Rethinking Retirement Spending Rules: A Market-Based Approach

Summary

- Determining a "safe withdrawal rate" in retirement is inherently difficult; no one can be certain how long they'll live, how their needs will evolve, and how markets will perform.

- PIMCO research suggests that starting portfolio yields may be a more accurate guide to feasible retirement spending than common rules of thumb or even knowledge of future market returns and inflation.

- The historical correlation between starting yield and future feasible spending was found to be 82%, higher than the 65% correlation between future market returns and feasible spending.

- The research also indicates that asset allocations emphasizing high, consistent yields may be desirable for retirees seeking optimal consumption without excessive risk of depleting funds.

Determining a feasible rate of spending in retirement ranks among the most vexing challenges in finance. Too many variables are unknowable: How long will an individual live? How will markets perform? What unexpected spending needs will arise? We believe portfolio yields may help determine feasible spending.

Rules of thumb – such as “the 4% rule” for annual withdrawals advanced by William Bengen in the 1990s – offer convenient solutions that seek to maximize consumption without undue risk of running out of money. Bengen updated his rule to 4.5% in 2006, noting the “safe withdrawal rate” can vary depending on taxes and other factors.

Morningstar in November said a prudent annual withdrawal rate is 4%, up from 3.3% two years ago and 3.8% last year. Higher bond yields help explain the increase, which is based on a common retirement portfolio allocation of 40% stocks and 60% bonds. Other strategies include adjusting the withdrawal rate based on the performance of the investment portfolio; altering the rate based on mortality risks; and determining a “safe withdrawal rate” based on Monte Carlo simulations.

A problem with these approaches is that they are based on past performance and assumptions about the evolution of markets, interest rates, longevity, and spending patterns over several decades in retirement. And these assumptions need regular updating.

However helpful these rules of thumb may be, retirees appear to largely ignore them. Wary of running out of money, nearly 60% of retirees plan to spend little of their savings or even grow balances.1

The upshot is that many retirees underconsume. They forgo travel and leisure activities, health and wellness expenditures, charitable contributions, and other uses of savings accumulated over a lifetime.

Fortunately, there may be a simple, reliable, and stable guide to feasible spending in retirement – the level of portfolio yields, including dividends, interest, and other investment income. PIMCO research finds that anchoring spending to the starting yield has the potential to preserve asset balances over 30 years.

In fact, it turns out that in addition to being easy to determine and understand, starting portfolio yields may be a more accurate guide to feasible spending than common rules of thumb. What’s more, our research finds that this number may be an even better guide to managing withdrawals than knowledge of future market returns and inflation over the planning horizon.

This sounds implausible. So let’s take a look at how we came to this result.

THE PREDICTIVE POWER OF PORTFOLIO YIELD

Looking out over the past four decades of market performance, we calculated feasible spending, defined as the annual percentage withdrawal from a 40/60 stocks-and-bonds portfolio that seeks to preserve funds at least 30 years. We also calculated a constant feasible spending amount in real (inflation-adjusted) terms at a rate that consumes portfolio assets over 30 years. (The 40/60 portfolio approximates the average in-retirement allocations of target date funds, according to 2022 year-end Morningstar data.)

