One of the primary benefits of municipal securities is that coupon income received, in most instances, is exempt from federal income taxation. It’s important to remember, however, that the price appreciation of securities purchased at a discount in the secondary market can be taxable. The rate at which these discounted securities will be taxed depends on a somewhat obscure section of the Internal Revenue Code referred to as the de minimis tax rule.

In a rising interest-rate environment, the de minimis rule creates a potential tax risk that can have a meaningful impact not only on the after-tax returns of investors in the upper tax brackets, but also on how municipal securities are priced. Indeed, it is one of the reasons PIMCO’s municipal bond portfolio managers often prefer to buy bonds priced at a premium. Here we explain the basics of the de minimis rule and discuss its potential significance for municipal bond investors.

De minimis rule basics

Essentially, the de minimis rule determines whether the price appreciation (also referred to as price accretion) of securities purchased at a discount will be taxed at the ordinary income tax rate or the capital gains tax rate. Prior to the early 1990s, this accretion was treated as a capital gain. In 1993, however, the federal tax code was revised to treat the accretion of discounted municipal bonds as ordinary income, but with certain key exceptions applied to smaller market discounts.

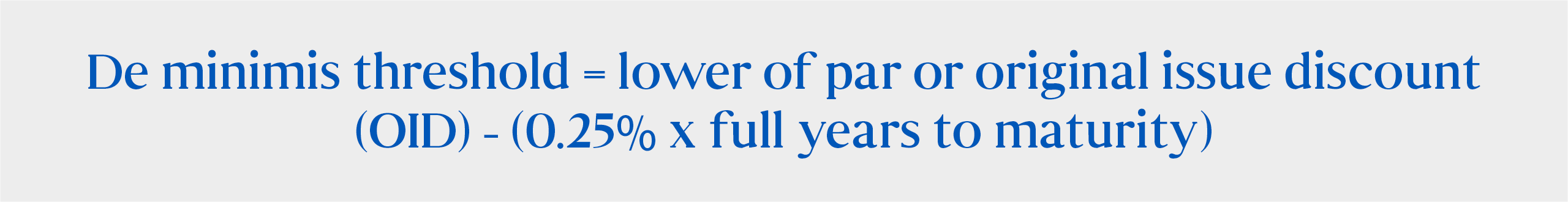

The de minimis rule states that if a discount is less than 0.25% of the face value for each full year from the date of purchase to maturity, then it is too small (that is, de minimis) to be considered a market discount for tax purposes. Instead, the accretion should be treated as a capital gain.

The de minimis threshold price determines whether the accretion of the market discount is taxable at the ordinary income or the capital gains tax rate. It is defined as follows.

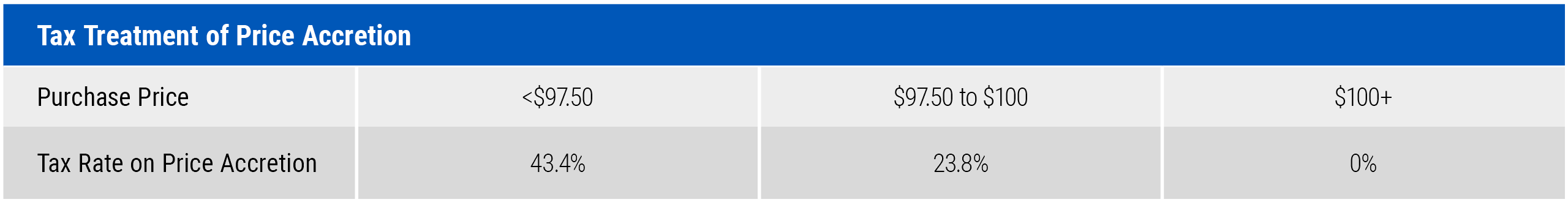

For some municipal investors – particularly those in higher tax brackets – taxation of bond’s market discount can have a noteworthy impact on after-tax returns. For a discounted municipal security purchased at a price below the de minimis threshold, price accretion is subject to the ordinary income tax rate (40.8% for top earnersFootnote1). Conversely, the accretion of a security purchased at a discount, but at a price above the de minimis boundary, is subject to a much lower capital gains tax rate (23.8% for top earners) if the bond is held for longer than one year.Footnote2

