All Asset All Access: Macro and Market Signals Inform Portfolio Strategy

Summary

- Over the next decade, Research Affiliates expects global inflation to remain elevated relative to pre-pandemic levels; in the near term, we focus on the investment implications of inflation surprises.

- Key indicators inform Research Affiliates’ economic forecasts, and the current environment is unusual in several ways. The U.S. Treasury yield curve is inverted, the U.S. labor market has more job openings than applicants, energy prices may increase inflationary pressure, and Federal Reserve policy may be unpredictable. Several factors may increase the risk of a hard landing for the U.S. economy.

- The current positioning of the All Asset strategies reflects many different signals about global capital markets, including long-term income potential, mean reversion in valuation, diversification, recent price trends, expectations for changes in the global business cycle, and inflation surprises.

Jim Masturzo, CIO for multi-asset strategies at Research Affiliates, explains their near- and long-term inflation outlook and how the All Asset strategies are positioned accordingly. Campbell Harvey, head of research at Research Affiliates, discusses market and macroeconomic indicators informing their economic outlook. As always, their insights represent Research Affiliates’ views in the context of the PIMCO All Asset and All Asset All Authority funds. All Asset All Access is published quarterly.

Views expressed here are from Research Affiliates as of 10 November 2022. U.S. inflation data discussed is through 31 October 2022.

Q: What is Research Affiliates’ long-term outlook for global inflation?

Masturzo: For more than a decade, following the end of the global financial crisis, many observers, including we at Research Affiliates, have been concerned about the potential long-term inflationary impact from the large amount of stimulus injected into the system by global governments. Coupled with explicit stimulus, there have been tax cuts and extended periods of zero and negative interest rates. The result was a decade of inflation, but since that inflation was restricted to asset prices, rather than goods and services affecting consumers and businesses, few complained.

Additional fiscal spending and monetary stimulus, which only increased during the COVID-19 crisis, coupled with a multitude of supply shocks, finally stirred the inflationary pot to bubble over into the real economy. Central banks are actively raising rates in an effort to put the lid back on the pot, but massive sovereign debt levels challenge this effort as interest coverage becomes more difficult in the current low-growth world.

Given the path the economy has been traveling, at Research Affiliates we expect global inflation over the next decade to remain elevated relative to pre-pandemic levels. History informs this view: Our research into inflationary episodes in developed market economies since 1970 finds that when inflation surged above a 6% annualized rate, it took a median of more than seven years for inflation to dial down to a 3% rate or lower. (For details on this research, see “History Lessons: How “Transitory” Is Inflation?” by Rob Arnott and Omid Shakernia, published by Research Affiliates in November 2022.)

