Risk-Off, Yield-On

Summary

- We believe caution is warranted during a period of elevated inflation and an economic slowdown. And yet, the volatility in financial markets over the course of 2022 has created attractive investment opportunities, in our view.

- We see a compelling case for bonds. Alongside what we see as attractive yield potential, fixed income also looks favorable from a macroeconomic perspective – bonds historically tend to be resilient in a recession.

- We believe investors should be thoughtful and selective when approaching investments in equities, real assets, and other higher-risk markets. We assess a range of market and macro factors to inform our thinking on when and how to re-engage more broadly with risk assets.

An extreme shift in macroeconomic conditions over the course of 2022 and the corresponding impact on financial markets have significantly altered the relative attractiveness of asset classes.

Markets are moving away from a “TINA” world (where “there is no alternative” to equities) to one in which fixed income is increasingly appealing.

Yet, as we navigate a period of elevated inflation and an economic slowdown, our starting point is one of caution. PIMCO’s business cycle models forecast a recession across Europe, the U.K., and the U.S. in the next year, and the major central banks are pressing ahead with policy tightening despite increasing strain in financial markets. The economy in developed markets is also under growing pressure as monetary policy works with a lag, and we expect this will translate into pressure on corporate profits.

We therefore maintain an underweight in equity positioning, disfavor cyclical sectors, and prefer quality across our asset allocation portfolios. The return potential in bond markets appears compelling given higher yields across maturities. As we look toward the next 12 months and the eventual emergence of a post-recession, early cycle environment, we will assess a range of market and macro factors to inform our thinking on when and how to re-engage with risk assets.

Key market signals

We will watch for several conditions to shift before we would consider risk assets as attractive investments again. First, in order to gain confidence around estimates of fair value, we need convincing evidence that inflation has peaked and that the “risk-free” interest rate has stabilized. While the U.S. Federal Reserve remains focused on taming inflation, there still may be upside risk to the hiking path as the central bank weighs the risk of a hard landing.

Next, we believe corporate earnings estimates globally remain too high and will have to be revised downward as companies increasingly acknowledge deteriorating fundamentals. At the time of this writing, Bloomberg’s consensus 2023 earnings growth estimate for the S&P 500 is 6%, or 8% excluding the energy sector. In addition, consensus estimates embed expectations of expanding profit margins, even though revenue is likely to slow along with demand while costs stay elevated. Bloomberg’s consensus estimates for earnings growth stand in contrast to the −11% growth suggested by PIMCO’s Earnings Growth Leading Indicator – see Figure 1. Historically, earnings per share (EPS) estimates have declined by 15% on average during recessions; this would indicate a mild recession could see a smaller drawdown in the mid-single-digits. In summary, only when rates stabilize and earnings gain ground would we consider positioning for an early cycle environment across asset classes, which would likely include increasing allocations to risk assets.

