Why isn’t traditional asset class diversification enough?

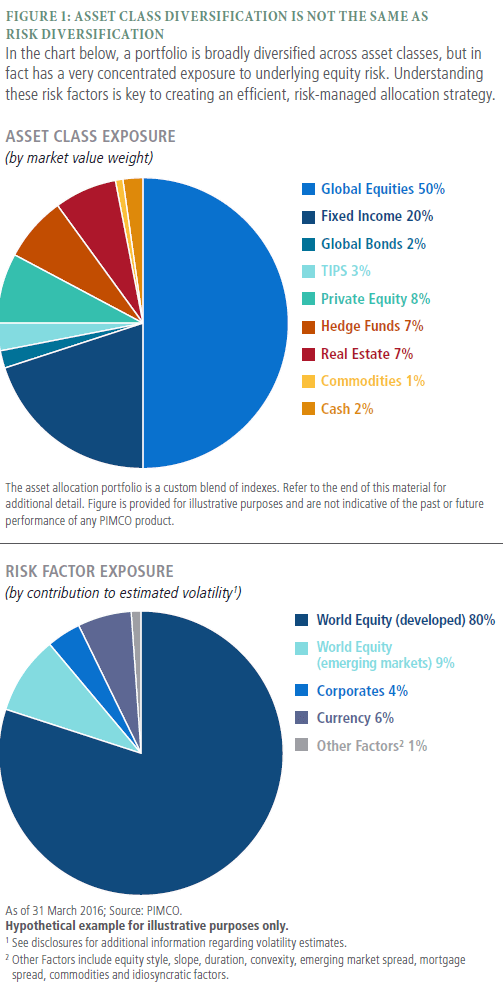

Traditional allocation strategies seek to mitigate overall portfolio volatility by combining asset classes with low correlations to each other, meaning that they tend not to move in the same direction at the same time. However, asset class correlations are less stable than many investors realize, and long-term trends such as globalization are driving correlations higher. In addition, correlations typically increase during periods of market turbulence. As a result, seemingly distinct asset classes are likely to behave more similarly than many people expect. In other words, even portfolios that are well diversified across asset classes may not be positioned to adequately diversify and cushion market volatility(Figure 1).

What is a risk factor?

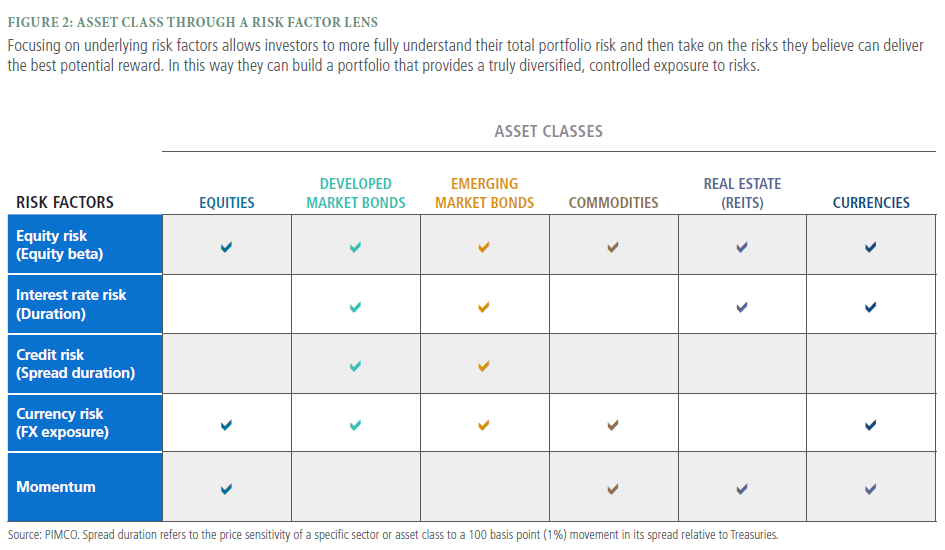

Risk factors are the underlying risk exposures that drive the return of an asset class (see Figure 2). For example, a stock’s return can be broken down into equity market risk – movement within the broad equity market – and company-specific risk. A bond’s return may be explained by interest rate risk – price sensitivity to changes in rates – and issuer-specific risk. And currency risk is a factor for assets denominated in foreign currencies. By targeting exposure to these underlying risk factors, investors can select a mix of asset classes that provides more diversified portfolio risk.

How does risk factor-based allocation work?

While it’s not possible to invest directly in a “risk factor,”using an allocation strategy based on risk factors can help investors more effectively choose a mix of asset classes thatbest diversifies their risks while also reflecting their viewson the global economy and financial markets.How would such a strategy work? By understanding the underlying risk factors within various asset classes, investors can ultimately choose which asset class allows them to most efficiently obtain exposure to that particular risk factor. For example, if they wished to add foreign currency risk to their portfolio, they could do so by investing directly in currencies, but they could also consider foreign equities, bonds or even commodities, if valuations seemed more attractive among those asset classes. Over time, that flexibility can help add significant value to a portfolio.

How can investors apply risk factor-based diversification to their portfolios?

Using a risk factor-based approach requires a forward-looking macroeconomic view on a wide range of variables, including monetary policy, geopolitical developments, inflation, interest rates, currencies and economic growth trends. Because few individuals have the resources or infrastructure to continually monitor these factors, it may make sense for them to talk to their financial advisors about funds that use such an approach.