Europe’s Economy Facing Short- and Long-Term Headwinds

Despite some signs of improvement in recent months, Europe continues to underperform U.S. growth on a cyclical basis, mainly due to tighter fiscal policy and a faster transmission of tighter monetary policy. However, this underperformance may become entrenched on a secular basis, as Europe faces a number of longer-term headwinds. Germany looks particularly exposed, but the rest of Europe is not immune, including the U.K.

A challenging macro outlook

Recently, Europe’s economy has diverged significantly from the U.S. In our minds, this is driven by two key factors. First, fiscal support was much more aggressive in the U.S. during the pandemic and its effect continues to leak through the system in the form of still-positive real household excess savings. Second, the shorter average maturities of European mortgage markets compared to those in the U.S. mean households have been feeling the pinch from tighter monetary policy in a more pronounced way.

While these dynamics are cyclical in nature, we think a few structural reasons explain why the ongoing growth divergence between the U.S. and Europe may persist.

First, the region is contending with elevated energy costs compared to pre-Ukraine war prices. Second, the competitive landscape has evolved, with China acquiring an increasing market share of manufactured goods that are in direct competition with European goods, not least autos. Third, Europe is a technology laggard, falling behind the U.S. and China on AI-related investments, in part the result of tighter regulatory burdens. Lastly, the European fiscal rule framework (including Germany’s constitutional debt brake) constrains the region’s potential for more active fiscal policy.

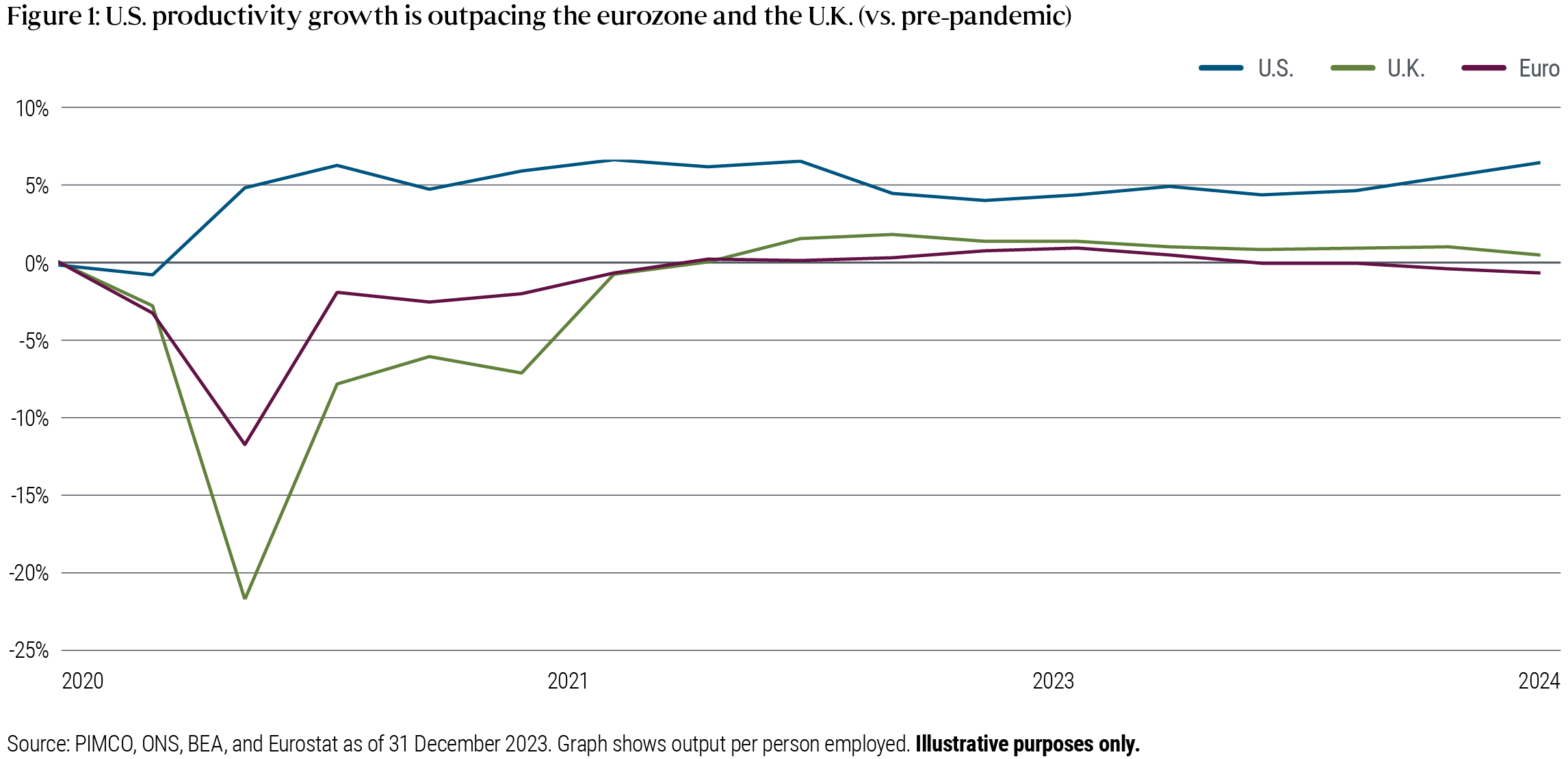

Taken together, we would argue that some of the recent divergence in productivity growth between the U.S. and Europe will be sustained (Figure 1). This reinforces the view that equilibrium policy rates in Europe – and destination policy rates in this rate-cutting cycle – are likely meaningfully lower than those in the U.S.

