Higher Bond Yields Can Be Fundamental to a Recession Investing Playbook

Investors who have already endured one of the most challenging years ever must now confront the question of how to invest when the U.S. and other major economies may be headed toward a recession. While financial market volatility is likely to persist, we believe the case for bonds is stronger than it has been in years, bolstered by significantly higher starting yields and bonds’ strong track record during economic downturns.

Bond yields have risen sharply in 2022 as the U.S. Federal Reserve and other central banks have hiked interest rates in an effort to tame inflation. Historically, starting yields have had a powerful correlation with bond returns, and today’s yields may offer investors both improved opportunities for income generation as well as greater downside cushion. The especially pronounced rise in shorter-dated bond yields means investors can find attractive coupons without taking on the greater interest rate risk inherent in longer-duration bonds.

Amid the current environment of inflation uncertainty, geopolitical risk, and potential economic contraction, we explore some reasons why bonds could offer better value compared with equities or cash.

1) Recession appears likely

A recession involves a significant, widespread decline in economic activity that lasts more than a few months, according to the National Bureau of Economic Research. Recessions are typically characterized by decreases in productivity, business profitability, and spending by both businesses and consumers, with the latter notable given consumer spending accounts for more than two-thirds of U.S. gross domestic product (GDP), according to Fed data. (For details, please see our recent publication, “Recessions: What Investors Need to Know .”)

As the Fed, the European Central Bank, and the Bank of England continue to pursue contractionary monetary policy, we now view a shallow, mild-to-moderate recession as our base case in the U.S. and other large developed markets such as the euro area and the U.K. There is risk that these downturns could be steeper.

