Sustainability in Bond Markets Amid COVID-19: ESG in Focus

Summary

- This pandemic is arguably the first sustainability crisis of the 21st century, and it’s clear to us that action and awareness from investors on long-term sustainability risk may only accelerate post-COVID-19.

- We expect this current crisis could serve as a springboard, causing more investors to potentially look for more sustainable investment choices. This may lead to new financial instruments and innovation.

- PIMCO is committed to leading the way in ESG fixed income through innovative strategies for clients, engagement with bond issuers, and industry collaboration to elevate market standards.

Policy responses and new bond issuance driven by the global health crisis may set the trajectory of ESG (environmental, social, governance) markets for years to come.

Is this health crisis turned economic shock the ESG inflection point that markets needed? In this Q&A, Scott Mather, CIO U.S. Core Strategies and responsible for ESG strategies; Olivia Albrecht, head of ESG business strategy, and Jelle Brons, member of the ESG portfolio management team, discuss the outlook for ESG and PIMCO’s approach to sustainable investing.

Q: IN LIGHT OF THE COVID-19 HEALTH CRISIS, WHAT IS THE OUTLOOK FOR GLOBAL SUSTAINABILITY IN 2020 AND BEYOND?

Albrecht: This pandemic is arguably the first sustainability crisis of the 21st century, and it’s likely to help accelerate action among investors on long-term sustainability risks. For many of us, the profound events of 2020 have illuminated just how interconnected, interdependent, and vulnerable the world is to the potential challenges that climate change will bring.

So far this year we have seen oil supply shocks, a global pandemic, and now protests and demonstrations across the globe regarding social justice. Our hearts go out to our clients and colleagues around the world whose lives have been disrupted. COVID-19 is first and foremost a humanitarian crisis that is disproportionately affecting the world’s poorest and most vulnerable. But it’s also turned into an economic and sustainability crisis.

For nearly 50 years, our investment process at PIMCO has been dedicated to helping millions of investors pursue their objectives, regardless of the shifting market conditions, and our leadership in ESG investing is essential to our commitment to delivering on our clients’ objectives while supporting long-term, sustainable economic growth globally. However, we need to do more as investors, issuers, asset owners, and asset managers to align efforts to bring cohesive change even sooner.

Q: HOW ARE BOND MARKETS EVOLVING TOWARD MORE SUSTAINABILITY?

Mather: Sustainability is tending to garner a greater share of mind in society and especially in the business and investment community – and we believe that is key to maximizing economic growth and resilience in the long term. A greater collective focus on sustainability may benefit investors in the near term in two key ways: first, more data and transparency. And second, growth in new financial instruments. We expect 2020 will be a busy year for innovation and new developments for investors.

PIMCO is actively involved in industry groups and policymaking circles that seek to innovate and develop new financial instruments. Due to our size, we are in a position to advise them on shaping market standards.

For example, to help drive this market innovation, PIMCO is co-chairing the UN Global Compact CFO Taskforce for the SDGs (Sustainable Development Goals). As a founding member of this two-year project, we aim to help mobilize hundreds of CFOs to tackle the financing needs around the SDGs while creating opportunities for impact-oriented investors. As a co-chair of the CFO Taskforce with Enel, we aim to use our expertise in bond markets to create sustainable bond issuance guidelines and norms that will help corporate finance become a meaningful force in closing the SDG financing gap.

Brons: This current crisis could serve as a springboard prompting more investors to look for more sustainable investment choices. We have seen growing issuance in COVID-19 bonds as well as SDG bonds and social bonds on top of a growing green bond market.

Q: HOW DOES PIMCO ENGAGE WITH FIXED INCOME ISSUERS ON ESG-RELATED FACTORS?