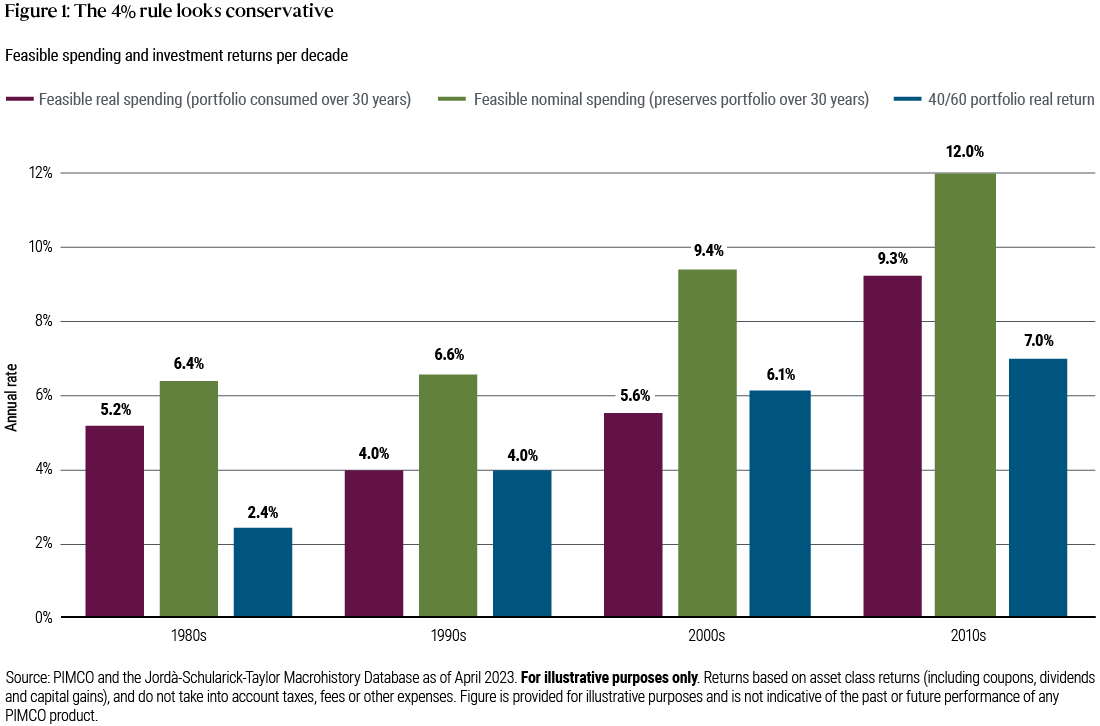

Feasible spending, in both real and nominal terms, has varied over each of the past four decades (see Figure 1).

These data are retrospective. And it’s impossible, of course, to know future market performance. Thus, the natural question remains: How could a retiree know how much to prudently withdraw?

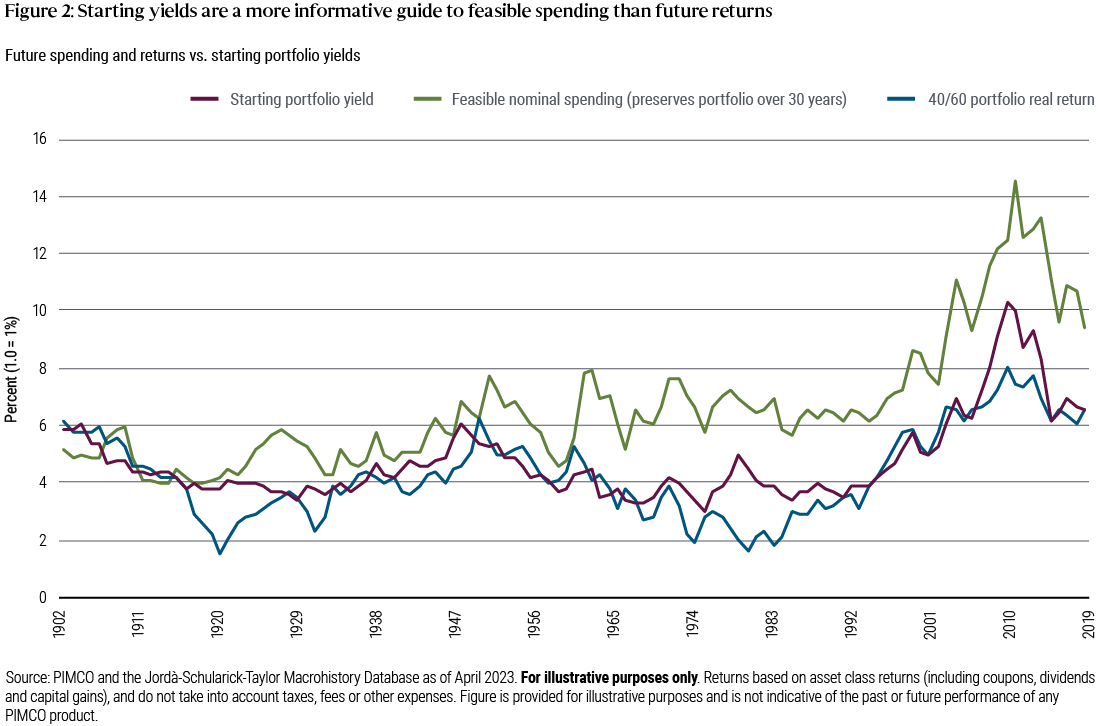

To answer this, we calculated feasible spending levels (in nominal terms with a preservation goal and in real terms with a spend-down goal) and historical portfolio returns. We then plotted nominal and real spending against starting yields of the 40/60 portfolio for each 30-year retirement horizon since 1902. Figure 2 shows that starting yields (the wine-colored line) were clearly related to future market performance (blue line). Not surprisingly, when yields were higher, future returns were likely to be higher.

Nonetheless, the informativeness of starting portfolio yield is remarkable. In nominal terms, the correlation between starting yield and feasible spending was 82%, higher than the 65% correlation between returns and feasible spending. In real terms, the correlation between portfolio returns and feasible spending was 68%.

Put simply, starting yields on a portfolio provided a better guide to nominal feasible spending over the planning horizon than foreknowledge of the market’s future performance would have.

ASSET ALLOCATION

This finding has an important practical implication: A retiree could base nominal spending on starting yields and feel relatively confident they could prudently preserve their assets. In fact, they could potentially spend a bit more than the starting yields. In our calculations based on data since 1902, which do not consider taxes or fees, retirees could have spent in excess of the starting yields by 1.9 percentage points annually and still retained their original principal 30 years into retirement.

Thus far, we have focused only on the 40/60 stocks-and- bonds portfolio typical of retirement income balanced funds and at-retirement target date fund allocations. However, asset allocation obviously impacts current and future portfolio yields. It also affects the informativeness of starting yields as a guide to feasible spending.