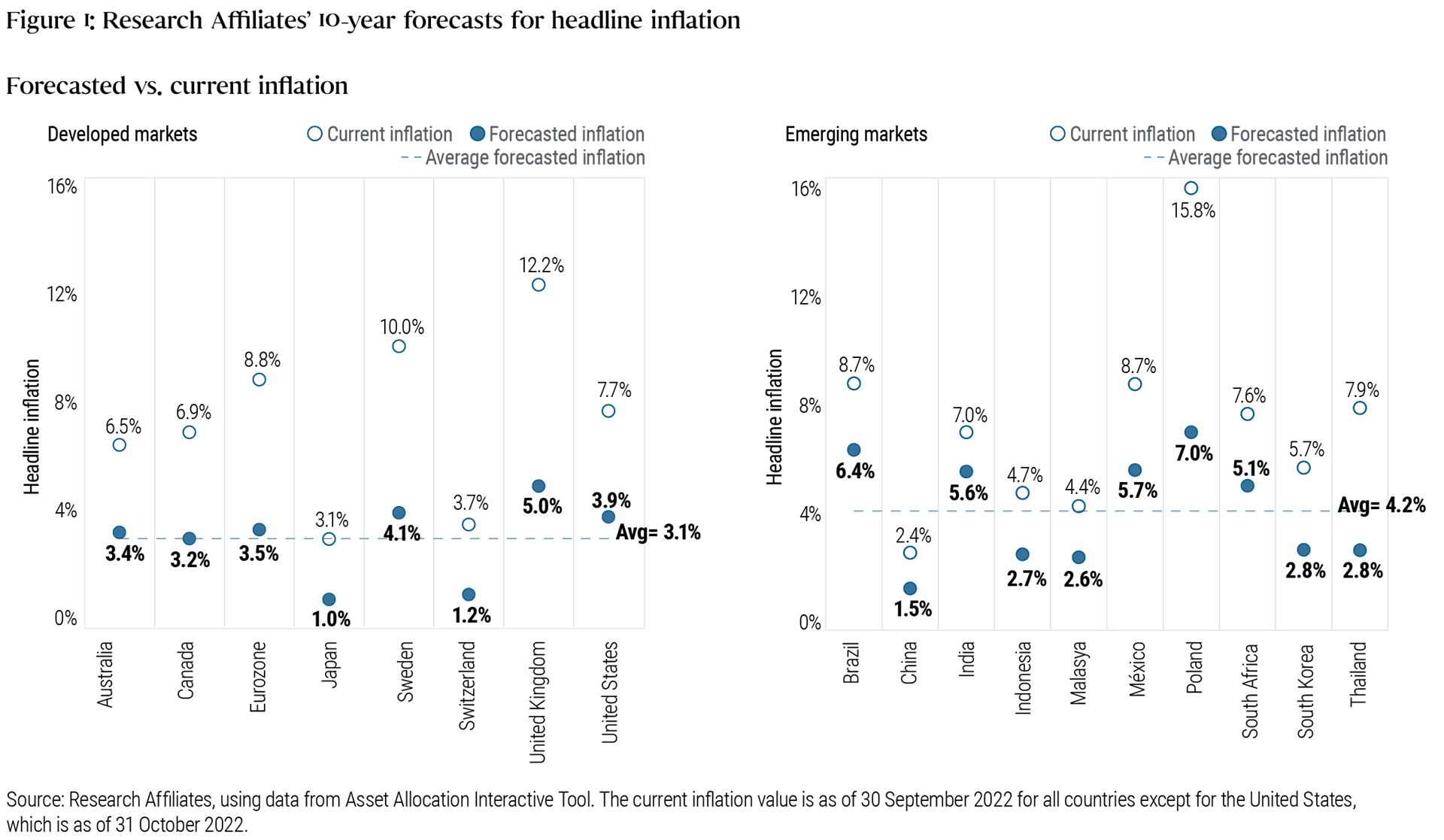

Figure 1 shows Research Affiliates’ long-term headline inflation forecasts. Over the next decade, in the U.S. we expect inflation will eventually fall from the current annualized level of 7.7% (as measured by the headline Consumer Price Index, or CPI) to a level of 2.1%, meaning consumers would experience an average annual inflation level of 3.9% over the decade.

Figure 1: Research Affiliates’ 10-year forecasts for headline inflation

We have a similar perspective for developed and emerging countries across the globe. We forecast decade average inflation levels of 5.0% in the U.K., 3.5% across the eurozone, and 3.4% in Australia. The only outlier is Japan, which we continue to expect to experience relatively muted inflation of 1.0%. In the emerging world, we expect long-term inflation rates of five to seven percent for Brazil, India, Mexico, Poland, and South Africa.

Q: What is Research Affiliates’ near-term inflation outlook?

Masturzo: We don’t explicitly create forecasts for global inflation over the short term, but instead focus on identifying the direction of surprises to the generally accepted forecasts in the market. In a recent paper titled “The Silver Lining of Unexpected Inflation” (Research Affiliates, September 2022), we show the inflationary impact historically on asset returns from inflationary surprises, i.e., the difference between actual inflation and forecasted expectations. In that paper, we show that different asset classes have demonstrated different sensitivities to inflation surprises. Assets like commodities have reacted positively when inflation surprised to the upside, while equities reacted negatively. U.S. Treasury Inflation-Protected Securities (TIPS), given their design, have barely been affected as their cash flows adjust for the realized inflation measure.

Since forecasts like those from the Survey of Professional Forecasters are produced with low frequency, our paper discusses how a moving average of realized inflation is a good proxy for these forecasts. Even though the October U.S. CPI inflation print of 7.7% was lower than September’s 8.2%, owing to the rolling off of last year’s 0.9% October inflation for this year’s 0.4%, the overall total remains elevated relative to trend. We expect this to provide a continued tailwind for such assets as commodities and a headwind for other risk assets.

Q: How are the All Asset strategies positioned in an effort to take advantage of today’s inflation regime?

Masturzo: The current positioning of the All Asset strategies reflects many different signals about various aspects of global capital markets, including long-term income potential, mean reversion in valuation, diversification, recent price trends, and expectations for changes in the global business cycle. In addition, Research Affiliates also looks at inflation surprises as a means to overweight (or underweight) assets given the latest surprise readings. Overall All Asset portfolio positioning is the result of positioning implied by each of these signals.

By incorporating a diverse set of signals into the investment process, Research Affiliates seeks to provide coverage and diversification across a landscape of asset risk drivers, while also providing diversification across different asset response horizons. For example, as inflation continues to surprise to the upside, we would continue to overweight assets that tend to be resilient to inflation surprises relative to the positioning we would take if inflation surprises were neutral. This allows us to target inflation-related asset price dynamics in our positioning, but would be insufficient to account for the way that high but decelerating inflation could also embolden investors to bid up prices in risk assets due to an expectation of a pivot in Federal Reserve policy. By also incorporating price trend and reversal signals in the process, we seek to also capture these more idiosyncratic dynamics that are best identified through faster-moving price response.

