Secular Stars: Why India and Indonesia Are Set to Shine as Global Economic Leaders

In 2013, India and Indonesia were notoriously named among the so-called “Fragile Five” emerging market (EM) economies that depend heavily on foreign investment to finance growth.Footnote1 A decade later, their fortunes have flipped: The two Asian nations are now seen as rising secular stars amid a challenging global economic outlook.

Growth in India is expected to outpace that of China this year and next – with Indonesia following closely behind in third place among major economies – according to the Organization for Economic Cooperation and Development (OECD). In 2023, the OECD forecasts India to grow 6%, China to expand 5.4%, and Indonesia to grow 4.7%, while the global economy grows 2.7%.Footnote2

Over the secular horizon, we expect annual real GDP growth for India at 6-7% and Indonesia at 5-6% due to continued reform-oriented governance and macro stability. Both countries, with a combined population of 1.7 billion, benefit from younger demographics in contrast to the rapidly aging populations in China and developed countries. In spite of uncertain external conditions, India and Indonesia have effectively managed inflation and fiscal financing.

Against this backdrop, we see scope for currency appreciation and growth outperformance, along with increased capital inflows.

Here, we take a closer look at six themes driving growth in the two countries.

1. Demographics

The size and age of the workforces of India and Indonesia will play a significant role in their economic growth in the coming years. Each has a young and growing labor force that is expanding faster than the number of dependents, with 68% of both populations currently aged 15-64 years and only 7% above 65. In contrast, in more developed regionsFootnote3, the old-age dependency ratio is much higher, with 20% above 65 years, and 64% aged 15-64.Footnote4 India alone will have over 1 billion working-age persons by 2030 and is expected to contribute about 24% of the additional global workforce over the next decade.Footnote5

The median population age is projected to remain under 40 until 2070 for Indonesia and 2057 for India, in contrast to 2027 for China.Footnote6 This translates to a competitive advantage not only in terms of workforce, but also an opportunity to unleash the consumption, savings, and investment power of a young population.

2. Infrastructure

Infrastructure development is crucial for India to achieve its 2047 vision of a U.S. $40 trillion economy and reclassification from a developing economy to a developed economy. Prime Minister Narendra Modi’s Union Budget for fiscal year 2023-24 allocates 10 trillion rupees (U.S. $122 billion) to infrastructure development – five times the amount spent in the previous nine years. Studies by the Reserve Bank of India (RBI) and the National Institute of Public Finance and Policy estimate that for every rupee spent on infrastructure, there is a 2.5 to 3.5 rupee gain in GDP.Footnote7

Infrastructure has also been a particular focus for Indonesia’s President Joko Widodo. Since he assumed leadership in 2014, there have been 2,042 kilometers of toll roads and 5,500 kilometers of non-toll roads constructed, as well as 16 airports, 18 seaports, and 38 dams, according to the president’s Cabinet secretariat.

3. Reforms

Modi’s sustained structural reforms are widely credited for helping the Indian economy enhance its overall efficiency, strengthen its fundamentals, and shed its “Fragile Five” tag. Bolstered by digital technology, the reforms are fundamentally aimed at improving the ease of living and doing business. They are guided by four broad principles: creating public goods, adopting trust-based governance, partnering with the private sector, and boosting agricultural productivity.

The 'Make in India' initiative launched in 2014 with the goal of making India a global manufacturing hub. With a transparent and user-friendly framework, and sector-specific production-linked incentives (PLI), it has helped foster innovation and increase foreign direct investment (FDI) in key sectors like railways, defense, insurance, and medical devices.

