Monthly Municipal Market Update, December 2021

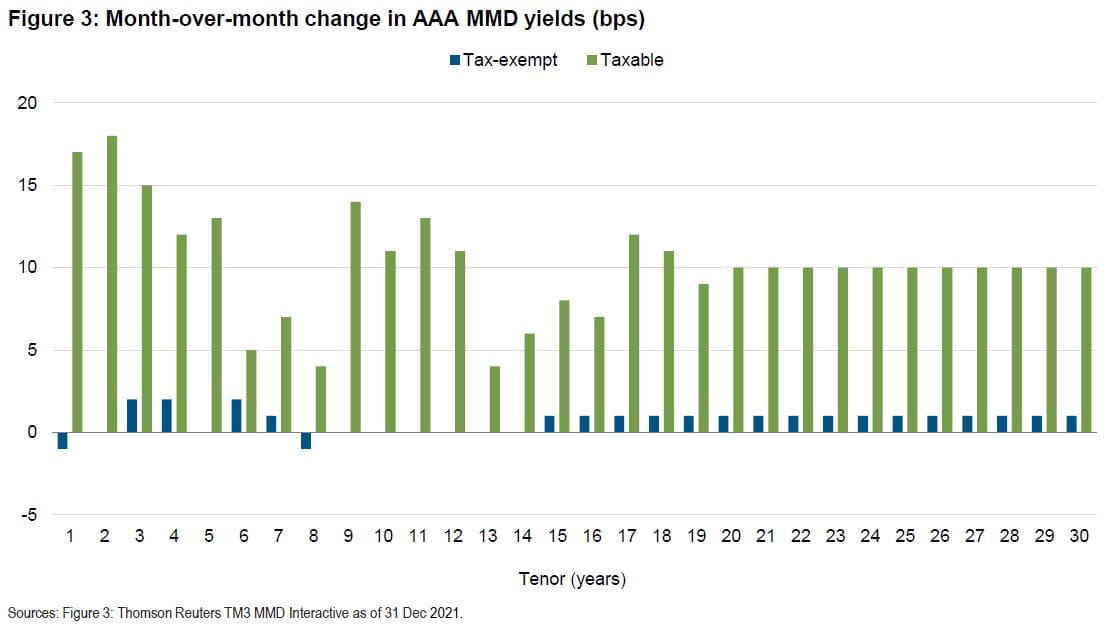

- The AAA Municipal Market Data (MMD) yield curve was relatively unchanged in December, with yields moving by no more than 2 basis points (bps) in either direction.

