Asia Strategic Interest Bond Strategy: A Higher‑Quality Approach to Harnessing Yield in Asia

As Asia’s growth/inflation dynamics continue to diverge from the rest of the world, investors are increasingly seeking exposure to Asia to benefit from the yield on offer. The region is forecasted to contribute about 70% of global growth this year – a much greater share than in recent years.Footnote1

In this Q&A, portfolio manager Stephen Chang and product strategist Jingjing Huang discuss how investing in a flexible and actively managed Asia fixed income strategy can offer the potential for attractive income and long-term capital appreciation.

Q: Why invest in Asia credit now?

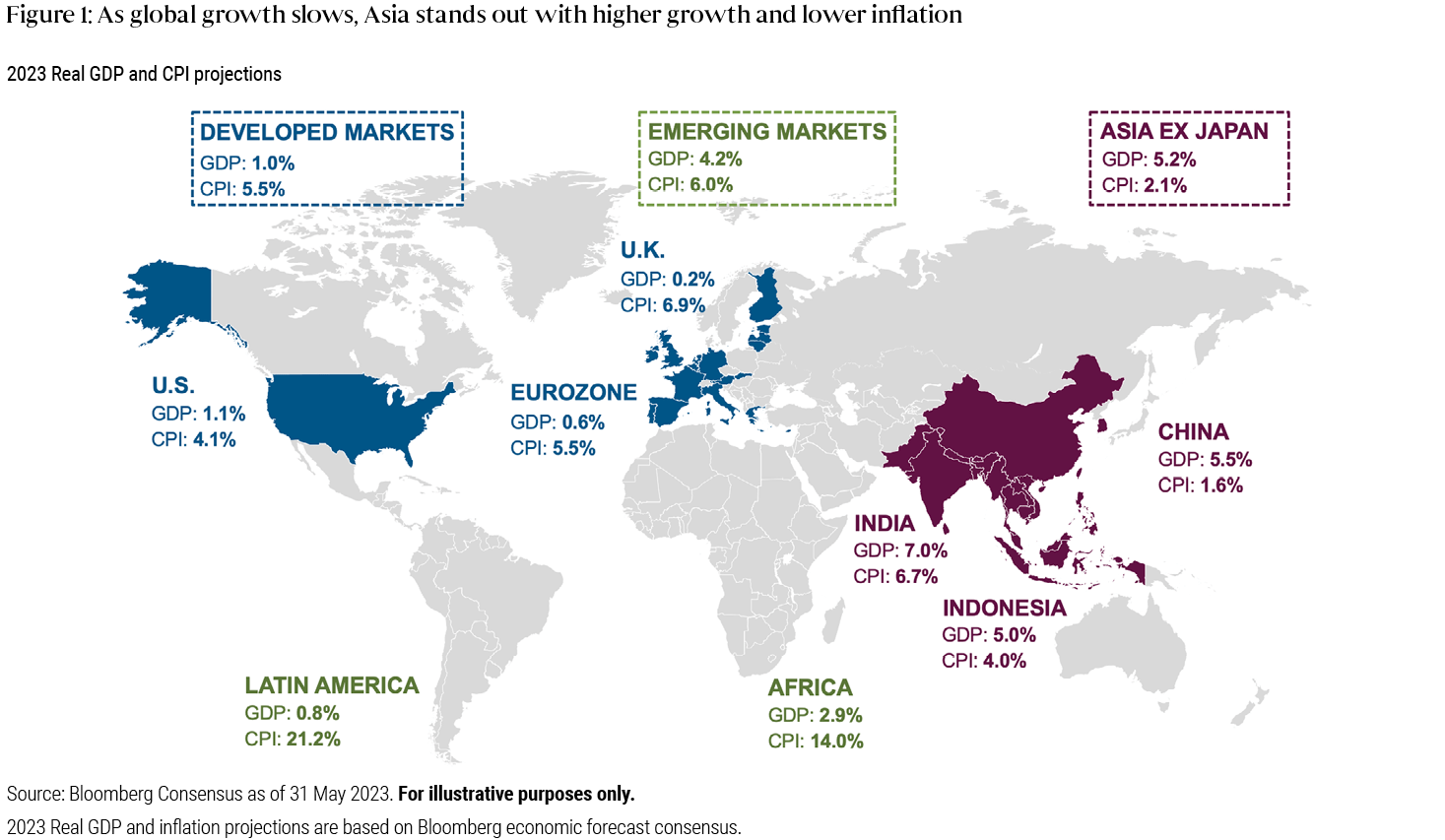

A: We see three factors behind the opportunities in Asia credit right now. First, amid a global economic slowdown, we believe Asia has bigger upside potential than developed markets, with forecasts of both higher growth and lower inflation (see Figure 1). Companies in emerging Asia are not facing the same inflation swings as those in developed markets, suggesting that their margins could be potentially more robust and their growth outlook more attractive.