Cross-asset valuation considerations

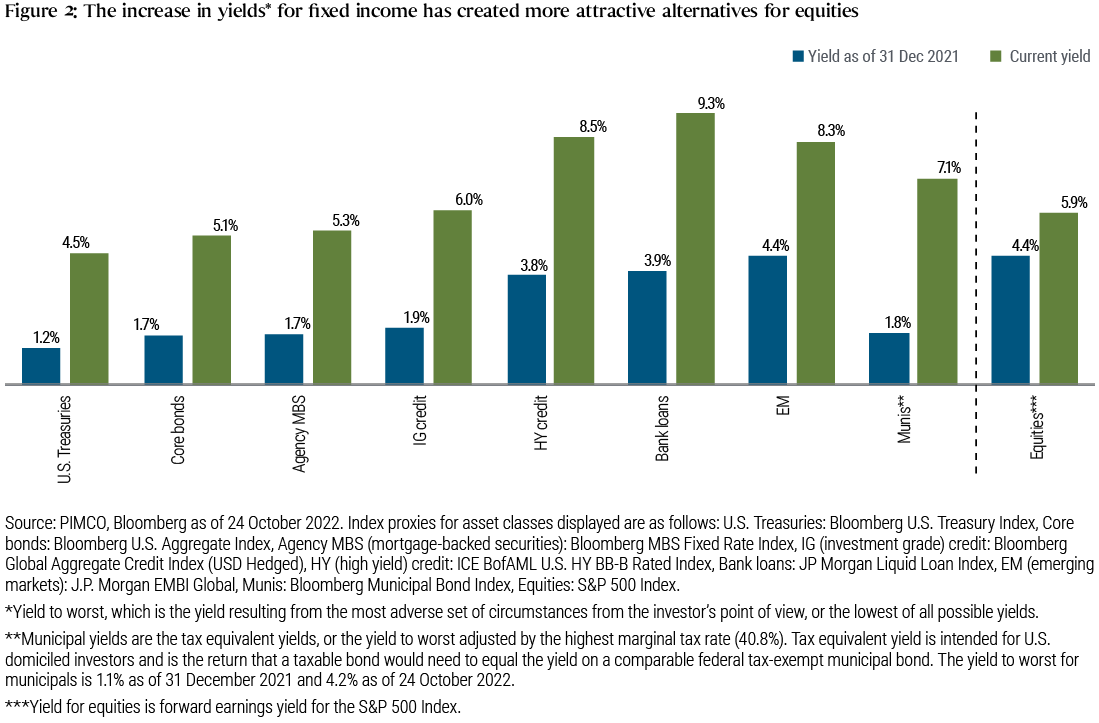

For asset allocation portfolios, a major consequence of higher rates is that the equity tailwind of “TINA” (there is no alternative) has moved to an equity headwind of “TARA” (there are reasonable alternatives). The era of unconventional monetary policy following the global financial crisis reached its zenith during the COVID-19 pandemic, with the market value of negative-yielding global debt peaking at more than $18 trillion, according to Bloomberg. At the end of 2021, a U.S. investor had to venture into emerging market U.S.-dollar-denominated debt to find an asset class in line with the S&P earnings yield. Only 11 months later, an investor can target a higher absolute yield in global investment grade bonds without even accounting for the riskier profile of equities. The earnings yield in equities has lagged the move higher in rates, which in our view is another sign that equities are expensive, making other assets relatively more attractive – see Figure 2.

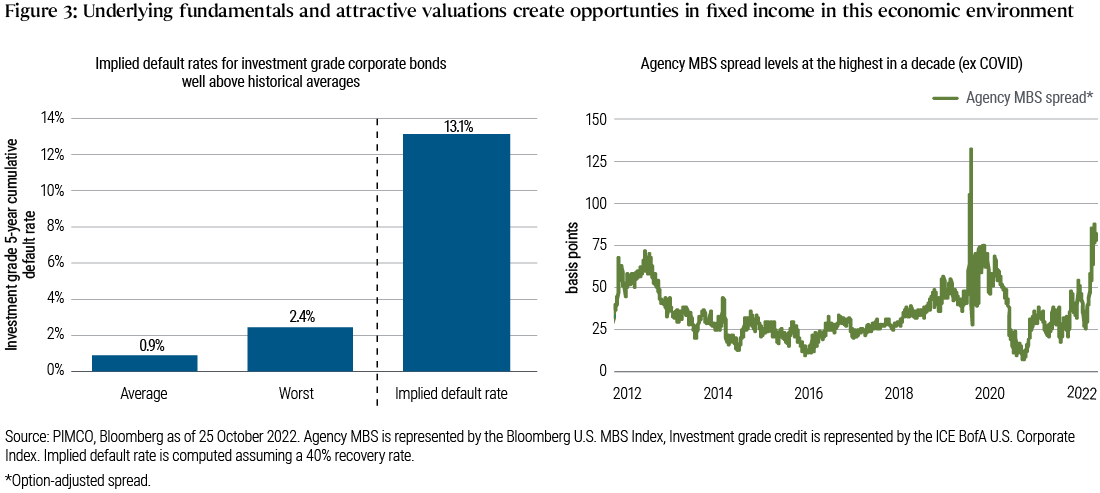

Alongside the higher yield potential, fixed income also looks more attractive in the context of our macroeconomic views. Figure 3 shows how U.S. household and corporate balance sheets are relatively healthy, especially when measured against wide investment grade spreads over U.S. Treasuries that imply a five-year default rate of 13% (assuming a 40% recovery rate), well above the worst realized default rate of 2.4% for a five-year period. Spreads for U.S. agency mortgage-backed securities (MBS), which overall are AAA rated assets, are at the widest levels in the last decade outside of the liquidity crisis in 2020 during the pandemic. In contrast, equity earnings expectations still have not priced in the risk of recession. And looking ahead, we believe investments in fixed income would tend to be resilient in a recession, when central banks typically cut policy rates.

