Peak Inflation May Hint at Peak Rates in Emerging Markets

Central banks across emerging markets (EM) have reacted to elevated inflation by significantly tightening monetary policy, in some cases well ahead of the U.S. Federal Reserve and the European Central Bank. Now, after a challenging period, EM inflation appears to be abating, with policy rates approaching previous cycle highs. This is lifting real, or inflation-adjusted, interest rates above neutral policy rates and toward prior peak levels, potentially creating a more favorable investing backdrop.

After largely synchronized rate-hiking cycles across EM, monetary policies could once again begin to diverge among individual countries. With real rates rising and valuations improving, we see more reason for optimism, though we remain cautious pending greater clarity on the Fed’s hiking path, given the outsized influence U.S. monetary policy has across EM.

Most EM countries have recently seen lower sequential monthly inflation readings. These are expected to decline further into year-end as growth slows and after commodity price increases have recently abated, even as the outlook for energy prices remains uncertain. This lower inflationary path follows from the early hiking cycle in many EM countries, such as Brazil and Chile, which started raising rates in 2021. By contrast, the Fed only began raising rates to tame inflation in March of this year.

For many investors, the discussion on EM policy is becoming more nuanced, moving from how high rates will go to whether EM central banks can hold rates steady (albeit at elevated levels) as the Fed continues to hike. In some EM countries, such as Brazil, local curves have even started pricing rate cuts into late 2023.