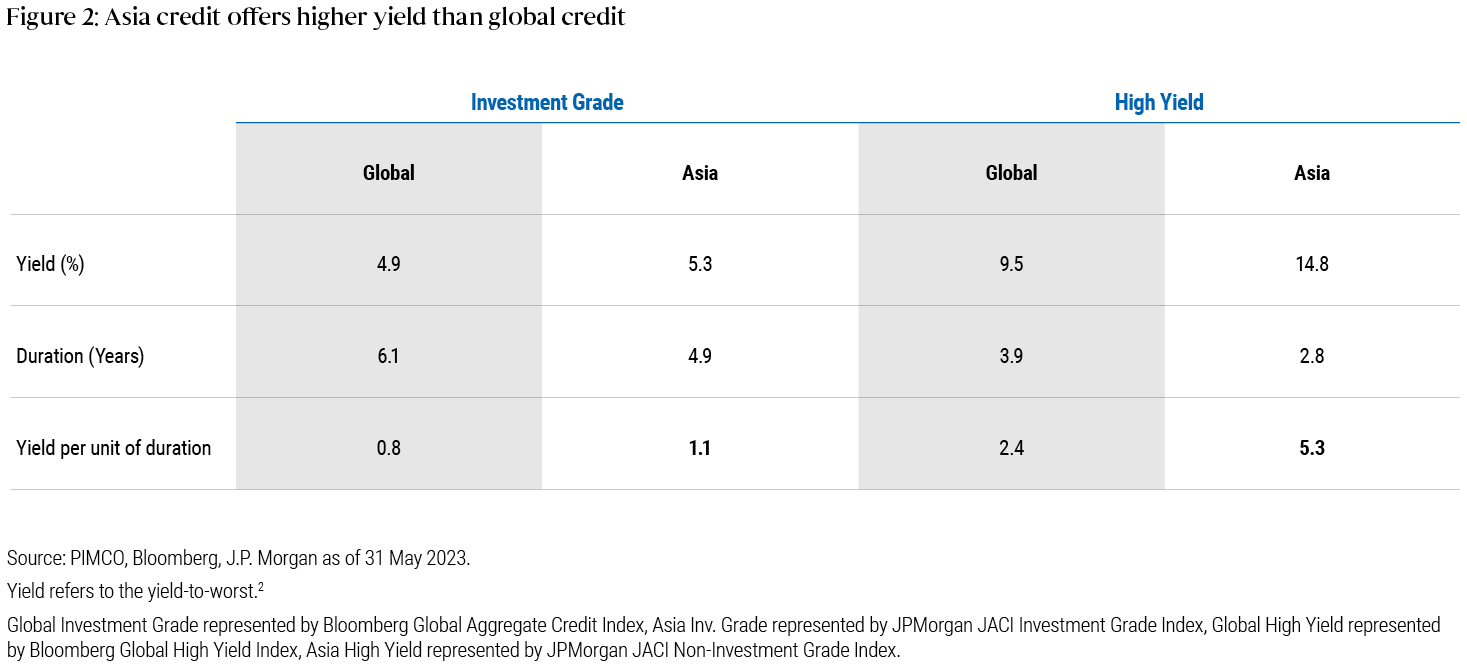

Second, we believe Asia bonds offer a source of income: The current risk/return ratio appears compelling, with both Asia investment grade (IG) and high yield (HY) currently providing higher yieldFootnote2 per unit of duration than global credit (see Figure 2). Asia credit can be an effective way to increase yield in a broader global portfolio.

