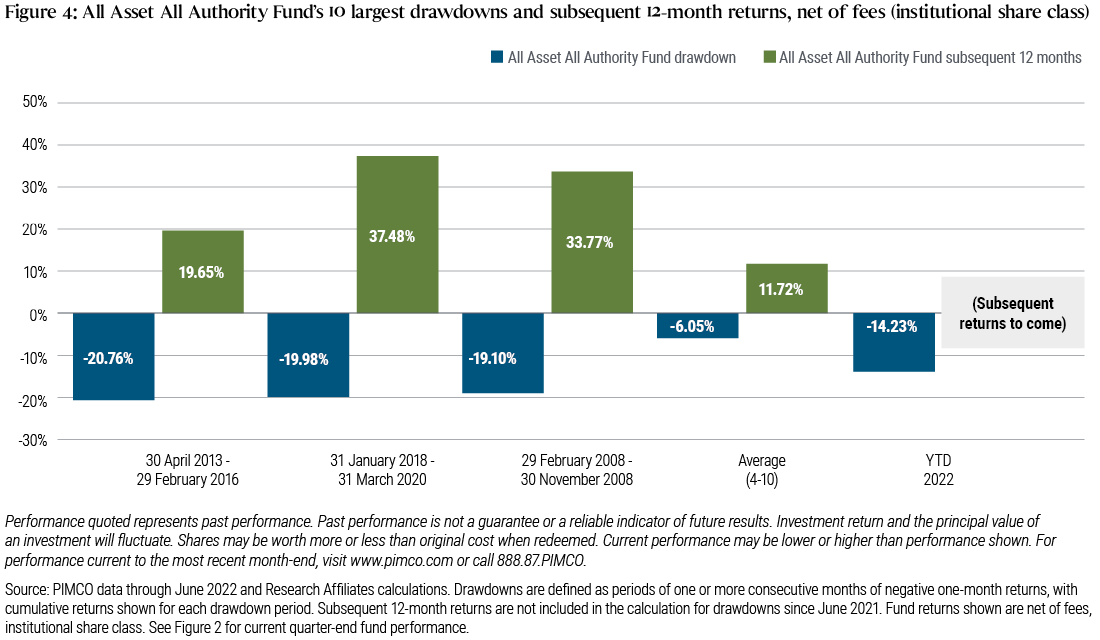

Kunz: We’ve analyzed the largest drawdowns and the subsequent 12-month returns of the All Asset Fund during its 20-year history (an anniversary milestone we achieve this month) – see Figures 3 and 4. (Returns shown are net of fees for the institutional share class.) Because most drawdowns have been in the single digits, we’ve separated the largest three from the average of drawdowns ranked 4–10 (which includes this year’s drawdown). Note that all of these drawdowns historically were followed by positive returns the next year. Further, in nine out of nine instances for All Asset (seven of nine for All Authority), the previous high water mark was exceeded within 12 months. With history as a guide, and given the increased return prospects provided by our tactical repositioning, we believe the All Asset strategies are poised to offer similar return potential, including outperformance of conventional stock/bond portfolios, in the coming year.

The All Asset strategies, including All Asset Fund and All Asset All Authority Fund, represent a joint effort between PIMCO and Research Affiliates. PIMCO provides the broad range of underlying strategies – spanning global stocks, global bonds, commodities, real estate, and liquid alternative strategies – each actively managed to maximize potential alpha. Research Affiliates, an investment advisory firm founded in 2002 by Rob Arnott and a global leader in asset allocation, serves as the subadvisor responsible for the asset allocation decisions. Research Affiliates uses their deep research focus to develop a series of value-oriented, contrarian models that determine the appropriate mix of underlying PIMCO strategies in seeking All Asset’s return and risk goals.

Disclosures

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted, and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting www.pimco.com. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results. The performance figures presented reflect the total return performance, unless otherwise noted, for the Institutional Class shares (after fees) and reflect changes in share price and reinvestment of dividend and capital gain distributions. All periods longer than one year are annualized. Periods less than one year are cumulative. The minimum initial investment for Institutional, I-2, I-3 and Administrative class shares is $1 million; however, it may be modified for certain financial intermediaries who submit trades on behalf of eligible investors.

Investments made by a Fund and the results achieved by a Fund are not expected to be the same as those made by any other PIMCO-advised Fund, including those with a similar name, investment objective or policies. A new or smaller Fund’s performance may not represent how the Fund is expected to or may perform in the long-term. New Funds have limited operating histories for investors to evaluate and new and smaller Funds may not attract sufficient assets to achieve investment and trading efficiencies. A Fund may be forced to sell a comparatively large portion of its portfolio to meet significant shareholder redemptions for cash, or hold a comparatively large portion of its portfolio in cash due to significant share purchases for cash, in each case when the Fund otherwise would not seek to do so, which may adversely affect performance.

Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

There is no assurance that any fund, including any fund that has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) a fund’s total return in excess of that of the fund’s benchmark between reporting periods or 2) a fund’s total return in excess of the fund’s historical returns between reporting periods. Unusual performance is defined as a significant change in a fund’s performance as compared to one or more previous reporting periods.

A word about risk: The PIMCO All Asset Fund and the PIMCO All Asset All Authority Fund invests in other PIMCO funds and performance is subject to underlying investment weightings which will vary. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. The cost of investing in the Funds will generally be higher than the cost of investing in a fund that invests directly in individual stocks and bonds. The Funds are non-diversified, which means that it may invest its assets in a smaller number of issuers than a diversified fund.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

Breakeven inflation rate (or expectation) is a market-based measure of expected inflation or the difference between the yield of a nominal and an inflation-linked bond of the same maturity.

The correlation of various indexes or securities against one another or against inflation is based upon data over a certain time period. These correlations may vary substantially in the future or over different time periods that can result in greater volatility.

Bloomberg U.S. TIPS: 1-10 Year Index is an unmanaged market index comprised of U.S. Treasury Inflation-Protected Securities having a maturity of at least 1 year and less than 10 years. Bloomberg U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation-Protected Securities rated investment grade (Baa3 or better), have at least one year to final maturity, and at least $500 million par amount outstanding. CPI + 500 and CPI + 650 Basis Points benchmarks are created by adding 5% or 6.5% to the annual percentage change in the Consumer Price Index (CPI). This index reflects seasonally adjusted returns. The Consumer Price Index is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices. S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market. Bloomberg U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Bloomberg Global Aggregate Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD investment grade 144A securities.

It is not possible to invest directly in an unmanaged index.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2022-0630-2269573