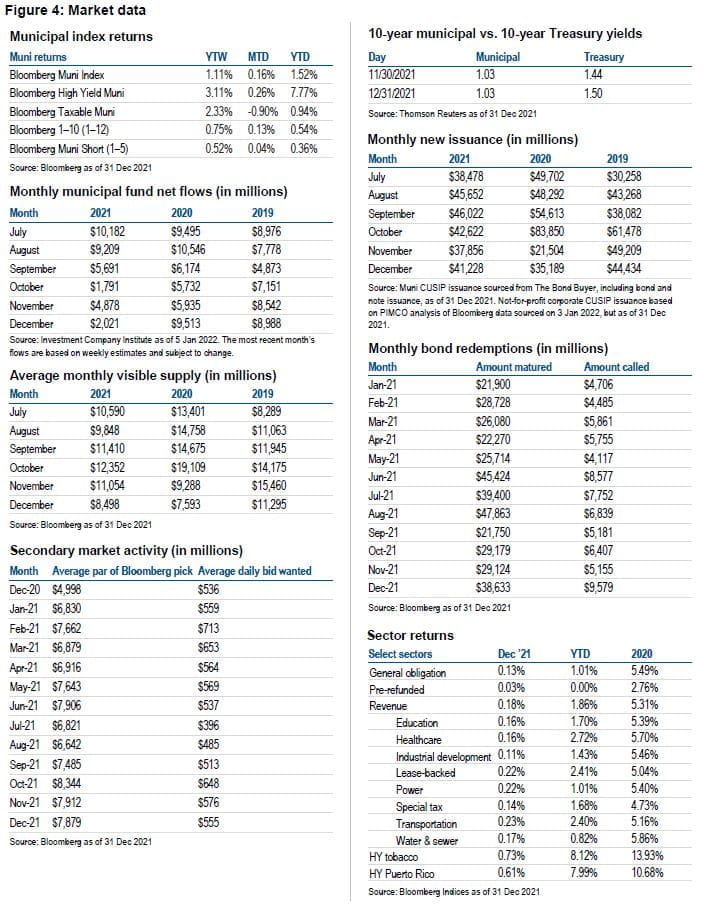

- In December, tax-exempt municipal bonds achieved positive returns while taxable munis experienced negative returns; ultimately, both tax-exempt and taxable munis delivered positive returns for the year.

- Despite the economic stress resulting from the pandemic, municipals weathered 2021, and most sectors entered the new year with stable or even positive outlooks.

December month in review

While major U.S. stock market indices notched impressive gains in 2021 – the S&P 500 rose 27% – many market participants expect a volatile start to the new year. Challenges posed by inflation, supply-chain disruptions and the omicron variant of the coronavirus loom overhead. At the same time, the Fed is preparing to unwind its asset purchase program at a faster pace than previously anticipated and is expected to raise rates multiple times.Footnote1

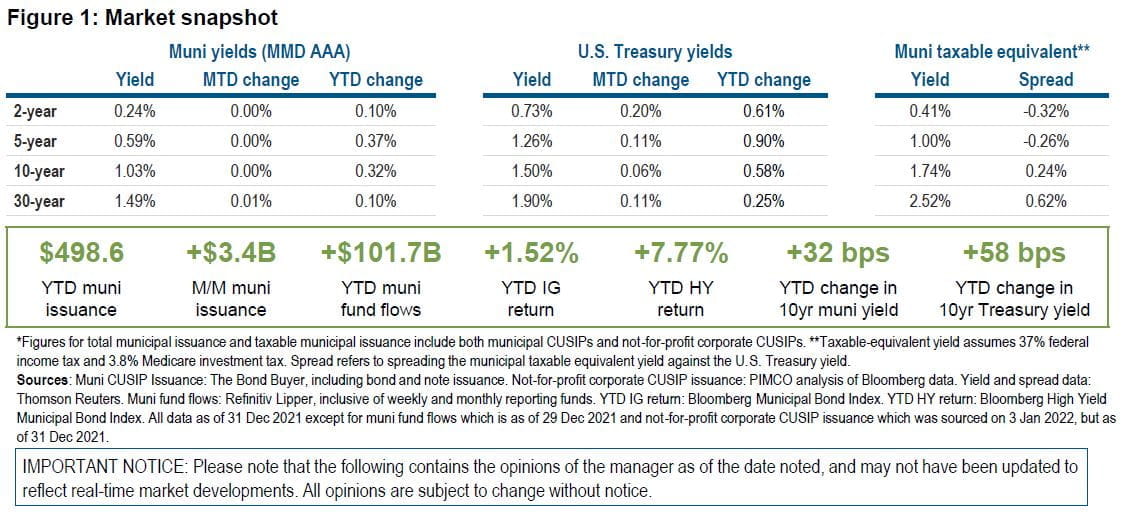

U.S. Treasury yields increased across the curve in December. The 1-, 5-, 10- and 30-year tenors of the curve closed the month (and year) at 0.38%, 1.26%, 1.50%, and 1.90%, respectively. Compared to 2020 year-end, these figures represented increases of 27 basis points (bps), 90 bps, 58 bps, and 25 bps, respectively.Footnote2 The AAA Municipal Market Data (MMD) yield curve was relatively unchanged in December, with yields moving by no more than 2 bps in either direction. In particular, 1-, 5-, 10- and 30-year tenors of the curve closed the month at 0.14% (down 1 bp), 0.59% bps (flat), 1.03% (flat), and 1.49% (up 1 bp), respectively. Similar to the Treasury curve, all of these figures were increases from the prior year-end, by 1 bp, 37 bps, 32 bps, and 10 bps, respectively.Footnote3

