All Asset All Access: Managing Portfolios Amid Evolving Market Narratives

Summary

- In Research Affiliates’ view, the long-term prospects of value stocks appear compelling, especially given today’s valuations.

- Research Affiliates’ data-driven models inform its long-term asset class forecasts and the portfolio allocations of the All Asset strategies. These models focus on three drivers of return: yield, growth, and valuation.

- Consistency across these predictive models is key, and Research Affiliates’ approach ensures that their macroeconomic expectations inform their market expectations.

Rob Arnott, chairman of Research Affiliates, discusses the prospects of value-oriented strategies in a high inflation environment. Michele Mazzoleni, partner in the multi-asset strategies team at Research Affiliates, explains the framework and the evolution of the long-term asset class return models that inform the All Asset strategies. As always, their insights represent Research Affiliates’ views in the context of the PIMCO All Asset and All Asset All Authority funds. All Asset All Access is published quarterly.

Q: If a high inflation environment persists, how does Research Affiliates expect value-oriented equity strategies to fare?

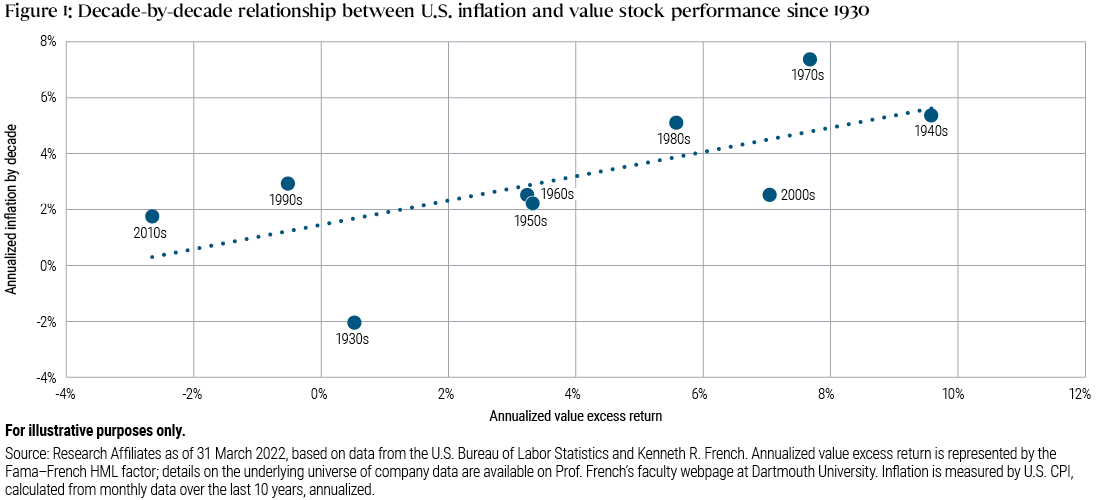

Arnott: While the relationship is not perfect, historically value has tended to win in inflationary regimes, and win or lose in disinflationary regimes. Looking back over the past nine decades, we observe this pattern of results, as reflected in Figure 1. As many of our readers may be aware, I’m on the record for forecasting that a high inflation environment is likely to persist, especially given my view of the likelihood of owners’ equivalent rent (OER), comprising approximately one-third of the U.S. CPI (Consumer Price Index), escalating rapidly in the coming years. If history is a guide, value is likely to fare well in such an environment.

From a portfolio perspective, I believe that ultimately, relative valuation trumps everything else. So, even in a scenario in which a high inflation environment doesn’t persist, the prospects of value markets and value-oriented strategies remain compelling. Why? Today the valuation of value stocks relative to growth stocks is as stretched as it was at the peak of the turn-of-the-millennium tech bubble. A narrowing spread should set the stage for potentially strong outperformance. With a current allocation of around 30% in value-oriented RAE strategies, the All Asset strategies should be well positioned to take advantage of this opportunity. At Research Affiliates, we believe we’re in the early stages of a major rebound of value in the years ahead.

Q: What do you see as potential risks to a continued rebound in value?

Arnott: In general, markets move based on changes in narratives, and most narratives have an element of truth. So, what current narratives could work against value, posing as potential risks to their rebound? A few plausible possibilities include renewed lockdowns, shutdowns, and worsening supply chain disruptions.

Another possible narrative is that technological innovations can cause value-oriented companies to become irrelevant. To that point, let’s not forget that disrupters get disrupted: In 2000, 3Com spun out the mobile device company Palm, which quickly traded to be worth more than many companies in the Dow Jones Index. A few years later, the Palm was disrupted by the Blackberry, and then the Blackberry was disrupted by the iPhone. Today’s disrupters disrupt past disrupters; this is the nature of innovation. As such, let’s be careful about overpaying for innovation, because today’s innovation may be tomorrow’s stale idea.

