All Asset All Access: Diversifying Portfolios Amid Inflation and a Declining Dollar

Summary

- Research Affiliates forecasts the U.S. dollar will continue along a downward trend, providing a potential tailwind for ex U.S. developed market equities as well as emerging market equities and bonds. This may bode favorably for the All Asset strategies given their structural orientation toward these and other diversifying asset classes.

- A study of decades of global inflationary episodes provides historical context on how long it may take for inflation to subside after it crests. Research Affiliates believes portfolios should be prepared for a range of outcomes.

- Since mid-2020, inflation has risen sharply, but long-term inflation expectations only modestly. The All Asset strategies embed a focus on diversifying markets that have tended to act as a hedge against rising inflation; these assets also have tended to fortify portfolios against the risk of rising inflation expectations.

Jim Masturzo, CIO for multi-asset strategies at Research Affiliates, explains their view that the U.S. dollar will likely continue to weaken, and what this means for investing. Rob Arnott, founder and chairman of Research Affiliates, and Omid Shakernia, head of research, discuss the outlook for inflation in light of historical analysis, and how this informs portfolio strategy going forward. As always, their insights represent Research Affiliates’ views in the context of the PIMCO All Assetand All Asset All Authority funds. All Asset All Access is published quarterly.

Views expressed here are from Research Affiliates as of 7 February 2023.

Q: What is Research Affiliates’ outlook for the U.S. dollar, and what informs your view?

Masturzo: While the U.S. dollar, as measured by the DXY index, has retreated 9% from its most recent high in September 2022, its descent has slowed more recently. Our view is that the slowdown is temporary and we expect the dollar, which is still 35% elevated from its low at the start of the last decade, to continue the downward trend.

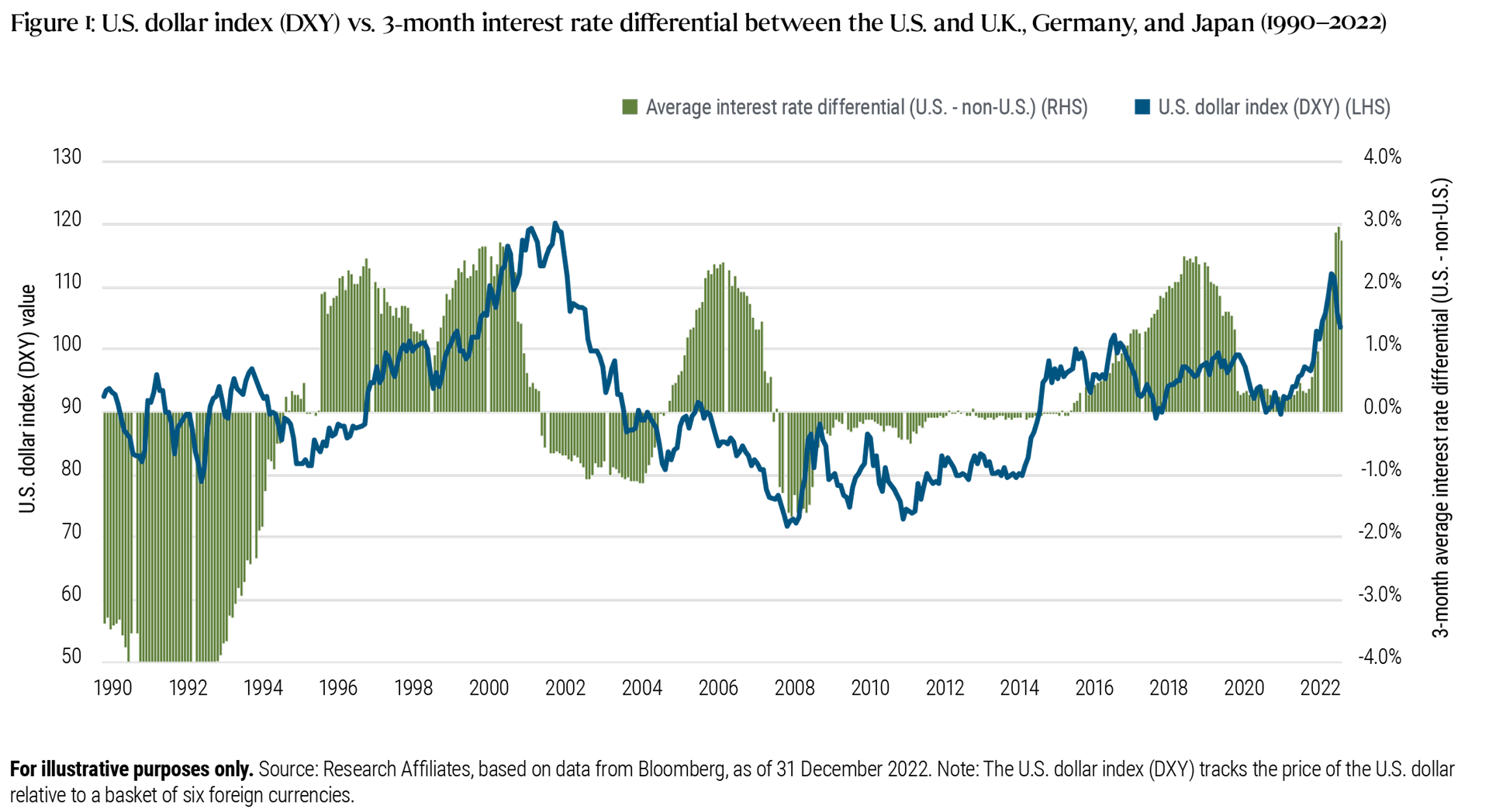

Consider the following: First, the dollar’s current strengthening cycle is now roughly 12 years long, surpassing its typical eight-year price cycle length. Second, during that time the U.S. has maintained higher interest rates than many other developed nations. Last, the rapid strengthening in the dollar in 2022 was largely fueled by expectations of a faster and stronger response by the U.S. Federal Reserve relative to other major central banks in an effort to fight inflation. Research Affiliates’ base case expectation is that the interest rate differential between the U.S. and other developed countries (see Figure 1) will continue to tighten, accelerating the dollar’s pullback.Footnote1

Q: How does this outlook inform positioning within the All Asset strategies?

Masturzo: Across a broad set of 14 asset classes since 1967 (where data is available), Research Affiliates has examined the historical relationship between the U.S. dollar’s movement (rising or falling) and each asset class’s return profile.Footnote2 Our research concludes that in a weakening dollar scenario, unhedged foreign stocks and bonds not only typically outperformed, but appeared to be the only statistically reliable relative relationship.Footnote3

The current weakening in the U.S. dollar, which we at Research Affiliates expect will continue, has a direct channel into the All Asset models via our asset class forecasts that underpin the structural positions in the portfolios. Unhedged exposures to foreign stocks and bonds are likely receiving a tailwind from appreciating foreign currencies. This bodes favorably for the All Asset strategies, in our view, given their structural orientation toward diversifying asset classes including EAFE equities (Europe, Australasia, Far East developed markets), emerging market (EM) equities, and EM bonds. As of year-end 2022, these assets constituted 34% of the All Asset Fund portfolio, above the 31% historical average since the fund’s inception on 31 July 2002 (the historical average is based on monthly weights).

Q: Let’s pivot to Research Affiliates’ outlook on global inflation. Rob and Omid, you recently conducted research on this subject. What does history suggest about the length of time it takes inflation to recede to 2%?

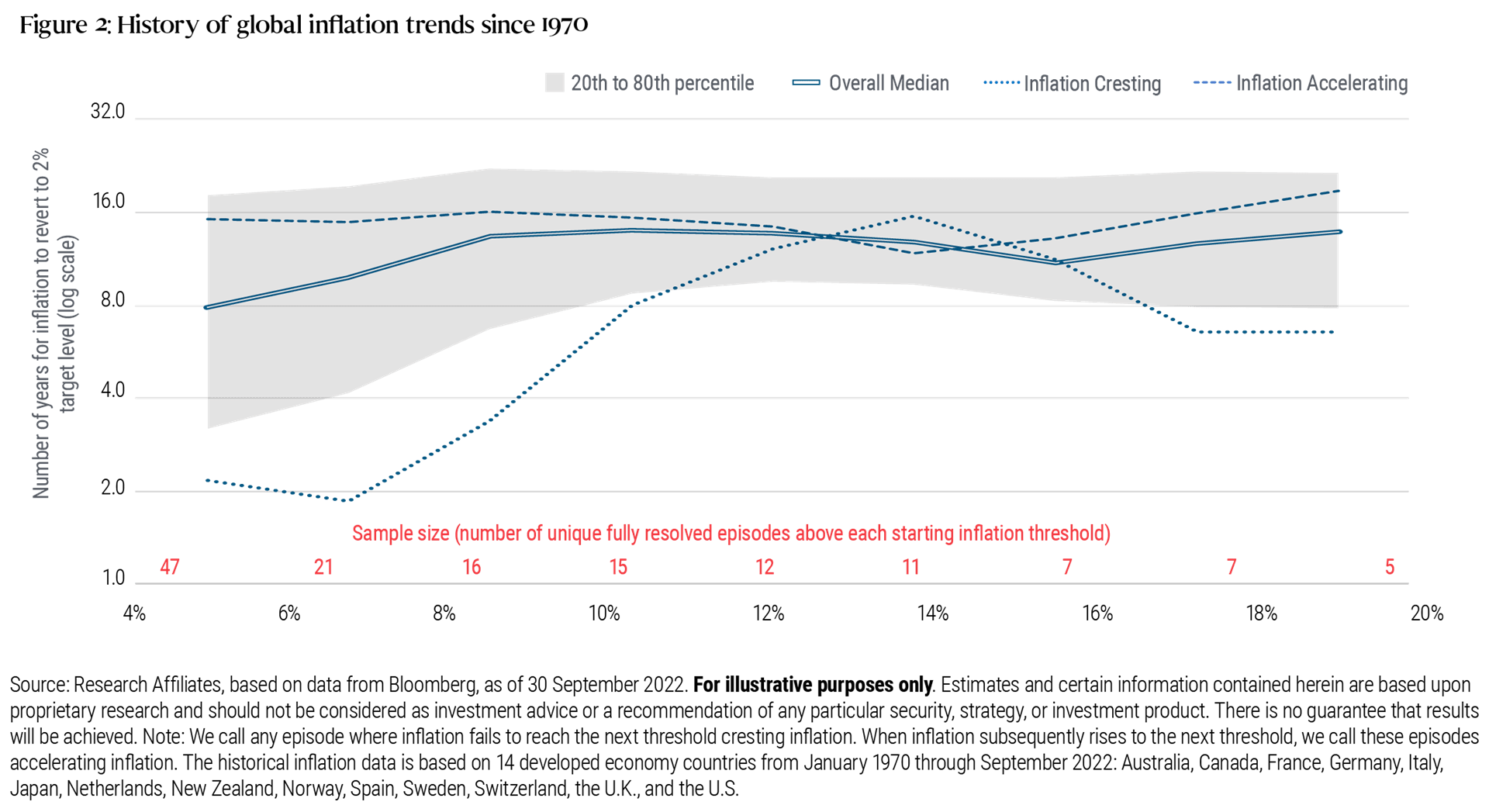

Shakernia: In our recent piece, “History Lessons: How ‘Transitory’ is Inflation?”Footnote4 Research Affiliates studied a 53-year history, spanning 14 developed economy countries, and measured how long it took inflation to subside to a 2% target after it surged past thresholds of 4%, 6%, or more up to a maximum threshold of 20%. We also measured the durability of inflation in cases where inflation either reached the next threshold (accelerating inflation) or did not (cresting inflation).

We observe an important pattern in the historical behavior of inflationary surges. We find that in about half of the episodes where inflation surged past the 4% threshold, it reversed course and receded back to 2% instead of reaching the 6% threshold (we call these episodes of cresting inflation). However, once inflation rose above 6%, approximately 80% of all episodes advanced to new highs (we call these accelerating inflation) – see Figure 2. As of this writing, Research Affiliates’ view is it seems reasonable to believe that we have seen the peak in this inflationary cycle and that this was an episode of 8% cresting inflation. Our historical analysis tells us that the median time for inflation that peaks at 8% to recede below 2% was just over three years. But the odds that we are now in an episode of cresting inflation are certainly not 100%. If inflation intensifies and breaks through the next threshold of 10% (certainly not our base case, but worth hypothesizing), then our historical research suggests a daunting median time span of 13 years for inflation to recede back to 2%. Expecting brief, benign inflation is certainly reasonable, but if history is a guide, setting this as a central expectation may be dangerous.

Q: Hasn’t global inflation already come down faster than recently expected? Is that historical perspective misleading?

Arnott: This question touches upon an interesting element of the inflation puzzle that Research Affiliates believes gets too little attention. Each new year-over-year inflation print adds a new month’s inflation and drops the year-ago figure. We can’t know the new month in advance, but we know the month that’s being dropped with precision. What does this mean, and why should we care?

In 2022, inflation in the first six months was 6.3% (nearly 13% per annum!), then a scant 0.2% in the next six months (as measured by headline U.S. Consumer Price Index or CPI). These months will be replaced, one month at a time, in 2023. As a hypothesis, suppose every month in 2023 matches the average inflation of the last three years, 0.46%/month. We may see widespread applause for what could be called an illusion that inflation is tapering as the year-over-year measure drops from 6.5% (as of the end of 2022) to 2.9%, followed later in the year by growing fear from an illusion that inflation is reigniting, as the measure rises from 2.9% to 5.7%.

So, at Research Affiliates we forecast that inflation will continue to tumble until mid-2023 and then reignite in the second half of the year. Both moves, from an annualized perspective, may be an illusion. Both could surprise many observers.

Q:How does your inflation outlook inform positioning within the All Asset strategies?

Arnott and Shakernia: The All Asset strategies are intended to provide investors with broad diversification and a hedge against changes in inflation expectations. As 2021 and 2022 demonstrated, changes in expectations are very different from inflation shocks. From mid-2020 to mid-2021 to mid-2022, the measure of year-over-year headline U.S. CPI inflation rose from 0.6% to 5.4% to 9.1%, respectively. Over that same span, 10-year “breakeven inflation” (an objective measure of the market’s expectations for U.S. inflation over the coming year, reported by the Federal Reserve Bank of St. Louis) rose from 1.3% to 2.3%, then essentially didn’t budge, remaining roughly around a 2.3% expectation to this day in February 2023!

Ten-year inflation expectations have not been near the reported inflation rates since early 2021. The big shock – for Research Affiliates and many others – was that, starting in April 2022, inflation expectations fell even as reported inflation was rising. So, after inflation expectations peaked in April 2022, most asset classes that historically have tended to hedge against rising inflation expectations got hit nearly as hard during the bear market as mainstream stocks and bonds. Where to from here? Inflation expectations are now below where they were in April 2021, when Federal Reserve Chair Jerome Powell first introduced the expression “transitory inflation” in Fed communications.

After about April 2022, most economists, pundits, and investors apparently didn’t think the inflation would “stick.” Research Affiliates believes this narrative will likely tend to be reinforced through mid-2023, as the lofty inflation months of early 2023 are replaced in the year-over-year measures. Then, late 2023 may challenge that narrative, as the near-zero inflation months of July–December 2022 are replaced. Diversifying markets that historically have tended to provide some measure of hedging against rising inflation (like commodities, U.S. Treasury Inflation-Protected Securities (TIPS), real estate investment trusts (REITs), emerging market stocks and bonds, value stocks, and high yield bonds) also historically have tended to help fortify portfolios against the risk of rising inflation expectations. At Research Affiliates, we believe rising expectations appear very likely later this year.

By emphasizing these kinds of diversifying markets, the All Asset strategies may complement a portfolio’s existing allocations to mainstream U.S. stocks and bonds, both of which historically have tended to underperform during inflationary surges. In response to the prospect for rising inflation expectations, the All Asset strategies have increased appetite for and emphasis on these asset classes within the portfolio.

The All Asset strategies, including All Asset Fund and All Asset All Authority Fund represent a joint effort between PIMCO and Research Affiliates. PIMCO provides the broad range of underlying strategies – spanning global stocks, global bonds, commodities, real estate, and liquid alternative strategies – each actively managed to maximize potential alpha. Research Affiliates, an investment advisory firm founded in 2002 by Rob Arnott and a global leader in asset allocation, serves as the subadvisor responsible for the asset allocation decisions. Research Affiliates uses their deep research focus to develop a series of value-oriented, contrarian models that determine the appropriate mix of underlying PIMCO strategies in seeking All Asset’s return and risk goals.

1 For further analysis and findings, read “The Buck Stops Here” by Jim Masturzo (Research Affiliates, January 2023). This article is available on the Research Affiliates website. Return to content

2 The 14 asset classes in this study are represented by the following indices (in parentheses, with data inception date): U.S. large equities (S&P 500 Index since 1967); U.S. small equities (Russell 2000 Index since 1979); Europe, Australasia, and Far East (EAFE) equities (MSCI EAFE Index since 1970); emerging market (EM) equities (MSCI EM Index since 1988); U.S. aggregate investment grade bonds (Bloomberg US Aggregate Index since 1976); global ex U.S. aggregate hedged investment grade bonds (Bloomberg Global Aggregate ex US Hedged Index since 1990); short-term U.S. Treasuries (Bloomberg US Treasury 1-3 Year Index since 1992); intermediate maturity U.S. Treasuries (Bloomberg US Treasury Intermediate Index since 1973); U.S. credit (Bloomberg US Credit Index since 1973); U.S. high yield bonds (Bloomberg Corporate High Yield Index since 1983); EM non-local bonds (J.P. Morgan EMBI+ Unhedged Index since 1994); EM local bonds (J.P. Morgan GBI-EM Global Diversified Composite Unhedged Index since 2003); real estate investment trusts or REITs (FTSE Nareit All Equity REITs Index since 1972); and commodities (Bloomberg Commodity Index since 1997). U.S. dollar index (DXY) data in this study is since 1967. Weakening U.S. dollar scenarios are defined by negative DXY Index returns, measured monthly (i.e., “weakening/falling” is any month with a negative DXY return, “strengthening/rising” is any month with a positive DXY return). Return to content

3 Statistical reliability is defined as a t-stat that is greater than +2 or less than −2; the unhedged foreign stocks and bonds that the study found to have a statistically reliable relative relationship include the following specific asset classes (with index proxies as listed above): EAFE equities, EM equities, EM non-local bonds, and EM local bonds. An asset class’s outperformance is defined relative to the other asset classes’ performance.Return to content

4 Rob Arnott and Omid Shakernia, “History Lessons: How ‘Transitory’ Is Inflation?” (Research Affiliates, November 2022). This article is available on the Research Affiliates website.Return to content

Featured Participants

Disclosures

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted, and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting www.pimco.com. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: The PIMCO All Asset Fund and the PIMCO All Asset All Authority Fund invest in other PIMCO funds and performance is subject to underlying investment weightings which will vary. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. The cost of investing in the Fund will generally be higher than the cost of investing in a fund that invests directly in individual stocks and bonds. The Funds are non-diversified, which means that it may invest its assets in a smaller number of issuers than a diversified fund.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve. Forecasts and estimates contained herein are those of Research Affiliates and may differ from PIMCO.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Breakeven inflation rate (or expectation) is a market-based measure of expected inflation or the difference between the yield of a nominal and an inflation-linked bond of the same maturity.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2023-0216-2746159