Municipal issuance in December totaled $41.2 billion, bringing 2021 total municipal issuance to $498.6 billion. This figure is nearly 5% shy of the prior year’s $524.3 billion figure, but still bested the previous record – $460.3 billion – set in 2017.Footnote4* Meanwhile, weekly and monthly reporting municipal bond funds gained $1.2 billion in the period ended Dec. 29, bringing inflows to $101.7 billion for the year. This is the highest full-year inflow figure since the data’s inception in 1992.Footnote5

- The Federal Reserve met in December and indicated an increased urgency in their economic tightening plans designed to combat inflation. Perhaps most notably, Fed officials approved an accelerated tapering of their asset purchase program, putting the program on track to end completely in March (as opposed to June). This puts the Fed’s policymakers in position to raise rates as early as their mid-March meeting, having previously made clear that they wanted to end the bond-buying program before doing so. The majority of Fed officials now project at least three interest rate increases in 2022.Footnote6

- In December, the Bloomberg Municipal Bond Index gained 0.16% and the Bloomberg High Yield Municipal Bond Index gained 0.26%, as muni rates were relatively unchanged. 2021 proved to be a strong year for tax-exempt municipal bonds, with investment grade munis returning 1.52% and high yield munis returning 7.77%. Meanwhile, the Bloomberg Taxable Municipal Bond Index returned -0.90% in December, bringing 2021 total return for the index to 0.94%.Footnote7

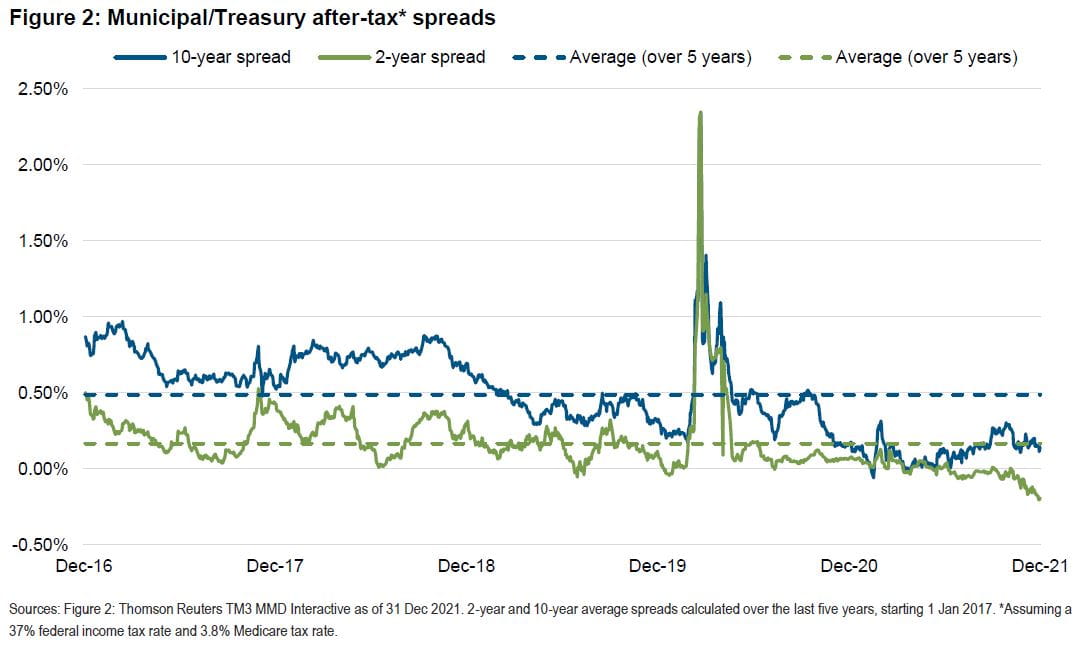

- Municipal/Treasury ratios decreased across the curve in December, with the ratio between 10-year AAA munis and 10-year Treasuries closing the month at 69% (down from 72%). Similarly, taxable-equivalent spreads from AAA municipal bonds to Treasuries tightened for the second straight month.Footnote8**