At Research Affiliates, we believe the return opportunity for value over the next five years is compelling, especially for the patient long-term investor. If one of the aforementioned narratives plays out, then long-term patient investors could have another chance to rebalance into value at even more attractive levels than today.

Q: Research Affiliates’ models of capital market return forecasts inform the asset allocation decisions of the All Asset strategies. How do you model long-term return forecasts of various asset classes?

Mazzoleni: Our modeling approach is based on three drivers of return: yield, growth, and valuation. Yield is an observable metric that expresses the attractiveness of the asset based on the cash distribution it pays relative to its current price. Because of its observable nature, yield is the natural foundation for any forecasting framework.

In contrast, the growth and valuation components must be predicted with the aid of fundamental models, which allow us to focus on long-term price dynamics. For instance, growth in equity markets reflects the expected evolution of companies’ earnings, and in our models we combine historical earnings data with our output growth forecasts in its estimation. Since earnings and output growth tend to be closely related variables, we seek to ensure our capital market estimates are consistent with our macroeconomic predictions.

In Research Affiliates’ models, the valuation component of return reflects an asset’s expected change in yield due to its reversion toward a fair value. For U.S. Treasury bills, the fair valuation reflects a combination of long-term expectations of real GDP growth and inflation, while for risk assets it reflects a continuously updated moving average of various valuation metrics including term premia, spreads, multiples, and exchange rates.

Q: Research Affiliates’ research-driven approach continually evolves with new insights. Could you share the recent enhancements to the methodology?

Mazzoleni: Consistency across our predictive models is key to generating precise predictions. As noted above, our approach ensures that our macroeconomic expectations inform our return expectations. We also apply the same modeling techniques across different asset classes whenever possible. For each asset class, we now measure the valuation parameters’ speed of mean reversion to fair value in a dynamic fashion. We employ weighted moving averages to identify fair values, and we estimate the speed at which current valuations will revert to equilibrium levels via regression models. These estimated speeds are continuously updated as new data become available, which allows us to balance the desire for stable parameter estimates with the need to gradually reflect potential changes in market dynamics.

Q: How are valuation-reversion building blocks of returns accounted for within the All Asset funds today?

Mazzoleni: As suggested by its labeling, the valuation component of Research Affiliate’s model reflects the concept of value investing from a multi-asset perspective. By relying exclusively on return expectations from expected changes in relevant valuation parameters, we generate portfolio tilts that seek to overweight “cheap” asset classes and underweight “expensive” ones. Within the All Asset strategies, these portfolio tilts are blended with a strategic portfolio reflecting Research Affiliates’ yield and growth expectations.

The choice of blending portfolios, in contrast to integrating the signals, is a recurrent theme in portfolio design and not unique to a multi-asset setting. We believe integrating signals can lead to more concentrated positions, which can be a costly decision when signals are relatively noisy. Instead, blending portfolios enables more diversified allocations within the All Asset portfolios and more attractive risk-adjusted return potential.

The All Asset strategies, including All Asset Fund and All Asset All Authority Fund, represent a joint effort between PIMCO and Research Affiliates. PIMCO provides the broad range of underlying strategies – spanning global stocks, global bonds, commodities, real estate, and liquid alternative strategies – each actively managed to maximize potential alpha. Research Affiliates, an investment advisory firm founded in 2002 by Rob Arnott and a global leader in asset allocation, serves as the subadvisor responsible for the asset allocation decisions. Research Affiliates uses their deep research focus to develop a series of value-oriented, contrarian models that determine the appropriate mix of underlying PIMCO strategies in seeking All Asset’s return and risk goals.

Disclosures

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted, and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting www.pimco.com. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: The PIMCO All Asset Fund and the PIMCO All Asset All Authority Fund invests in other PIMCO funds and performance is subject to underlying investment weightings which will vary. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Inflation-linked bonds (ILBs) issued by a government are fixed-income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives and commodity-linked derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. The cost of investing in the Funds will generally be higher than the cost of investing in a fund that invests directly in individual stocks and bonds. The Funds are non-diversified, which means that it may invest its assets in a smaller number of issuers than a diversified fund.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

The terms “cheap” and “rich” as used herein generally refer to a security or asset class that is deemed to be substantially under- or overpriced compared to both its historical average as well as to the investment manager’s future expectations. There is no guarantee of future results or that a security’s valuation will ensure a profit or protect against a loss.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2022-0509-2192331