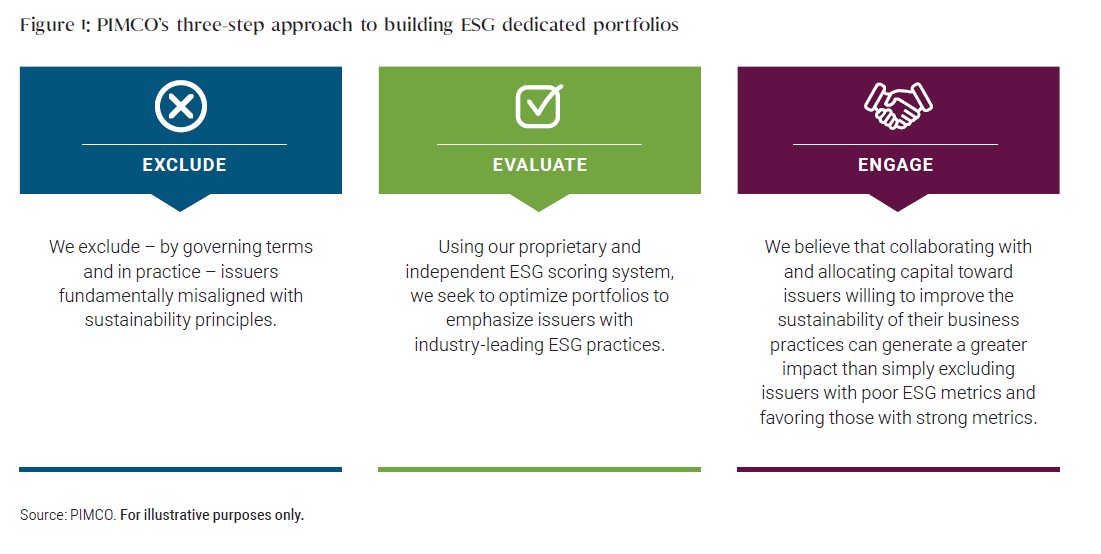

Mather: As an active manager, PIMCO has always believed in engaging with issuers as part of our proprietary research. Engagement is a crucial part of our three-step process to build ESG dedicated portfolios (see Figure 1), and the insights and impact from these engagement efforts may inform portfolios across the firm, in addition to those dedicated to ESG.

Face-to-face engagement is key to the understanding of issuers’ approaches to management and sustainability. We typically meet numerous times per year with the issuers represented in PIMCO portfolios, and naturally, they want to know what their large investors think.

Fixed income investors also have another way of engaging issuers to provide even more direct influence: bond issuance. Bond issuers need to come back to market consistently, they constantly need to engage with companies that are rating them, and with investors like PIMCO that are buying the bonds. ESG factors are increasingly more important to many clients and ratings agencies alike, which is directly affecting issuers’ cost of raising capital. So in a lot of ways, bond investors can have more influence than equity investors – they certainly may have more opportunities to engage.

Q: WHAT DEVELOPMENTS ARE TAKING PLACE THIS YEAR SPECIFIC TO SOCIAL FACTORS – THE “S” IN ESG INVESTING?

Albrecht: Given recent events, including the COVID-19 pandemic, but also protests around the world about inequality and injustice, we’re seeing an increasing focus and data on social factors . Key social issues are data security, product quality, and human capital management, but inequality is especially top of mind.

Touching briefly on human capital management, we are seeing many companies formalize their strategy on how they manage people. Being able to attract, retain, and engage great employees can give businesses an edge. Key social data points we monitor include employee turnover, engagement, and sentiment as well as formalization of these strategies at an executive level. We ask issuers these questions:

- How does the company monitor and value employee engagement, sentiment, or other indicators of corporate culture?

- How does the company evaluate the impact of turnover, layoffs and outsourcing decisions and are these reports reviewed by the Board?

- What is the annual training budget per employee (3 year trend)? How are training areas tied to strategic growth drivers?

- Does the company provide incentives to managers and employees linked to health and safety outcomes? Are health and safety systems certified, for example to the Occupational Health and Safety Assessment Series (OHSAS) 18001 standard?

We expect to see lasting changes in the global workplace. Given how many people are unemployed globally, it’s inevitable that work will be reallocated in the future. Many people who have been laid off won’t return to work in exactly the same capacity. So there could be long-term advantages for firms that are able to innovate and respond quickly. Firms that fail to innovate are at risk of losing key talent in this human capital redistribution.

Q: HOW DOES PIMCO ENGAGE WITH COMPANIES AMID COVID-19?

Albrecht: As COVID-19 started to unfold, we reached out to companies to share ideas and gather information about their initial responses and crisis management. Here are examples of our active engagements and conversations:

- We asked companies to increase transparency on the immediate and long-term risks that they are facing.

- We asked how companies are treating their employees and whether they are extending benefits in the short term.

- We are focused on improving our understanding of companies’ full supply chains, increasing transparency over the value chain, and understanding how they are responding to this kind of disruption.

We believe good engagement goes hand in hand with good research. Since we have long-term relationships with these companies, we are able to help them identify and implement best practices. We are starting to see some leading social practices come out of this crisis:

- First and foremost, protecting essential workers, seeking to ensure their health and safety.

- Improving benefits and flexibility – e.g., extending mental health counseling or expanding telehealth options.

- Supporting suppliers – those with a transparent value chain are better able to support suppliers.

- And of course, maintaining workforces throughout the disruption is crucial for a stable economic recovery. We understand that not every company can keep every employee, but some hard-hit companies that could not maintain all their employees have still found innovative solutions to ensure access to health and other critical insurance.

Q: WHAT IS THE OUTLOOK FOR CLIMATE PLEDGES IN 2020, IN LIGHT OF THE UNEXPECTED PANDEMIC-RELATED PRESSURES? AND HOW IS PIMCO ENGAGING ON CLIMATE ACTION IN ESG PORTFOLIOS?

