Fly Fishing In A Deli

Long before political correctness become de rigueur de jour, people of the South practiced essential courtesy. Where I grew up in Virginia, it was considered simply impolite to call someone a liar, even if the evidence pointed compellingly in that direction. We'd say such a person "didn't fish from a pond of truth," or "sliced the bologna just a little bit too thin." With that backdrop, I have recently had repeated visions of Fed Chairman Greenspan fly fishing in a deli.

I wish I didn't. Over the thirteen years of his tenure, I have publicly and steadfastly praised the man (even when he torpedoed one of my forecasts!), because of his extraordinary skill as an economist and his deftness as a policy maker. Indeed, such is my admiration for him that a letter of kindness he wrote to me in 1993 is framed on my office wall.

When confronted with evidence that consensus models of economic behavior have gone awry, he has been willing to acknowledge the evidence, and override policy prescriptions flowing from those models. This is the essence of good analysis and good policymaking.

It is much better to seek the approximately correct answer in a manifestly changing world, than to slavishly follow the precisely wrong answer flowing from old models.

Mr. Greenspan has done this admirably, most significantly in his willingness to see how low the unemployment rate could go, and how fast productivity could accelerate. Perceived wisdom just five years ago was that NAIRU (Non-Accelerating Inflation Rate of Unemployment) was 6% and that when the unemployment rate was at that NAIRU, sustained growth was limited to only about 2¼% — the combination of about 1% labor force growth and 1¼% productivity growth. As the economy "violated" those perceived limits, a majority of Mr. Greenspan's colleagues pined loudly for sharply tighter monetary policy. But he resisted, tapping the brakes only lightly at times, effectively letting the New Economy prove the consensus wrong.

Mr. Greenspan is, to be sure, religious as to the proposition that the economic laws of supply and demand have not been repealed, but he is agnostic as to the precise level of both NAIRU and potential productivity growth. There are limits, he says, but he is wisely unwilling to declare what they are, because he honestly doesn't know. I applaud this honesty, and applaud it loudly. So, you ask, why do I have visions of Greenspan fly fishing in a deli?

Excuse Me, Mr. Greenspan:

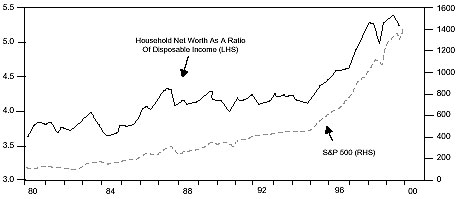

"The Wealth Effect Is Not That Closely Tied To The Stock Market?"

Figure 1

Source: Goldman Sachs

The Man's Own Words

Over the last two weeks, Mr. Greenspan has, to put it bluntly, been duplicitous in his assessment of the role of the stock market in the Fed's policy formulation. The analysis that he has presented screams that he is gearing policy to capping gains in equity prices, yet he declares that the Fed is not targeting equity prices. First the analysis, from his Humphrey Hawkins testimony:

"Accelerating productivity entails a matching acceleration in the potential output of goods and services and a corresponding rise in real incomes available to purchase the new output. The problem is that the pickup in productivity tends to create even greater increases in aggregate demand than in potential aggregate supply. This occurs principally because a rise in structural productivity growth has its counterpart in higher expectations for long-term corporate earnings. This, in turn, not only spurs business investment but also increases stock prices and the market value of assets held by households, creating additional purchasing power for which no additional goods or services have yet been produced.

Outlays prompted by capital gains in excess of increases in income, as best we can judge, have added about one percentage point to annual growth of gross domestic purchases, on average, over the past five years. The additional growth in spending of recent years that has accompanied these wealth gains as well as other supporting influences on the economy appears to have been met in about equal measure from increased net imports and from goods and services produced by the net increase in newly hired workers over and above the normal growth of the work force, including a substantial net inflow of workers from abroad.