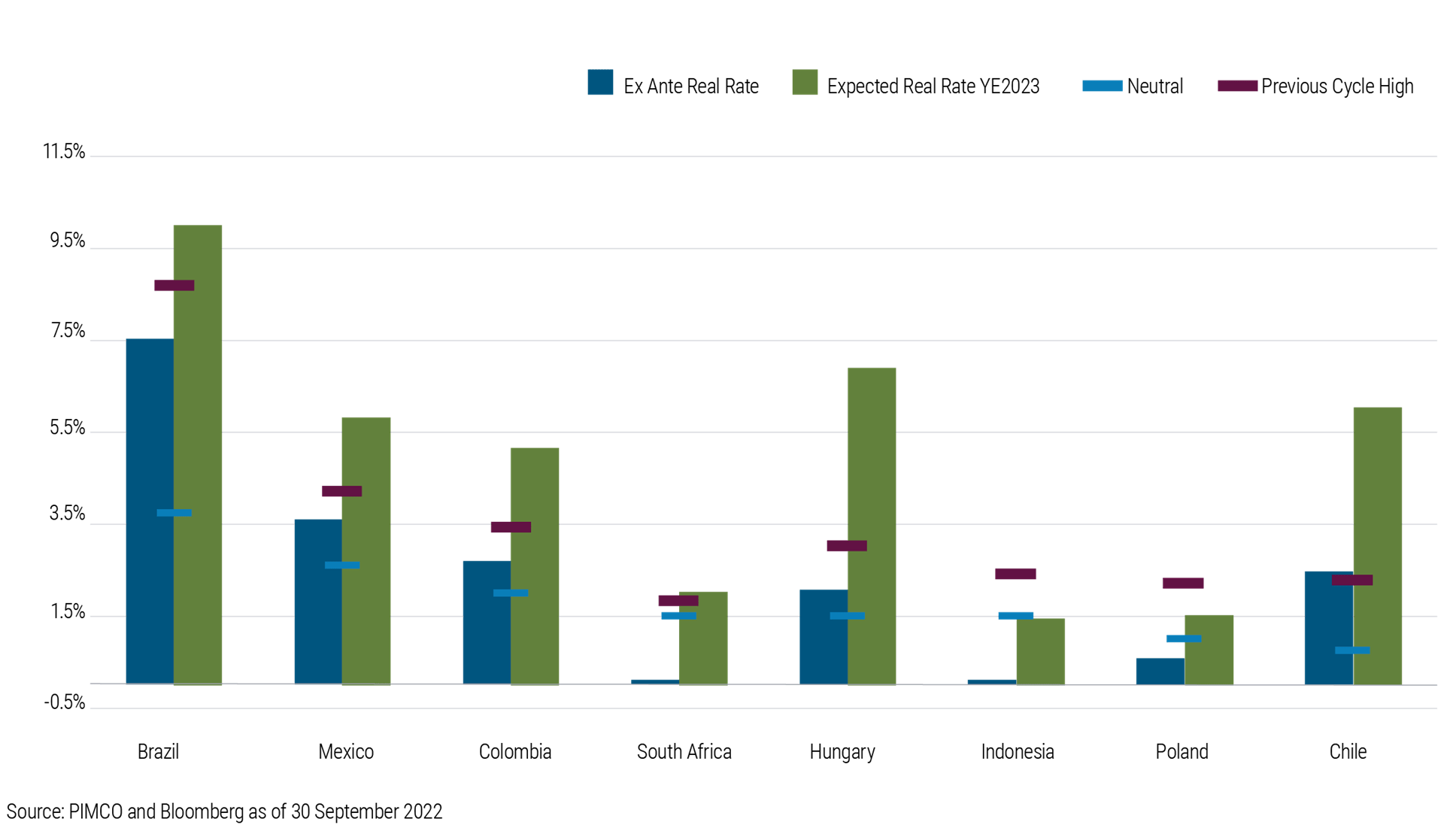

Real rates are now above the neutral – or equilibrium – level in most EM countries (see Figure 1). Looking ahead, with inflation expected to decline, those real rates are poised to rise significantly as long as policy rates stay where they are. That scenario appears increasingly likely as inflation expectations remain above many central banks’ inflation targets through 2023 in EM and developed markets alike.

Figure 1: Real rates are above neutral in many major EM economies and near previous cycle highs

That said, individual nations’ paths may vary significantly or even diverge. For example, real rates appear poised to fall in EM economies such as Brazil and Chile, but to remain high in others such as Mexico and Poland where core inflation has been much more persistent. Here are four countries that illustrate the diversity of scenarios playing out around the world:

- Brazil: In the current monetary policy cycle, Brazil has been an exemplar of being ahead of the curve. The nation’s central bank staged an aggressive hiking cycle that has left rates significantly above neutral. With inflation expectations now declining, policy will get even tighter in real terms (and even higher than in the 2016–2017 cycle). The central bank would need to start a cutting cycle next year just to keep real rates where they are. Assuming no shock effects in the aftermath of the October presidential election, we expect Brazil’s central bank to keep rates unchanged for the next few months, with a cutting cycle starting in mid-2023.

- South Africa: Inflation never really got that high, partially due to a generous 4% inflation target that has allowed South Africa’s central bank to be patient in its hiking cycle, with rates still not at the neutral level. Fiscal policy has been doing some of the heavy lifting together with more modest depreciation of the currency, given the country is a commodity exporter.

- Mexico: The nation’s central bank will likely try to keep a constant real spread to the U.S. Federal Reserve’s policy rate and follow the Fed’s hiking pace. Core consumer price index (CPI) inflation is still running above the Mexican central bank’s target, with the underlying inflation components most linked to activity and wages still very high, so hiking with the Fed is in line with Mexico’s own internal inflation dynamics. Our expectation is for another 75 basis points (bps) of hikes and a 10% policy rate by 2023.

- Poland: Inflation is expected to remain significantly above target well into next year. Policy rates are not yet neutral, meaning Poland is one of the countries that will likely have to do more tightening.

In spite of such country-specific factors, much in EM still depends on the Fed’s own policy cycle and the global risk backdrop. Clarity from the Fed on its path, and the impact on the U.S. dollar and global liquidity conditions, will be key factors to watch that will inform the policy cycles across EM. Looser financial conditions and a weaker U.S. dollar would provide EM central banks room for a deeper rate-cutting cycle.

Overall, the signals are looking more positive for EM local rates exposures. EM economies are not out of the woods yet, but the balance of valuations, technical factors, and fundamentals (for details, see our recent blog post, “Spotting Opportunities and Risks Across the EM Investment Universe ”) at the moment points toward scaling into positions that we currently favor, such as being long Brazil and short Poland.

To learn more, visit PIMCO’s Emerging Markets site.

Pramol Dhawan leads emerging markets portfolio management, and Lupin Rahman leads emerging markets sovereign credit portfolio management.

Featured Participants

Disclosures

Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. All investments contain risk and may lose value.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.