In the current market environment, bond-heavy portfolios will tend to generate higher income but have lower prospects than equities for long-run capital appreciation. Depending on the investment horizon, higher equity allocations usually result in higher levels of feasible spending due to embedded long-term capital gains.

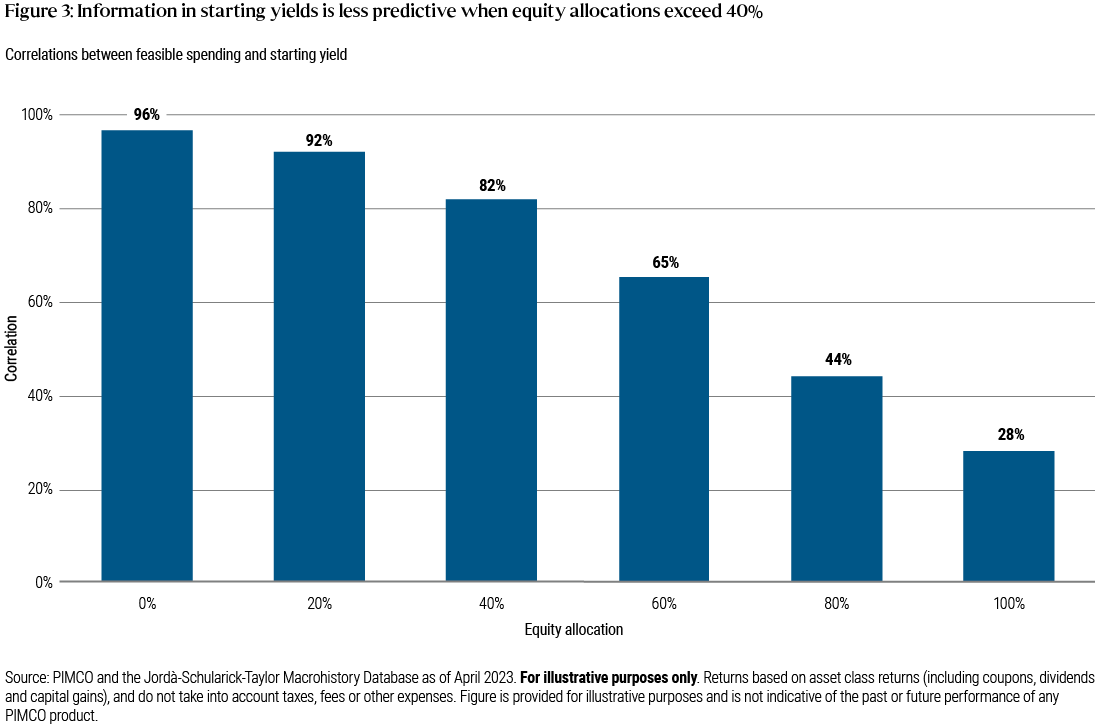

However, higher equity allocations also increase risk (which may be too much for someone in or near retirement) and, importantly, reduce the informativeness of starting portfolio yields as a guide to feasible spending. As Figure 3 shows, the correlation between feasible spending and starting yields drops rapidly when equity allocations exceed 40%, signifying a weaker linkage and less informative power (we view 70% and above as high correlation).

An implication is that asset allocations that emphasize high, consistent yields may be desirable for retirees seeking optimal consumption without excessive risk of depleting funds.

CONCLUSION

Our research builds upon the widely accepted belief that bond yield-to-maturity is among the best indicators of future bond returns. We extend this understanding by demonstrating that starting portfolio yield also holds predictive value, particularly in determining feasible retirement spending rates. Our findings suggest that portfolio yields may offer more insights than portfolio returns.

As starting yields can be easily observed at various times, they can serve as a valuable tool for retirees planning their spending and for younger workers assessing their retirement readiness. While further research is needed to fully explore the predictive power of starting portfolio yields, this discovery presents a promising solution to the complex task of establishing prudent retirement spending rates, especially given the constraints of existing rules-of-thumb approaches.

REFERENCES

Browne, Erin, Sean Klein, Steve Sapra, and Alan Taylor, “Asset Allocation Implications of Household Diversity,” PIMCO In Depth, December 2022.

Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics, 134(3), 1225-1298.

Martel, Rene, Steve Sapra, and Georgi Popov, “A Framework for Understanding Sequence-of-Returns Risk in DC Plans,” PIMCO In Depth, February 2021.

Featured Participants

Disclosures

The “safe withdrawal rate” is an economic theory intended to help investors withstand market downturns by limiting their withdrawals. All investments contain risk and may lose value. There is no guarantee that an investor will not run out of money during retirement.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic and industry conditions.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Hypothetical illustrations have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve results similar to those shown. In fact there are frequently sharp differences between hypothetical results and actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical results is that they are generally prepared with the benefit of hindsight. In additional, hypothetical scenarios do not involve financial risk, and no hypothetical illustration can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation if any specific trading program which cannot be fully accounted for in the preparation of a hypothetical illustration and all of which can adversely affect actual results.

It is not possible to invest directly in a Morningstar category or an unmanaged index.

© 2023 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-1121-3246130