As would be expected, imbalances between demand and potential supply in markets for goods and services are being mirrored in the financial markets by an excess in the demand for funds. As a consequence, market interest rates are already moving in the direction of containing the excess of demand in financial markets and therefore in product markets as well. For example, BBB corporate bond rates adjusted for inflation expectations have risen by more than one percentage point during the past two years.

However, to date, rising business earnings expectations and declining compensation for risk have more than offset the effects of this increase, propelling equity prices and the wealth effect higher. Should this process continue, however, with the assistance of a monetary policy vigilant against emerging macroeconomic imbalances, real long-term rates will at some point be high enough to finally balance demand with supply at the economy's potential in both the financial and product markets.

Other things equal, this condition will involve equity discount factors high enough to bring the rise in asset values into line with that of household incomes, thereby stemming the impetus to consumption relative to income that has come from rising wealth. This does not necessarily imply a decline in asset values—although that, of course, can happen at any time for any number of reasons—but rather that these values will increase no faster than household incomes."

Here, Mr. Greenspan could not be clearer that he plans to (a) drive real interest rates high enough to (b) drive equity discount factors high enough to (c) slow asset appreciation to the rate of household income growth. Yes, that's what he said. He wants higher "equity discount factors" on equity earnings growth, so that equity prices will go up no faster than household income. Whether you agree or disagree with this as a policy objective, the message is unambiguously clear. He is targeting the stock market, more specifically the P/E multiple!

But Mr. Greenspan vigorously maintains that he is merely attempting to curtail the wealth effect, and that he is not targeting stocks:

"Let me empathize, Senator (Schumer), that we are not focusing monetary policy on the stock market. We are focused on the economy. To the extent that the stock market affects the economy, we respond to that. But it doesn't necessarily follow that if stocks prices go up or go down they will have an effect on the economy which requires us to respond. We don't look at stock prices and say, if they're rising, we have to raise interest rates. We look at the wealth effect and the wealth effect is not that closely tied to the stock market (bold added). I mean, it's a broad sort of thing, but we cannot argue there is a direct relationship between what's happening in the stock market and what's happening to monetary policy. That is not our interest."

So, in one breath, Mr. Greenspan says that the equity market-driven wealth effect is the skunk at the aggregate demand picnic and that he's going to scotch it, and then in the next breath, he says that the equity market is only a distant relative of the skunk family. This simply doesn't square, as graphically displayed in Figure 1.

"Oh, cut him a break," I hear some of you retorting, "he can't really declare that he's targeting stocks, even if that is in fact what he's doing." I understand that political argument. And if all that was involved were the normal winking and nodding of politically correct life, I would have no problem with Mr. Greenspan's euphemistically fuzzing up the truth. For central banks, however, which have legally-granted monopoly control over short-term interest rates, fuzziness in the identification of policy targets is not a virtue, but a vice.

Remembering Louvre

By definition, a variable takes on a different character once it becomes a central bank's target variable (in economic circles, this is known as Goodhart's Law). The previous endogenous relationship between the variable in question and other variables breaks down, because the target variable becomes an exogenous variable that the central bank is seeking to influence.

A textbook example of this phenomenon is the period after the Louvre Accord in February 1987, when the Fed and its G-7 brethren decided to adopt target zones for major currency rela-tionships. The explicit targets were not revealed at the time, but the principle was: The dollar's huge decline over the preceding two years would be stopped by coordinating monetary policies. More specifically, a continued decline for the dollar would compel the Fed to tighten and/or for other G-7 central banks to ease.

In April 1987, with the dollar under pressure, the U.S. and Japan implemented the Accord, with the Fed tightening and the Bank of Japan easing, in explicitly coordinated fashion. With the dollar again under pressure in August 1987, the Fed tightened again. However, the Bundesbank didn't ease but, rather, tightened itself in September 1987. Which, of course, led to expectations of even more Fed tightening, driving bond yields sharply higher and ultimately, triggering the Crash of October 1987.