The secular shift toward resilience

In our view, fixed income has also become more attractive relative to equities when looking over the secular (longer-term) horizon. As the economy transitions from decades of globalization to a more fractured world in which governments and companies focus on building resilience, we expect a reversal of some of the previous era’s tailwinds for equity returns. Indeed, as highlighted in PIMCO’s latest Secular Outlook, “Reaching for Resilience,” we believe companies will need to build more robust supply chains through geographical diversification and re-shoring. Capital expenditures and inventory levels will both increase as businesses shift from “just in time” to “just in case.” The prioritization of resilience over efficiency will tend to pressure corporate margins, reversing the long-standing improvement in return on equity derived from cost reductions made possible by globalized supply chains. Simultaneously, after a 20-year period of declining effective tax rates, we believe tax burdens in many countries will rise as corporate tax increases are passed, windfall taxes come into the mainstream, and governments move toward a global minimum tax.

Given the uncertainties in the longer-term global macro outlook, investors are likely to require higher equity risk premia, putting pressure on equity multiples. In contrast, starting bond yields, which tend to be a good indicator of future returns, have increased significantly, implying attractive long-term return potential. Thus, over the secular horizon, fixed income should become structurally more attractive than equities, which have benefitted from a low rate environment for the last two decades.

Asset allocation through recession and recovery

After a year of sustained central-bank-induced drawdowns across most asset classes, and with many investors pushed to broadly de-risk portfolios in both duration and equities, the coming months could bring crucial events that break the trend.

Our base case of an economic slowdown or recession would bring demand destruction and ease inflationary pressures, which also implies that the U.S. fed funds rate may peak in early 2023. If the Fed is able to pause or even cut rates in an environment of decelerating inflation, this could limit the depth of a U.S. recession and chart a path toward a more normal economic environment, in which different asset classes tend to respond in different ways through the stages of the business cycle (instead of responding in generally the same way – i.e., poorly – as they have in 2022). Investors should therefore consider not just how to position for entering a recession, but how to invest as the recession progresses, and what indicators to watch as they consider increasing their exposure to risk assets. The typical business cycle and hiking cycle playbooks can be a useful guide, but it is also important to consider the differences in this cycle.

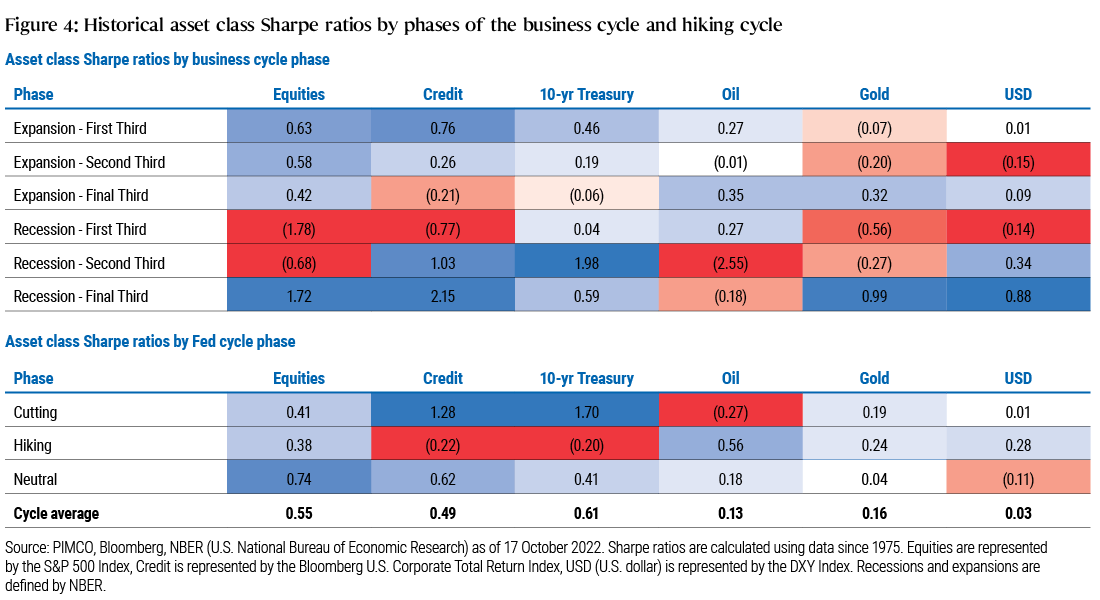

Figure 4 shows the historical (since 1975) behavior of key asset classes throughout the typical business and hiking cycle: During economic expansions, company earnings tended to grow, driven by consumer spending and investment, so that equities and credit had the strongest performance. During recessions, investors moved into more defensive asset classes like government bonds or cash. Splitting the cycle into sixths gives even greater granularity on asset class timing, since the market would often price the next phase of the cycle before it began.