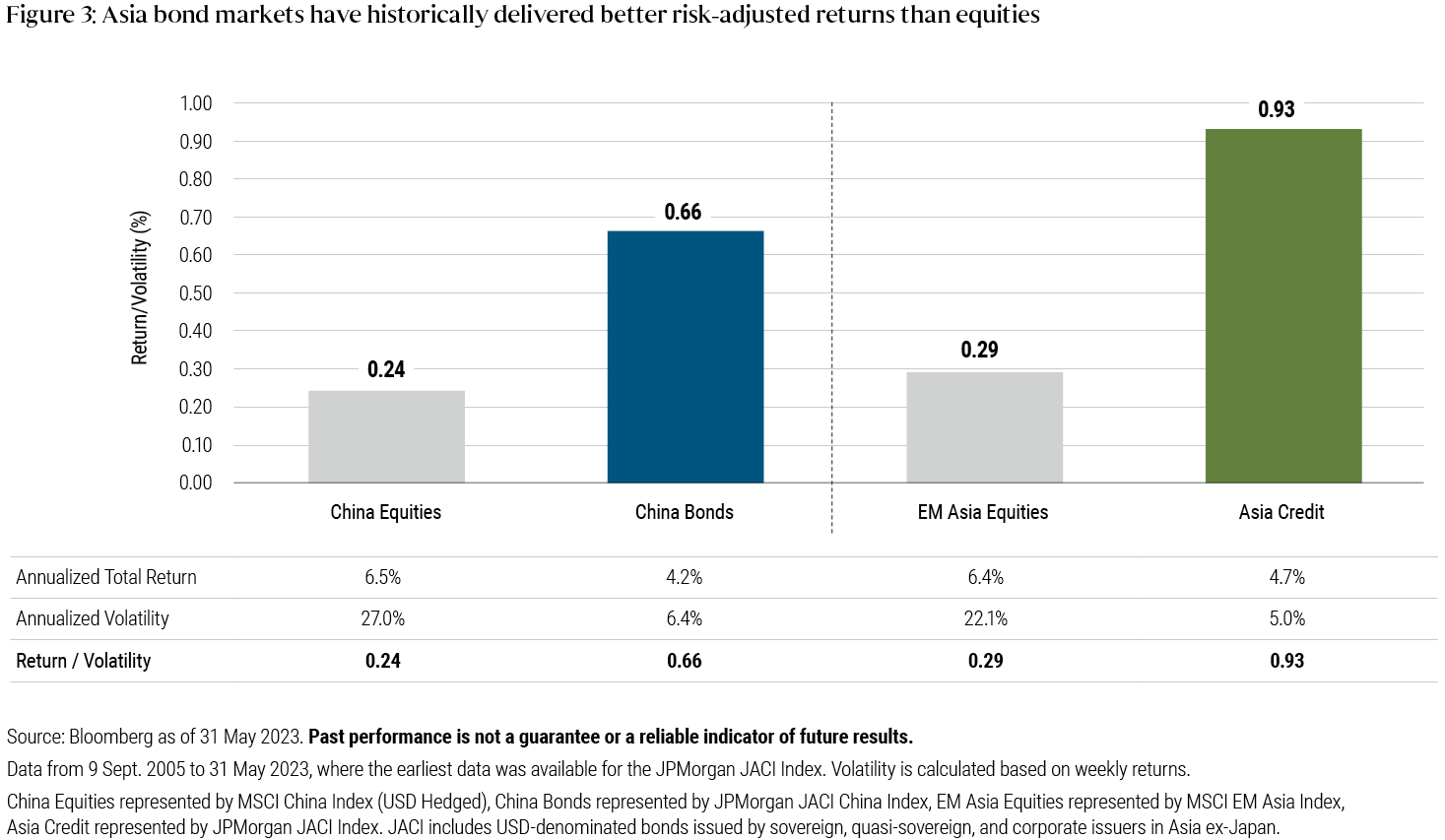

Third, as investors look to capture the upside and spillover from China’s reopening, it’s important to note that historically Asia fixed income has delivered higher risk-adjusted returns than Asia equities or the China stock market. We believe China’s reopening will have a positive impact on the broader Asia region, including increased commodity demand (especially for commodity exporters), and pent-up Chinese demand boosting not only domestic consumption but also regional tourism. While some investors may get excited about the potential upside and buy equities, Asia bonds have historically offered investors the potential to take on less risk to capture comparable returns, measured by return/volatility (see Figure 3).

The Asia credit market represents an approximately US$1 trillion opportunity set that has grown roughly 2.5x over the last 10 years, albeit about $300 billion down from its peak in 2020 following China’s real estate crackdown. With the percentage of real estate much smaller than before, the quality of the Asia credit universe has improved, since IG now forms a bigger part of the overall market.

Q: Why invest in Asia Strategic Interest Bond (ASIB) Strategy?

A: When investing in Asia credit, investors typically opt to buy funds benchmarked to the J.P. Morgan Asia Credit Index (JACI). While ASIB invests primarily in the JACI universe, it offers unique features that set it apart from other Asia bond funds: more attractive income, greater flexibility and active management, and consistent distribution.

First, the strategy targets more attractive income and yield than that of the JACI, by having a structurally higher HY allocation (capped at 50%, actual exposure depends on investment view), while maintaining a high average credit quality. By contrast, nearly 85% of the JACI is IG, with only about 15% HY (including non-rated).