Impact of market discounts in a rising interest-rate environment

In the years following the 2008 financial crisis, through March 2022, the U.S. economy experienced an extraordinary period of declining and persistently low interest rates. As a consequence, municipal bond investing did not require careful consideration of the de minimis tax rule. The majority of the municipal market did not price below the de minimis threshold, and given low interest rates prior to 2022, most municipal securities traded at a significant premium.

This has changed after Fed raised rates from near zero in 2022. In a rising rate environment, declining bond prices implies that more municipal securities could fall below the de minimis threshold. Also, the prolonged low interest rate environment of the past contributed to an uptick in municipal issuance with lower-coupon bond structures at lower prices than their higher-coupon counterparts.

As higher interest rates drive bond prices lower, those securities issued at or near par may now be more vulnerable to negative tax and liquidity implications associated with the de minimis rule.

- Tax impact. Given the higher tax rate any buyer would incur as a result of purchasing bonds below the de minimis threshold, securities trading near or below the boundary will likely trade at an even lower price (and higher yield) to compensate investors for the impact of additional taxes.

- Liquidity impact. Potential taxes associated with the de minimis rule may also lead to demand distortions in the marketplace as the result of a reduced buyer base. The traditional tax-sensitive municipal buyer may shun securities with any tax consequences, even in instances when yields compensate investors for the higher tax treatment.

These dynamics, in effect, may create a “price cliff” as bonds approach the de minimis cutoff. The impact of higher taxes and diminished liquidity may cause bond prices to deteriorate more rapidly than they otherwise would if the price was higher and further from this threshold.

The significance of rising rates: an example

Consider the following example using a municipal security that was issued at par with 10 years to maturity:

- If the security was purchased below $97.50, the entire accretion from the purchase price to $100 would be subject to the ordinary income tax rate (40.8% for top earners)

- If the security was purchased at a price between $97.50 and $100, the entire accretion from purchase price to $100, under the de minimis rule, would be subject to the capital gains tax rate (23.8% for top earners) if held for greater than one year

- If the security was purchased at a premium ($100 or higher), there would not be accretion (or tax consequences) associated with the bond as it matures

How PIMCO helps investors manage these potential tax consequences

PIMCO favors municipal bonds priced at a premium, in part because they are less likely to be subject to the tax, liquidity and ultimately, price consequences associated with the market discount issue. In a rising rate environment, municipal bonds purchased at a premium should provide a greater cushion from the de minimis threshold compared to discount or par securities. Higher coupon premium securities may also offer additional cushion against rising rates since the front-loaded cash flows (via a higher coupon payment) reduce the security’s overall duration (or market sensitivity to interest rate changes).

Although many investors view their municipal allocation as buy and hold to maturity, credit deterioration or unforeseen cash requirements may necessitate future bond sales even in buy and hold portfolios. Therefore, the potential impact of the de minimis rule should still be considered when choosing between par and premium bonds.

In a rising rate environment, it may be more difficult to liquidate market discount securities because of the tax and liquidity implications associated with the de minimis rule. By maintaining an investment bias toward premium securities and focusing on after-tax returns, PIMCO seeks to protect municipal portfolios against the potentially adverse effects of the de minimis market discount rule.

To receive up-to-date municipal market insights from PIMCO,

subscribe to our Muni Insights list.

(Generally one to three key emails per quarter. Unsubscribe at any time.)

1 Tax rate is determined using the top Federal Marginal Tax Rate of 37.0% plus a Medicare Tax of 3.8% for top earners.Return to content

2 Note that the de minimis rule would generally apply to individual holders – institutional investors, such as mutual funds, generally amortize market discount into current income as taxable income. Tax rate includes Medicare Tax of 3.8% for top earners.Return to content