Brons: Overall, despite the global pandemic and the drop in oil and gas prices, we’ve observed that most companies’ and countries’ strategic, long-term climate pledges remain in place. While we expect that the pace of progress toward a lower-carbon future will be a bit slower, we’ve also seen encouraging progress. For example, major players in the oil and utilities industries are switching from coal to renewable energy, and issuing green bonds, to be in accordance with the Paris Agreement.

The impact of April’s oil market shock has been brutal for business models that rely on sustained higher oil prices, and it is not just companies, it is some countries as well. We have seen several defaults in the energy sector in the U.S.

By avoiding exposure to fossil fuels, ESG-focused investors also have been able to avoid much of the oil-related volatility. All of PIMCO’s ESG portfolios have basically no fossil fuel exposure – they are not invested in typical energy companies and they have no coal exposure or oil sector exposure. Our ESG strategies may invest selectively in green bonds issued by utility companies that are moving away from coal and into renewable energy. We seek to engage with these companies on their climate plans, targets, and progress toward the renewables transition. We are also actively encouraging some large energy companies to issue green bonds that will fit with their strategic goals of moving into renewable energy.

Q: HOW DOES PIMCO EVALUATE GREEN BONDS TO DETERMINE WHETHER THEY ARE SUSTAINABLE INVESTMENTS (VERSUS “GREENWASHING”)?

Brons: When a new green bond comes to market, our analysts look at two key topics:

- First, do the green bonds’ objectives and use of proceeds actually align with the company’s ESG strategy?

- Second, do we see evidence of a significant positive outcome?

Here is a hypothetical example: A large $50 billion to $100 billion U.S. utility has not issued a green bond for a long time, mainly because it is not actively pursuing a transition renewable energy at this time. The utility then issues a $300 million green bond, with some of the proceeds going into natural gas. We would consider this a bad green bond. Here is why:

- The use of proceeds is partly going into natural gas, and based on the size of the proceeds and the size of the company, this bond issue is probably not making a significant positive impact.

- If this issuer also has not come forward with a substantial plan for moving into renewable energy, it would raise additional red flags in our analysis. We also look for alignment with established standards such as the Green Bond Principles (GBP) published by ICMA (International Capital Market Association). PIMCO is currently one of eight investors on the ICMA GBP and SBP (Social Bond Principles) Executive Committee.

Q: WHAT IS PIMCO’S HIGH-LEVEL BUSINESS STRATEGY FOR ESG INVESTING?

Albrecht: Our ESG platform is composed of two key areas:

- ESG integration: PIMCO is systematically incorporating environmental, social, and governance factors into our broad investment process that touches the nearly $2 trillion of assets that we manage.

- ESG dedicated strategies: We manage a range of portfolios designed to target traditional PIMCO-style risk-adjusted returns while also targeting sustainability objectives.

PIMCO’s firmwide ESG integration is implemented from the bottom up as our analysts incorporate ESG factors into their assessments and valuations. Climate change, regulatory shifts, and consumer preferences are factors that may influence our valuations of investment opportunities on behalf of our clients globally. This bottom-up ESG integration spans our investments across credit, sovereigns, municipalities, and securitized assets.

We also research and assess sustainability factors from a top-down perspective. Our views on climate risk, for example, inform our outlook on risks to financial market stability. Income inequality is another factor we incorporate in our top-down macro views.

PIMCO is a signatory of the Principles for Responsible Investment (PRI), and we received an A+ rating (highest score) from PRI in their annual Assessment Report in 2020 (see Figure 2). For the third consecutive year, we scored A+ in every indicator, highlighting our commitment to sustainable investing. We were one of the few managers who received an A+ rating for integrating ESG factors into fixed income investing.

Our ESG dedicated strategies leverage PIMCO’s time-tested investment process, which starts with high-level macro and market views developed at our Secular and Cyclical Forums. These top-down views are complemented by bottom-up perspectives from specialists and quantitative analysis of individual securities and portfolio construction. We then translate our views into model portfolio targets based on the key risk factors. For example, we use our proprietary ESG scores to build portfolios that tilt toward the higher-scoring issuers (all else equal), to focus appropriate portfolios on carbon reduction, and to emphasize green and sustainability-linked bonds where they are aligned with portfolio objectives.

PIMCO is committed to leading the way in ESG fixed income through innovative strategies for clients, engagement with bond issuers, and industry collaboration to elevate market standards.

We hope investors will join us in bringing ESG past the rhetoric and into action in bond markets.

To learn more about PIMCO’s ESG investment and active engagement platform, please see our latest ESG Investing Report at www.pimco.com/esg-annual-report