The simple dynamic in play was that if policy were to prevent the dollar from falling, then dollar-dominated asset prices would have to fall. After the Crash, of course, target zones for the dollar were abandoned, the Fed eased, stocks went up, and the dollar went down. The simple lesson of the episode (re-learned again in the emerging markets in the 1990s) is that a central bank should think long and hard, before it puts a kick-me sign on its back. But if it does, it should mean it!

Mr. Greenspan no doubt knows Goodhart's Law, and he had just begun his career at the Fed when the Louvre Accord stuff hit the oscillator. Thus, it is understandable that he does not want to declare that the Fed is now targeting stocks.

He does not want to set in place a dynamic in which expectations of tightening are ratcheted mechanically higher in other markets, every time stocks go up.

What he wants, it would appear, is for rising stocks to take his threat of tightening seriously, so he will not have to tighten seriously. Fed Chairman Volcker no doubt had the same hope when he entered the Louvre Accord, that the falling dollar would take his threat of tightening seriously, so that he would not have to tighten seriously.

Tortured Logic

What Mr. Greenspan seems to want is an immaculate correction in the wealth effect, without being named the father of a bear market in stocks. He resolutely maintains that he is not taking a position as to whether stocks are fairly valued:

"I'm not making a judgment as to whether in fact the wealth effect is overdone, the values overdone or not. It's not relevant to the argument that I'm making very specifically. It has secondary effects. I'm essentially saying that if you're getting accelerating productivity in an economy, the value of your capital assets should be going up. They are really worth more. The prospective earnings they can generate are indeed greater.

I'm not commenting on the secondary question as to whether the rise that has occurred is more than it should have. As I've argued previously, it is very difficult to make a judgment on whether we have a bubble, which is really what that would be, except after the fact. So, I'm not raising the issue in this context of there being an irrational surge in stock prices or speculative imbalances which are threatening the economy. That's a different type of argument. It's not the one I'm making."

Given the equity market's performance since Greenspan coined the phrase in December 1996, it is understandable that he refuses to use an "irrational exuberance" argument for targeting stocks. But by his own tortured current logic, he could make a case against stock price appreciation, even if (a) prospective stock earnings growth were being under-discounted in equity values, and (b) the equity risk premium was fair.

In that case, even if the stock market were theoretically irrationally pessimistic, it could still be appreciating too quickly, if it were generating a wealth effect, justifying Fed tightening to push up real interest rates. Reductio ad absurdum, I say. It is just not credible for a central bank to target a variable, and at the same time maintain that it has no sense of fair value for the variable!

Get Set For A Test

Here at PIMCO, we are willing to take a view where Greenspan isn't, and we believe that of the three "equity discount factors" in play, (a) real interest rates are probably closest to fair value, if not cheap, while (b) earnings growth expectations are over-discounted, and (c) the equity risk premium is too low — because it incorporates (d) the Greenspan Put, born of his record of easing whenever stocks fall sharply, and his expressed willingness to do the same in the future.

Thus, we are willing to say stocks are irrationally exuberant, notably growth stocks, and, in particular, technology stocks. And we're also willing to forecast that the whole constellation of global financial markets is going to test Mr. Greenspan's avowed intent to curb the wealth effect, as long as he argues that it is "not that closely linked to the stock market."

We hope he gets lucky, and that speculators long of the NASDAQ have more respect for him than speculators short of the dollar did in 1987. But we wouldn't bet it that way.

Men fly fishing in a deli are easy targets.

Paul McCulley

Executive Vice President

March 1, 2000

mcculley@pimco.com

Disclosures

No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission.

This article contains the current opinions of the author but not necessarily Pacific Investment Management Company, and does not represent a recommendation of any particular security, strategy or investment product.

The author's opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed.

This article is distributed for educational purposes and should not be considered as investment advice or an offer of any security for sale. Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Copyright ©1999-2003 Pacific Investment Management Company LLC. All rights reserved.