Despite some signs of improvement in recent months, Europe continues to underperform U.S. growth on a cyclical basis, mainly due to tighter fiscal policy and a faster transmission of tighter monetary policy. However, this underperformance may become entrenched on a secular basis, as Europe faces a number of longer-term headwinds. Germany looks particularly exposed, but the rest of Europe is not immune, including the U.K.

A challenging macro outlook

Recently, Europe’s economy has diverged significantly from the U.S. In our minds, this is driven by two key factors. First, fiscal support was much more aggressive in the U.S. during the pandemic and its effect continues to leak through the system in the form of still-positive real household excess savings. Second, the shorter average maturities of European mortgage markets compared to those in the U.S. mean households have been feeling the pinch from tighter monetary policy in a more pronounced way.

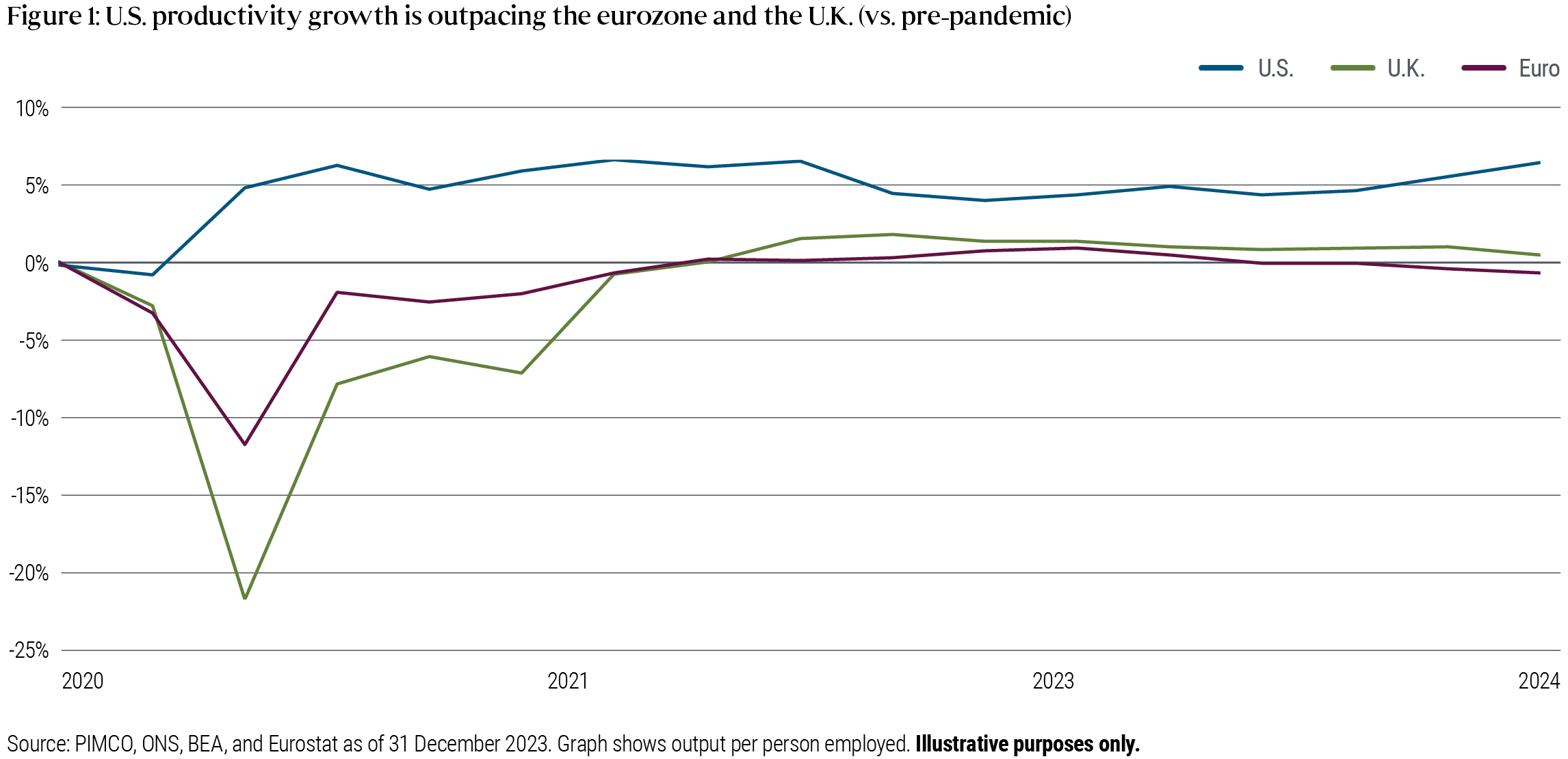

While these dynamics are cyclical in nature, we think a few structural reasons explain why the ongoing growth divergence between the U.S. and Europe may persist.

First, the region is contending with elevated energy costs compared to pre-Ukraine war prices. Second, the competitive landscape has evolved, with China acquiring an increasing market share of manufactured goods that are in direct competition with European goods, not least autos. Third, Europe is a technology laggard, falling behind the U.S. and China on AI-related investments, in part the result of tighter regulatory burdens. Lastly, the European fiscal rule framework (including Germany’s constitutional debt brake) constrains the region’s potential for more active fiscal policy.

Taken together, we would argue that some of the recent divergence in productivity growth between the U.S. and Europe will be sustained (Figure 1). This reinforces the view that equilibrium policy rates in Europe – and destination policy rates in this rate-cutting cycle – are likely meaningfully lower than those in the U.S.