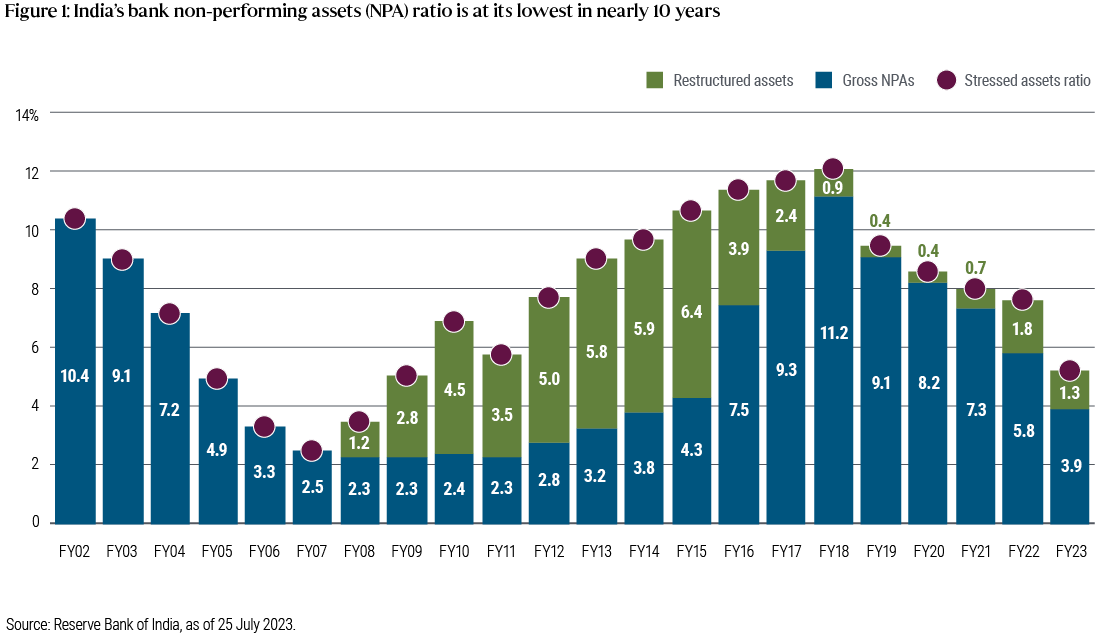

India’s macro stability has improved significantly since 2013, with the RBI building reserves and implementing effective liquidity management measures. Its flexible inflation-targeting policy, and central bank and government coordination on supply side measures, helped curb currency volatility and tame inflation without sacrificing growth. Its bank non-performing assets ratio is at the lowest in a decade (see Figure 1), bank profitability has improved, and corporate balance sheets have deleveraged. This will help ensure efficient credit provisioning, contributing to higher growth in the coming years through higher investments and consumption.

Indonesia’s turnaround has been driven by infrastructure investment, structural reforms, Bank Indonesia’s (BI) prudent policy mix, and the strength of its exports. Globally, the commodity boom has helped the resource-rich archipelago shore up its economic resilience and reduce its current account deficit.

BI set up its domestic non-deliverable forward foreign exchange program, and promoted greater use of currencies other than the U.S. dollar in trade and investment. Regulatory and tax changes resulted in higher local investor ownership of government bonds. These measures helped to curb currency volatility (see Figure 2), and with its burden-sharing agreement ensured financing costs were manageable during times of stress. Meanwhile, government reforms have reduced restrictions for foreign investors, streamlined permitting processes, and lowered foreign investment limits, which helped increase FDI.

4. Shifting global value chains

As global companies adapt their manufacturing and supply chain strategies to build resilience in an increasingly fractured world, India and Indonesia stand to gain.

India’s services exports have been fueling overall export growth (see Figure 3), with a 14% compound annual growth rate (CAGR) over the last two decades.Footnote8 IT and business process outsourcing services make up 62% of total services exports. India has also become a leading global capability center (GCC) hub, accounting for over 45% of GCCs in the world outside of the home country.Footnote9 With a large talent pool and wages about 8-10 times lower than developed markets, we expect India to continue to gain share in global IT services spending.

As for goods exports, India has sectoral advantages in automotives, chemicals, pharmaceuticals, industrial machinery, and electronics. We expect manufacturing as a share of gross value addition (GVA) to grow to 21% of GDP over the next 10 years, vs. 16% in the last decade (9-10% real growth). Its manufacturing push and strong U.S. ties make India a top destination for firms’ “China-plus-one strategy”Footnote10. A sign of early success: India assembled a record $7 billion worth of iPhones last fiscal year, accounting for 7% of global iPhone production (vs. 1% in 2021), and expected to reach 25% in the next few years.

For Indonesia, further downstream processing of its natural resources would be a key driver of its growth potential, as shown by its success with nickel, a key ingredient in lithium-ion batteries used for electric vehicles (EVs). Home to 22% of the world’s nickel reserves, Indonesia’s ban on exports of unprocessed nickel since 2020 has lured foreign investment into locally-based processing plants and smelters, and enabled it to move up the resource value chain.

As a result, Indonesia has become a basic balanceFootnote11 surplus economy on the back of drastic improvements in the metal trade balance (see Figure 4). Its exports of processed nickel have soared from $1 billion in 2015 to $30 billion in 2022, and it is expected to account for half the global production increase in nickel up to 2025.Footnote12 It is looking to replicate this success with bauxite, tin, and copper.

Tourism is another key focus area for Indonesia with the nation’s “Five New Balis” plan, which seeks to invest in and promote five "super priority” Indonesian tourist destinations, in order to further boost tourism receipts, which as of 2019 stood at just 1.6% of GDP vs. 11.3% for Thailand.