Second, as a flexible and actively managed strategy, ASIB has less emphasis on a particular benchmark – while it is mainly invested in Asia, the portfolio managers also have the ability to take advantage of local currency instruments and other compelling income opportunities outside Asia (capped at 33.3%Footnote3 ). The strategy targets a diversified set of holdings based on bottom-up credit analysis, while our investment approach emphasizes a balance of risk factors across countries, industries, and issuers.

Third, to meet the investor demand for consistent income distribution, ASIB’s monthly dividend cents per share will be set at a consistent and sustainable yield reflective of the income generated by the strategy. The capacity for distribution will increase as the yield-to-maturity of the portfolio shifts up, which makes the strategy particularly appealing for investors seeking a reliable income stream.

Q: How is ASIB strategy positioned in the current market?

A: In our view, this evolving market presents a range of opportunities, such as in India and Indonesia. We expect performance dispersion within the Asia credit universe to be high. As such, we are focused on carefully selecting credit positions where we see value and remote default risk (particularly in a sustained default cycle), relying on the insights and best ideas of our credit research analysts in the region.

The strategy maintains a diversified portfolio across sectors and issuers, focusing larger exposures in areas with stronger secular growth potential, barriers to entry, adequate asset coverage, and more attractive relative value. In the coming months, we continue to expect further differentiation between winners and losers, providing significant opportunities for bond investors such as PIMCO that employ an active and selective investment approach.

Q: How can this strategy benefit a broader portfolio?

A: We believe the strategy can help meet multiple portfolio objectives. For investors seeking stable income generation, the strategy offers a more attractive yield than the JACI, and yield pickup from global developed market holdings. For investors seeking to maintain their Asia exposure but who are worried about the volatility from a pure Asia HY strategy, ASIB offers a higher credit quality solution with less risk. And finally, for investors who are looking to invest in Asia to capture the market’s growth upside, the strategy offers a more balanced solution versus a high octane strategy such as a pure HY fund or an Asia/China equity fund.

Whilst income generation is an important goal of the strategy, we also aim to achieve capital appreciation over time, and thus the strategy may also be suitable for investors looking to generate an attractive total return from an investment in Asia fixed income.

Q: What is PIMCO’s experience investing in Asia fixed income markets?

A: PIMCO has one of the largest and most established Asia fixed income teams, including more than 20 investment professionals spanning portfolio management and credit research across our Hong Kong, Singapore, Tokyo, and Sydney offices. The team is fully integrated into PIMCO’s global investment platform, enabling it to draw on the firm’s macroeconomic expertise and combine this with top-down and bottom-up input from the Asia region to implement investment views. As a firm, PIMCO has decades of experience investing in Asian and emerging markets debt across multiple market cycles.

Performance in Asia fixed income tends to be uneven and differentiated across credit sectors, industries, and individual companies. PIMCO’s forward-looking fundamental credit and sovereign analysis and our internal ratings process that is completely independent from ratings agencies allow us to identify risk and capitalize on opportunities not fully priced into Asian markets.

2 Yield refers to Yield to Worst (YTW): the estimated lowest potential yield that can be received on a bond without the issuer actually defaulting. The YTW is calculated by making worst-case scenario assumptions by calculating the returns that would be received if provisions, including prepayment, call, or sinking fund, are used by the bond's issuer. PIMCO calculates a Fund's Estimated YTW by averaging the YTW of each security held in the Fund on a market-weighted basis. PIMCO pulls each security's YTW from PIMCO's Portfolio Analytics database. In general, the calculation will incorporate the yield based on the notional value of all derivative instruments held by a Fund. The measure does not reflect the deduction of fees and expenses and is not necessarily indicative of the Fund's worst possible performance. A portfolio’s actual yield or distribution rate may be significantly lower than its estimated YTW in practice. Estimated YTW is not a projection or prediction of the actual yield or return that a portfolio may achieve or any other future performance results. There can be no assurance that a portfolio will achieve any particular level of yield or return and actual results may vary significantly from estimated YTW. Return to content

3 As of 31 May 2023. Return to content

Featured Participants

Disclosures

Disclaimer

All investments contain risk and may lose value. Investing in thebond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Investing in foreign denominated and/or domiciled securitiesmay involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets.Currency ratesmayfluctuate significantly over short periods of time and may reduce the returns of a portfolio. Mortgage and asset-backed securitiesmay be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. U.S. agency mortgage-backed securities issued by Ginnie Mae (GNMA) are backed by the full faith and credit of the United States government. Securities issued by Freddie Mac (FHLMC) and Fannie Mae (FNMA) provide an agency guarantee of timely repayment of principal and interest but are not backed by the full faith and credit of the U.S. government. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, interest rates, property tax rates, regulatory limitations on rents, zoning laws, and operating expenses. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.