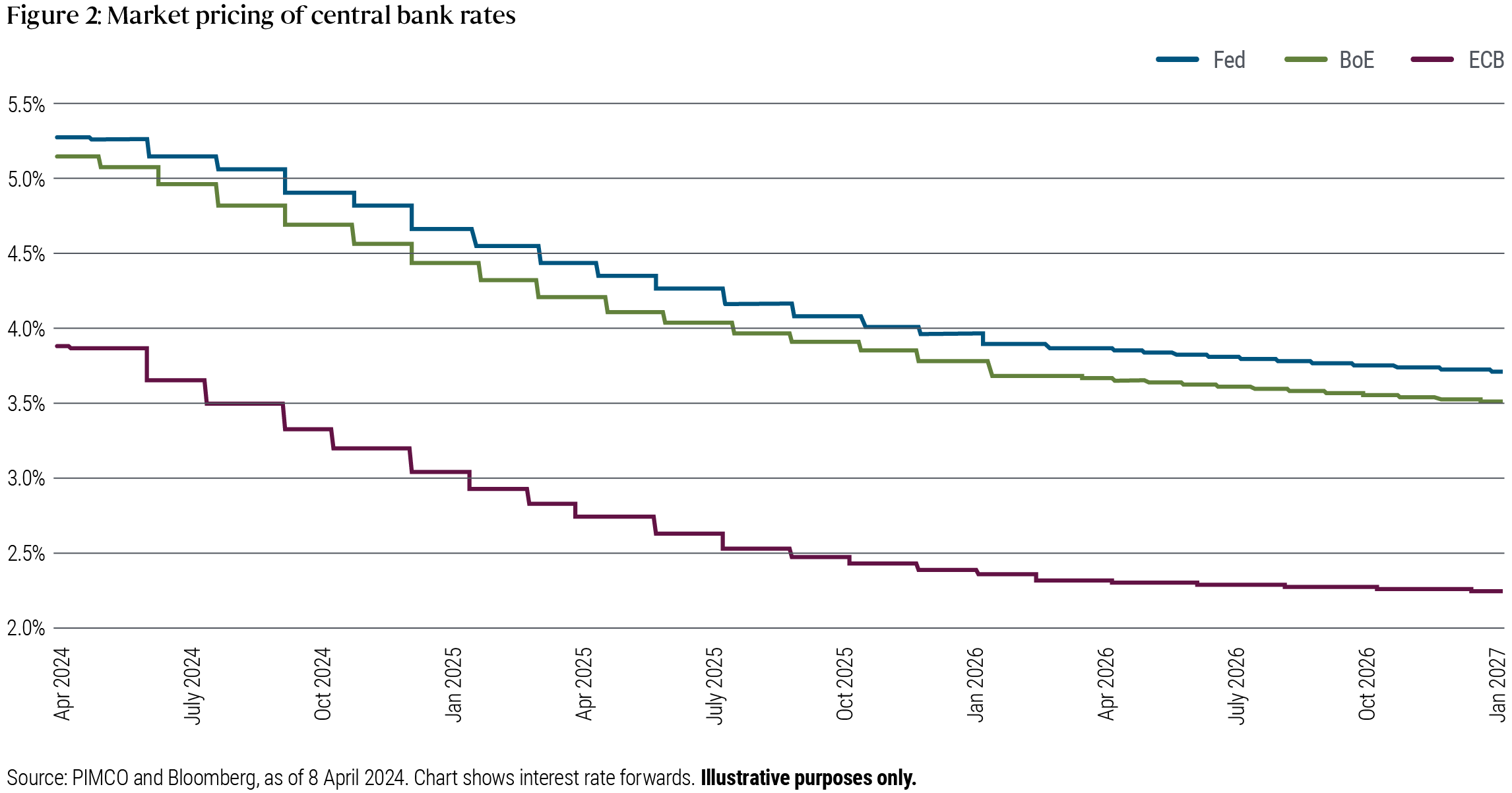

Granted, these issues are particularly acute in Germany, but the rest of Europe is also affected, including the U.K. In the U.K. specifically, we believe there is a market opportunity, given the Bank of England’s rate path is priced on top of the Federal Reserve’s (Figure 2), despite lower cyclical and secular growth expectations and a tighter fiscal stance ahead.

Following the 2022 gilts crisis (triggered by the announcement of £45 billion of unfunded tax cuts), the U.K. government announced significant tightening, worth around 2% of GDP, split equally between spending cuts and tax hikes. These measures remain in place and the government has set out measures to bring the primary balance from a deficit of around 1% of GDP to a surplus of around 1% of GDP by 2027. As a result, the U.K. is on track to run one of the most contractionary fiscal policies among developed countries – one reason why we expect growth to remain below trend.

Investment implications

Given our macroeconomic outlook, interest rate exposure in Europe is attractive, with the region being a good diversifier for duration in global portfolios. This is especially the case in the U.K., given market pricing, with the Bank of England likely to cut rates more rapidly than the Fed over time. Across the curve, we continue to believe the most attractive part is the intermediate rates, where we would expect low-destination policy rates in this cycle. That intermediate “belly of the curve” seems to be the sweet spot for taking interest rate exposures. Front-end yields, being fleeting, will fall as central banks start cutting rates, whereas long-end bonds are more vulnerable to global fiscal concerns.

Featured Participants

Disclosures

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.

Statements concerning financial market trends are based on current market conditions, which will fluctuate.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager] and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.: ©2024, PIMCO]

All material contained on this website is purely for informational purposes only and is not intended as investment advice. Investors should seek financial advice before making any investment decisions.

PIMCO Europe Ltd (Company No. 2604517,11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, via Turati nn. 25/27 (angolo via Cavalieri n. 4), 20121 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. 2604517, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication.| PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland) . The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser.