Extra! Long Yields Peak

| Lost Relatives Appear At Gross Doorstep By Matthew Hodge

Laguna Beach, Feb. 3 – After decades of self-imposed estrangement, as many as fifteen distant relatives of William Gross, the often described “Baron of Bonds,” have renewed contact with the portfolio manager, sources claim. Gross, whose salary and future retention bonuses were disclosed in the national press in early January, refused to comment, but friends claim he has been inundated with “best wishes” and “good luck” messages from at least 4 uncles, 6 aunts, and numerous nephews and nieces whom Mr. Gross claims to have never met. All reportedly expressed awe over Mr. Gross’ recent achievements in connection with the sale of his interest in PIMCO to Allianz, a German insurance company, although Gross claims he had never received as much as a phone call from any of them prior to the announcement of the acquisition and the sizable sums he is expected to receive. “Money makes the man,” one relative was heard to remark, “so this must be quite a man. I regret not having sent Bill and his lovely wife Sue a Christmas card these past several decades but it’s time we all came together as a family now in celebration of… Cont. on page C16

|

Yield Curve Dynamics Said Responsible

By William Gross

Newport Beach, Feb. 3 – Long-term Treasury yields have peaked due to a rather complex set of “yield curve” dynamics which may “invert” standard curve relationships for years to come. During the space of a few trading days in late January, interest rates for long-term Treasuries dropped over 30 basis points, while yields on shorter maturity T notes were rising. This inversion, while typical of late business cycle interest rate behavior brought about by Federal Reserve tightening of monetary policy, had additional dynamics behind it this time around.

Granted, with inflation accelerating and the U.S. economy experiencing 5%+ annualized growth rates, the market’s expectation of future Fed behavior played a part in the sudden inversion. Instead of two future hikes, continued strong growth suggested there may be additional ones beyond that. Short-term Treasuries therefore rose in yield to reflect that possibility. But the dramatic drop in long-term Treasury rates was almost inexplicable in the face of poor inflation news and the resultant rise in short-term rates. However, there are several major secular, rather than cyclical, explanations which suggest that the current inversion may persist for years to come unless the stock market itself crashes and forces another round of central bank easings à la October ’98.

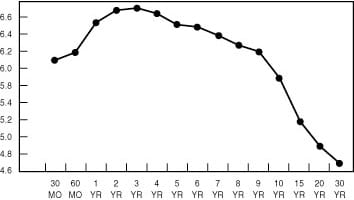

The first of these secular changes has to do with the recently announced Treasury buyback of longer-term Treasury debt. While that program has been in gestation for over a year now and was publicly announced in late 1999, Y2K fears appear to have deflected portfolio managers’ focus until just recently. In mid-January, however, PIMCO and several other money managers began to shift their curve strategies from what is known as a “bullet”– loaded with intermediate-term bonds – to something closer to a barbell – consisting of lots of long-term Treasuries and cash. The idea, in part, was simple: beat the Treasury to the punch by purchasing the exact issues that they were going to buy a few months later. Flush with budget surplus cash, the Treasury has announced a Treasury “buyback” program of $30 billion for the current fiscal year consisting of bonds anywhere from 10 to 30 years in maturity. With the Treasury buying $30 billion of longer dated paper and adding to the supply of short-term to intermediate (1-10 year) securities by selling these issues in periodic Treasury auctions, the potential for a “shortage” of long-term bonds became a distinct possibility. A similar situation has been in existence in the U.K. for years, which had produced a long-standing inverted yield curve shown in the chart below.

UK - Yield Curve

Figure 1

Source: Bridgewater Associates

The U.K. situation is related more to a need to hedge long-term liabilities than to a burgeoning budgetary surplus, and is far more extreme than the situation now posed by the U.S. Treasury buyback proposal. But the implication is clear: persistent supply/demand distortions can invert a country’s yield curve for long stretches of time, even during periods of financial turmoil and central bank liquefaction such as the third and fourth quarters of 1998. As the projected U.S. budget surplus grows ever larger due to the current S curve productivity miracle, future years’ Treasury buybacks promise to be larger and larger. While the Treasury is still issuing small amounts of 30-year bonds every six months, the buybacks could reduce much of the Treasury paper between 10 and 28 years. As fellow PIMCO M.D. Chris Dialynas postulated in one of PIMCO’s whirlwind meetings held to understand the buyback’s implication – “suppose there were no bonds between 10 to 28 years and that pension funds and insurance companies required even a constant amount of 30-year Treasuries to hedge existing liabilities. The demand for the Treasury’s twice annual offerings of 30-year bonds would create a near panic, forcing long yields lower and lower,” Chris said. While Chris’ example was a mind experiment only, it points out one reason why 10-30 year bonds have moved substantially below intermediate yields – potential shortages of long Treasuries will invert a substantial portion of the curve as long as the Treasury’s buyback program continues and they purchase 10–30 year securities . That time horizon in my view is at least several years in the future, perhaps more.

The second secular dynamic is more conceptual but no less powerful. Alan Greenspan, through two dramatic steps – one in 1987 to shore up the stock market, the other in late 1998 to “save the world” – has demonstrated to investors that he will, when required, lower interest rates and provide emerging liquidity to support the stock markets. That means that equity investors have been given a free “put,” or, in other words, a floor below which stocks cannot fall. Where that floor lies is difficult to know – it may in fact be adjusted steadily upward and lie perhaps 20-25% below peak levels. But the mere fact of a floor anywhere close to existing levels emboldens stock investors to buy more and more since they can make a lot but lose only a little.

If this is true in the stock market and is one of the reasons for dramatic market gains in the past 14 months, then the same logic must apply to bonds, real estate (homes) and other long-dated asset classes. With long maturity bonds, however, the effect is not so much on yield levels themselves, but the shape of the curve. Constant resuscitations of the stock market and the economy eventually lead to inflation, which would be more and more of a negative for bonds as an asset class. But long bonds themselves, when compared to shorter dated notes, will trade lower on the curve – whatever interest rate that may be – because stocks and therefore bonds are the object of policy and not the tools of implementation. Stocks and long assets have become the barometer, nay the drivers, of marginal economic growth. They are the modern age’s visage of financial royalty and have replaced banks as the key components of the financial economy. Short assets are the serfs and the attendants. In Greenspan’s world, short-term interest rates move gradually upward until that point where the economy and inflation grow at a safe rate of speed and the market’s exuberance is throttled; if an accident should occur, they’ll plunge sharply downward à la 1987 and 1998. But King Equity and Queen Long Bond will be supported because they are the new keys to the kingdom.

Perhaps the explanation hasn’t been made perfectly clear yet in terms of this Greenspan “stock put” – long bond connection. Both are long assets, you’ll admit, but why would this cause bond investors to prefer long bonds versus intermediates at equal durations? Look at it this way: if stocks are perpetually supported by Greenspan perhaps 20-25% below peak levels, then the stock market will be higher than it should be at any point in time given this implicit protection. In turn, the economy will be stronger than it should be at any point in time, and short rates – the policy implementers, the serfs – will be higher than they would at any point in time. THEREFORE, THE YIELD CURVE WILL BE FLATTER AT ANY GIVEN POINT IN TIME. It won’t always be flatter. A crisis will steepen it sharply, and the anticipation of a crisis – say a 300-point drop in the stock market – will do a little steepening as well. But during normal expansion periods – which occur, after all, during 90% of the modern business cycle, short rates will be higher than would be the case if Alan Greenspan were to play laissez-faire with stocks. That, in turn, means a flatter yield curve than otherwise, and given the Treasury’s buyback program, will force an inversion on the long end for years to come, absent a “crash.”

My newspaper headline and opening column paragraph states that long yields have peaked. While this forecast does not necessarily follow from the logic described above, I believe the Treasury buyback dynamics, combined with an eventual understanding by portfolio managers of Greenspan’s “put” dynamics vis-à-vis the bond market, should be enough to keep 30-year Treasuries from exceeding 6 3/4% as the Fed continues to push short rates higher. Let me therefore be clear: it is only the long bond that has seen its peak yield. Intermediates are another story. But the message of this column is that the yield curve of the future will more closely resemble that of the U.K. than what we’ve been used to in the U.S. – except during crisis periods or anticipations thereof. Bond managers had better start lifting barbells and toss away the bullets.

| Extra, Extra, you read it here first. That and the stuff in the top column about my relatives. I’ve notified the Laguna Beach Post Office to expect an overflow of birthday cards this coming April and to double their staff this Christmas season. In addition... Cont. on page C16 |

William H. Gross

Managing Director

Disclosures

No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission.

This article contains the current opinions of the author but not necessarily Pacific Investment Management Company, and does not represent a recommendation of any particular security, strategy or investment product.

The author's opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed.

This article is distributed for educational purposes and should not be considered as investment advice or an offer of any security for sale. Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Copyright ©1999-2003 Pacific Investment Management Company LLC. All rights reserved.