Figure 4 shows how in a transition from late-phase expansion to recession, credit was usually the first risk asset to underperform, followed by equities and commodities. Credit was also the first risk asset to recover, starting in the middle of a recession and through early expansion. Duration (i.e., investments in interest-rate-sensitive assets such as sovereign bonds, as represented by the 10-year U.S. Treasury in Figure 4) has not usually provided much buffer to a portfolio in the very early stages of a recession, and only outperformed when the recession deepened. Understanding this behavior is key to repositioning portfolios throughout the business cycle. In contrast, Fed rate cycles have displayed a lower correlation to equity performance historically, but had a more direct impact on rates and the U.S. dollar.

While acknowledging that history is never a perfect guide, we believe that despite the unusually rapid 2020–2022 cycle, we could see more typical behavior in the coming cycle. As a recession begins and inflation slows, duration is likely the first asset class to be poised for outperformance, especially in rate-sensitive countries like Australia and Canada as well as select emerging markets that are ahead in the hiking cycle. In the U.S., unlike previous cycles, we do not expect a rapid transition from Fed hikes to rate cuts and the ensuing market support. But even without a significant rate rally, U.S. Treasury yields are already high enough to offer compelling return just from the income alone. In addition, a stabilization in rates could draw more investors back into the asset class.

Once a recession is underway and the initial deleveraging is mostly done, we expect high quality investment grade credit spreads would also begin to tighten. This year, the initial condition of corporate balance sheets is generally healthy, and we view a default wave as unlikely, especially considering the Fed’s continuing focus on financial stability and functioning credit markets.

Finally, high yield credit and equities generally only rally late in a recession and early in an expansion, once the credit markets have stabilized sufficiently that companies can begin to re-leverage in pursuit of growth while rising employment supports consumer sentiment. To reach that rally point, equity valuations will need to adjust to a level appropriate to the level of the fed funds rate, real yields, and the broader earnings outlook, so that they offer a risk premium consistent with a recessionary environment.

Final takeaway

The swift change in macroeconomic conditions over the course of 2022 has brought caution to the fore. Simultaneous drawdowns in equities and bond markets not experienced in decades have many investors waiting for more certainty on the path of interest rates and the severity of a looming recession.

At PIMCO, we believe caution is warranted during a period of elevated inflation and an economic slowdown. And yet, the volatility in financial markets over the course of 2022 has created several compelling investment opportunities. Most notably, we see ample evidence that both the near- and long-term case for fixed income is strong today. Higher starting yields have increased long-term return potential, while higher-quality bonds should resume their role as a reliable diversifier against equities if a recession materializes. We believe investors should be cautious and selective when approaching investments in equities, real assets, and other higher-risk markets, seeking the best relative opportunities both within and across asset classes. In addition, it will be critical to position portfolios to withstand additional volatility and capitalize on dislocations through the next business cycle.

As we emerge from the “TINA” environment that has characterized much of the last decade, the menu has expanded and investors should be encouraged about the opportunities on the horizon.

Download our investor handout for details on how we are positioning portfolios across global asset classes.

Featured Participants

Disclosures

The "risk-free" rate can be considered the return on an investment that, in theory, carries no risk. Therefore, it is implied that any additional risk should be rewarded with additional return. All investments contain risk and may lose value.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds is exempt from U.S. federal income tax and may be subject to state and local taxes and at times the alternative minimum tax. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Bank loans are often less liquid than other types of debt instruments and general market and financial conditions may affect the prepayment of bank loans, as such the prepayments cannot be predicted with accuracy. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Diversification does not ensure against loss.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively.

The option adjusted spread (OAS) measures the spread over a variety of possible interest rate paths. A security's OAS is the average earned over Treasury returns, taking multiple future interest rate scenarios into account. The Sharpe Ratio measures the risk-adjusted performance. The risk-free rate is subtracted from the rate of return for a portfolio and the result is divided by the standard deviation of the portfolio returns.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

PIMCO does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.