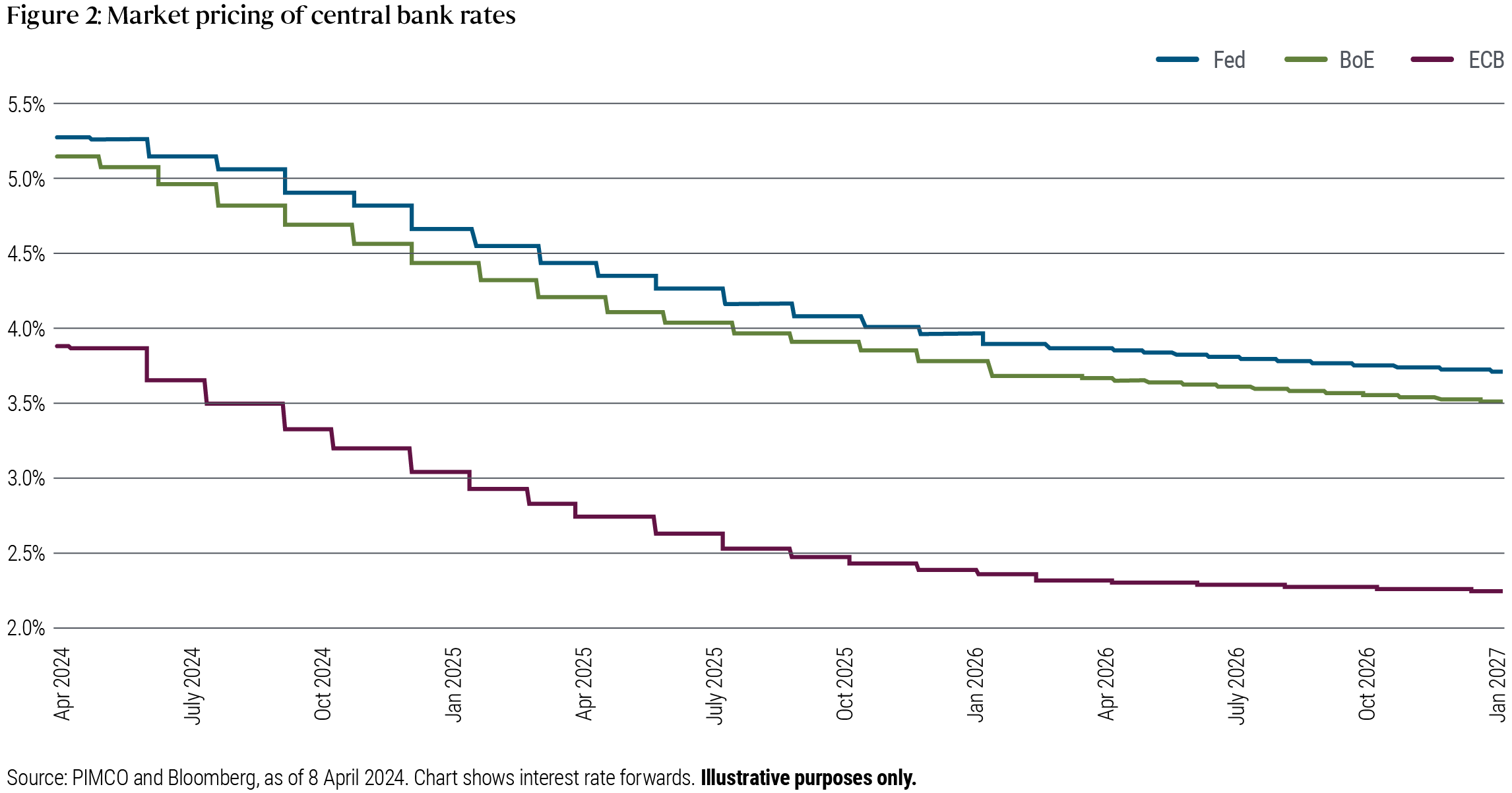

Granted, these issues are particularly acute in Germany, but the rest of Europe is also affected, including the U.K. In the U.K. specifically, we believe there is a market opportunity, given the Bank of England’s rate path is priced on top of the Federal Reserve’s (Figure 2), despite lower cyclical and secular growth expectations and a tighter fiscal stance ahead.

Following the 2022 gilts crisis (triggered by the announcement of £45 billion of unfunded tax cuts), the U.K. government announced significant tightening, worth around 2% of GDP, split equally between spending cuts and tax hikes. These measures remain in place and the government has set out measures to bring the primary balance from a deficit of around 1% of GDP to a surplus of around 1% of GDP by 2027. As a result, the U.K. is on track to run one of the most contractionary fiscal policies among developed countries – one reason why we expect growth to remain below trend.

Investment implications

Given our macroeconomic outlook, interest rate exposure in Europe is attractive, with the region being a good diversifier for duration in global portfolios. This is especially the case in the U.K., given market pricing, with the Bank of England likely to cut rates more rapidly than the Fed over time. Across the curve, we continue to believe the most attractive part is the intermediate rates, where we would expect low-destination policy rates in this cycle. That intermediate “belly of the curve” seems to be the sweet spot for taking interest rate exposures. Front-end yields, being fleeting, will fall as central banks start cutting rates, whereas long-end bonds are more vulnerable to global fiscal concerns.