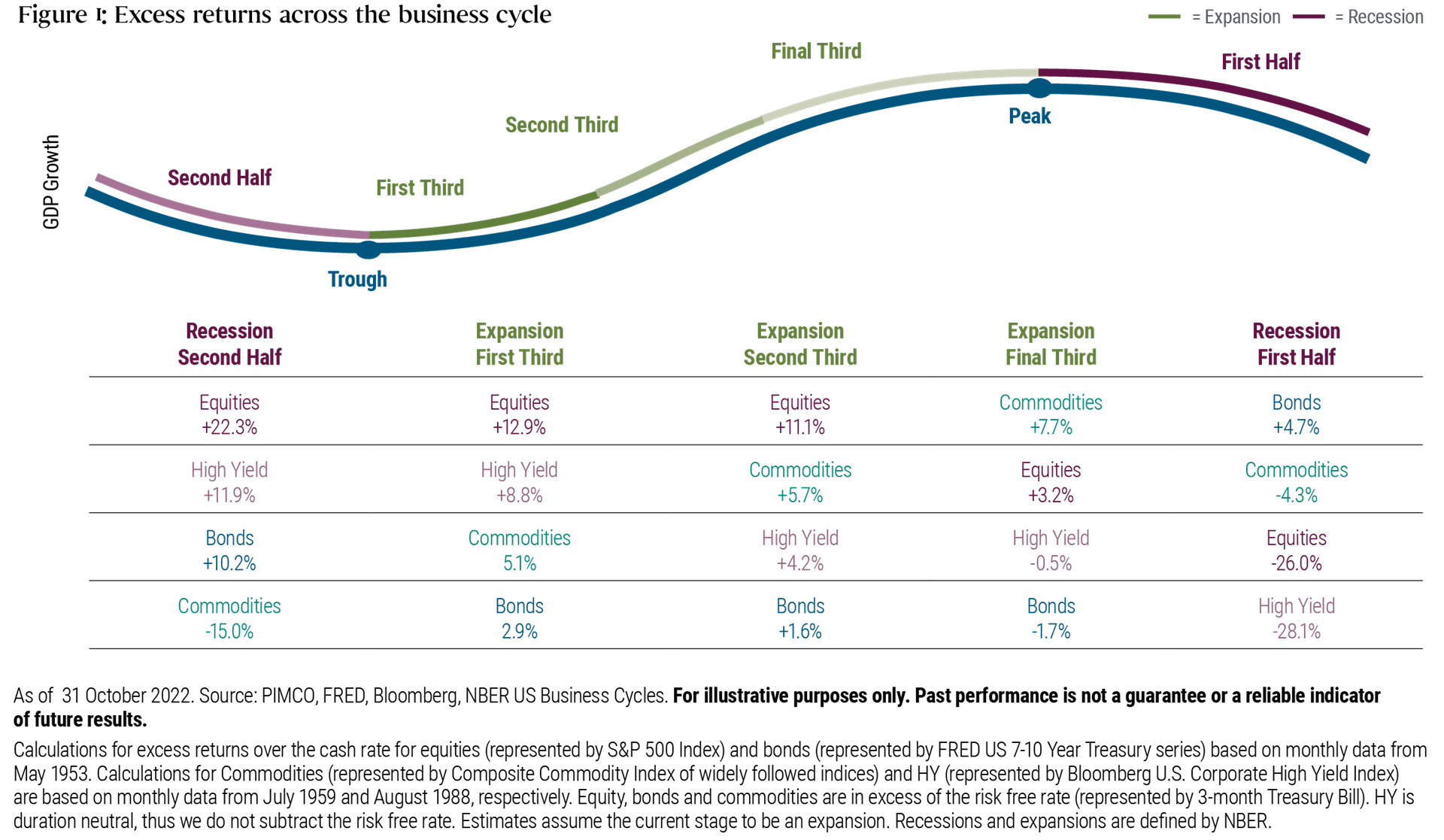

The first half of a recession is typically marked by a decline in economic activity from a late-cycle peak. During this phase, core bond returns (i.e., U.S. Treasuries and investment grade securities) have historically been positive, while returns for high yield bonds, equities, and commodities have typically been negative (see Figure 1).

2) Outlook for equities is uncertain

Following losses in 2022, major stock indices may face further difficulties into next year if early recessionary headwinds gather force, as illustrated in the chart above. Continued concerns about inflation, and whether policy tightening may lead to or accelerate a downturn, could challenge equity markets in the coming months, with potential downside risks to corporate earnings estimates and margin expectations. We still see downside risk to the S&P 500 and other key equity indices from current levels (for more on our views on equities, see our latest Asset Allocation Outlook, “Risk-Off, Yield-On”).

3) Improved opportunities in bonds

While the outlook for other investments appears clouded, bonds look more attractive than they have in years, especially for income-seeking investors, given the broad repricing in 2022.

For example, the yield on the two-year U.S. Treasury note, which was just above 0.7% at the start of 2022, was about 4.5% in late November. That creates an incentive to stay invested in the market, and a platform to seek attractive income even in low-risk, short-dated government bonds.

Investors can then look to augment that yield – without taking on substantial credit or interest rate risk – by venturing into other high-quality areas of public fixed income markets. Sectors that we currently find attractive include municipal bonds (specifically for U.S. investors), U.S. agency mortgage-backed securities, and the debt of banks and companies with strong investment grade credit ratings. U.S. Treasury Inflation-Protected Securities (TIPS) also offer a means of hedging against inflationary risks. Other areas we like include structured credit, which in some cases has been trading at historically cheap levels, and short-dated credit, which may offer attractive all-in yields.

Although yields could still rise further, we think the steepest part of the increase may be behind us. Bonds are poised to offer increasingly attractive real – or inflation-adjusted – yields if central banks are able to get inflation back closer to their target levels over the next couple of years. Furthermore, bonds may reassert their traditional role as a source of portfolio diversification if a slowing economy causes equities to slump, potentially smoothing the ride for investors.

We still expect volatility to persist across markets through year-end and potentially into 2023. But with the attractive valuations and higher yields available across fixed income sectors today, investors who have been struggling just to play defense this year may have increasing cause for optimism.

Learn more about PIMCO’s approach to active fixed income management .

Marc P. Seidner is CIO Non-traditional Strategies.

Featured Participants

Disclosures

The "risk-free" rate can be considered the return on an investment that, in theory, carries no risk. Therefore, it is implied that any additional risk should be rewarded with additional return. All investments contain risk and may lose value.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Diversification does not ensure against loss.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.