5. Energy transition

Indonesia’s advantage lies in commodities, buoyed by rising demand due to the global energy transition. By 2030, it is expected to be the world’s fourth-largest producer of “green commodities” used in batteries and grids, behind only Australia, Chile, and Mongolia.Footnote13

With its edge in nickel, Indonesia is poised to be Southeast Asia’s hub for the EV ecosystem. Coupled with aggressive growth estimates for EV domestic demand (based on Indonesia’s energy transformation commitments to reach net zero by 2060), we expect to see greater FDI flows into the country.

Meanwhile, India’s aggressive energy transformation agenda, especially with solar energy and its push for green hydrogen, should help drive India’s potential growth higher.

6. Digitalization

Prior to 2009, India had no nationally recognized form of identification. Today, more than 1.2 billion Indians (including over 99% of the adult population) have a biometrically-secured digital identity known as Aadhaar. Launched in 2009, the Aadhaar program is part of the “India Stack”, India’s open-source digital public infrastructure that also consists of complementary payment systems and data exchange.

The India Stack has been harnessed to foster innovation and competition, expand markets, close gaps in financial inclusion, boost government revenue collection, and improve public expenditure efficiency. Meanwhile, the “Digital India” initiative, launched in 2015, seeks to improve online infrastructure and increase internet accessibility for citizens, empowering them to become more digitally advanced.

According to European Commission data, the pace of digitalization in India was the fastest among most major economies in the world during 2011 to 2019.Footnote14 India’s digital economy grew at 15.6% CAGR from 2014 to 2019 – 2.4 times faster than the overall economy.Footnote15 In 2021, there were 48.6 billion real-time payments in India, compared to 18.5 billion in China.Footnote16 Digitalization has also enabled the growth of micro, small and medium-sized enterprises (MSMEs), which contribute almost a third of the country’s GDP, but have long struggled to gain access to formal credit.

Indonesia has also made enormous strides in digitalization – accelerated by the COVID-19 pandemic – in terms of digital infrastructure, pro-digital legislation and regulation (such as the Digital Indonesia Roadmap for 2021-2024), and improvements in citizens’ digital literacy and proficiency. In 2021, there were 202 million internet users contributing U.S. $70 billion to Indonesia’s digital economy, with U.S. $146 billion projected in 2025. Similar to India, digitalization is accelerating the growth of Indonesia’s MSMEs, which contribute 61% of the nation’s GDP and provide employment for 97% of the total workforce.Footnote17

Implications for investors

India and Indonesia went through a series of reforms before and during the COVID-19 pandemic under the leadership of Modi and Widodo, which have played a key role in developing resilience in both economies. Both countries emerged strong from the pandemic and Russia-Ukraine crisis, which challenged their institutional stability and political resolve.

We believe currency valuations have not fully reflected these positive developments. Given favorable cyclical dynamics, we see scope for currency appreciation and growth outperformance, along with increased capital inflows. We expect stable sovereign credit ratings with a potential for an upgrade. However, due to taxes and tight valuations, we do not find duration and credit to be attractive in either country.

The 2024 elections in both countries pose a risk to our view should they usher in a change of government, but we broadly expect policy continuity.

1 In 2013, Morgan Stanley coined the term “Fragile Five” in reference to the emerging market economies of Brazil, India, Indonesia, South Africa and Turkey, due to their high vulnerability to capital outflows and a currency slump whenever global interest rates rise. Return to content

2 OECD Economic Outlook, June 2023 Return to content

3More developed regions, as defined by the UN Population Division, are Europe, North America, Australia, New Zealand and Japan. Return to content

4 United Nations Population Fund (UNFPA) State of the World Population 2023 report Return to content

5 https://www.ey.com/en_in/india-at-100Return to content

6 https://database.earth/population/ Return to content

7 Investindia.gov.in Return to content

8 https://www.ey.com/en_in/india-at-100 Return to content

9 https://www.ey.com/en_in/india-at-100 Return to content

10 The “China-plus-one strategy” is a policy of managing risk by locating plants and facilities in China and one other Asian nation. Return to content

11 In a balance of payments, the basic balance is the net balance of the combination of the current account and the capital account. Return to content

12 https://www.aseanbriefing.com/news/indonesia-sectors-to-watch-for-in-2023/ Return to content

13 https://www.economist.com/briefing/2022/11/14/indonesia-is-poised-for-a-boom-politics-permitting Return to content

14 EY Economy Watch, April 2023 Return to content

15 Reserve Bank of India, December 2022 monthly bulletin Return to content

16 ACI Worldwide, Prime Time for Real Time 2022 report Return to content

17 https://www.weforum.org/agenda/2022/05/digitalization-growth-indonesia-msmes/ Return to content

Featured Participants

Disclosures

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-0803-3038657