Q: What does your long-term research suggest about the macroeconomic implications of the current U.S. Treasury yield curve?

Harvey: The 10-year/3-month yield curve has inverted – meaning we are in a rare situation where long-term rates are lower than short-term rates. This indicator, which I developed in my dissertation at the University of Chicago, has successfully forecasted eight of the past eight recessions – without a false signal yet. Importantly, the 10-year/3-month yield curve needs to invert for a full quarter to qualify as a recession forecast – one or two weeks does not count. In my research I use a quarter because that matches the frequency that GDP is measured. This is a serious situation; and by December 31, we will know for sure if the signal goes code red.

Q: What other indicators do you monitor when assessing the direction of the economy?

Harvey: Indeed, the yield curve is only one input into creating Research Affiliates’ economic forecasts. This particular economic episode presents a number of unusual features. The first is the U.S. job market. Employment is typically a coincident or even a lagging indicator of the business cycle, so it is no surprise that unemployment is low before any recession. However, the nature of current U.S. unemployment is unusual in that there are still more job openings than applicants. This means there is a rare surplus labor demand. In a recession, many industries engage in layoffs, and typically people have trouble finding a new job because there are very few openings. That is, the duration of the unemployment in a recession tends to be long and painful. The current situation is different because of the excess demand for labor, which holds the possibility of shorter duration for unemployment. Indeed, it is possible that the unemployment rate rises but in a very moderate way. Taken on its own, the unique labor situation is an indicator consistent with a soft-landing scenario – a short, shallow recession, or even a zero-growth non-recession.

Another wild card in the current environment is inflation and the related actions of the Federal Reserve. From Research Affiliates’ perspective, the Fed appeared to be very late realizing that the U.S. inflation surge was not temporary. While the October 2022 year-over-year CPI appeared to moderate, it is important to closely look at the data. The October 2022 month-over-month headline inflation of 0.4% equates to a 4.8% annualized pace. This replaced the relatively high 10% annualized print in October 2021, which is why the rate went down. The next release will drop November 2021, which was a more moderate 5.9% annualized. In January 2022, we will drop a very low 3.7% annualized observation from the prior year. So even if we repeat the recent relatively moderate CPI print in the next two months, headline inflation would still increase to 7.8% by the January release.

There is also the matter of energy prices. While not well covered in the media, the Strategic Petroleum Reserve (SPR) appears to have been a major force in moderating U.S. gasoline prices. Additional releases before the election (and this is a not a partisan comment because I believe either party likely would have pursued the same policy) probably led to gas prices being lower than if there were no SPR intervention. Importantly, the level of reserves is at its lowest point since late 1984, according to the U.S. Energy Information Administration. Given it is unlikely that there will be additional SPR support following the election, I believe this increases inflationary pressures.

Inflation is like a tax and is generally bad for economic growth: Inflationary periods historically are highly correlated with recessions. Further, the Fed seems committed to using its blunt instrument, the fed funds rate, as well as quantitative tightening to reduce demand. Essentially, it appears the Fed officials’ plan is to push the U.S. economy into recession (but they hope a mild one). Whether a recession can be considered moderate is open to debate. One thing that is clear to us at Research Affiliates is that the combination of lingering inflation and the Fed’s delayed actions have increased uncertainty and, in my opinion, increased the chance of a hard-landing recession.

The All Asset strategies, including All Asset Fund and All Asset All Authority Fund, represent a joint effort between PIMCO and Research Affiliates. PIMCO provides the broad range of underlying strategies – spanning global stocks, global bonds, commodities, real estate, and liquid alternative strategies – each actively managed to maximize potential alpha. Research Affiliates, an investment advisory firm founded in 2002 by Rob Arnott and a global leader in asset allocation, serves as the subadvisor responsible for the asset allocation decisions. Research Affiliates uses their deep research focus to develop a series of value-oriented, contrarian models that determine the appropriate mix of underlying PIMCO strategies in seeking All Asset’s return and risk goals.

Featured Participants

Disclosures

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted, and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting www.pimco.com. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: The PIMCO All Asset Fund and the PIMCO All Asset All Authority Fund invests in other PIMCO funds and performance is subject to underlying investment weightings which will vary. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. The cost of investing in the Funds will generally be higher than the cost of investing in a fund that invests directly in individual stocks and bonds. The Funds are non-diversified, which means that it may invest its assets in a smaller number of issuers than a diversified fund.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2022-1125-2606484