The secondary market experienced its most active month since June, with 641,000 total trades and $198 billion par traded in December. Final figures for the year amounted to 7,640,000 total trades (down just under 10% from 2020) and $2.2 trillion par traded (down nearly 27% from 2020).Footnote9

Muni technicals in focus: Municipal yields remain anchored while inflows cap off a record year

Against a backdrop of surging coronavirus cases and the Fed signaling an accelerated tapering of their asset purchases, the municipal market held steady in December, with municipal yields and credit spreads generally flat over the month.Footnote10 The 10-year municipal/Treasury ratio closed the year at about 69%, lower than 2020’s final print of approximately 77%.Footnote11

As the year concluded, demand for municipals was unabating, with four consecutive weeks of inflows in December.Footnote12 This came amid a year in which municipal bond mutual fund inflows totaled a record $101.7 billion, with inflows in 51 of 52 weeks.Footnote13 On the supply side, December experienced $41.2 billion in monthly issuance, bringing total issuance for the year to $498.6 billion.Footnote14 Forward-delivery sales, which allow issuers to lock in current rates and receive proceeds on a future delivery date, grew to a record of about $15 billion in 2021 as market participants anticipated future rate hikes.Footnote15 Looking forward, most forecasts predict between $400 billion and $480 billion of municipal issuance over the coming year, less than the record-setting $524.3 billion from 2020.Footnote16

From a credit perspective, the overarching theme of the past year has been the resiliency of the municipal market. Despite the economic stress resulting from the pandemic, municipals weathered 2021, with most sectors entering the new year with stable or even positive outlooks and municipal credit spreads generally having tightened to pre-pandemic levels.

We expect the emergence of the omicron variant to have an impact on municipals, but we believe most of the market is well-prepared. For example, larger cities, transit systems, and airports are likely to be adversely affected by omicron, but unprecedented federal relief should provide a degree of short-term flexibility.

Schools may again move to remote learning, though we do not expect this to materially impact credit quality. We believe that high quality nonprofit healthcare obligors, many of which posted solid profit margins last year and benefited from federal aid, have the tools to manage increased stress from the pandemic. Though we expect labor-related headwinds to be a key concern for the foreseeable future, recent boosts to liquidity should help management teams contend with these cost pressures as they seek longer-term budgetary adjustments.

To learn more about investing in municipals at PIMCO, please visit pimco.com/munis

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds is exempt from federal income tax and may be subject to state and local taxes and at times the alternative minimum tax; a strategy concentrating in a single or limited number of states is subject to greater risk of adverse economic conditions and regulatory changes. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not.

References to specific securities and their issuers are not intended and should not be interpreted as recommendations to purchase, sell or hold such securities. PIMCO products and strategies may or may not include the securities referenced and, if such securities are included, no representation is being made that such securities will continue to be included.

The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Forecasts, estimates and certain information contained herein are based on proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

PIMCO does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Any tax statements contained herein are not intended or written to be used, and cannot be relied upon or used for the purpose of avoiding penalties imposed by the Internal Revenue Service or state and local tax authorities. Individuals should consult their own legal and tax counsel as to matters discussed herein and before entering into any estate planning, trust, investment, retirement, or insurance arrangement.

Bloomberg Municipal Bond Index consists of a broad selection of investment-grade general obligation and revenue bonds of maturities ranging from one year to 30 years. It is an unmanaged index representative of the tax-exempt bond market. The index is made up of all investment grade municipal bonds issued after 12/31/90 having a remaining maturity of at least one year. The Bloomberg High Yield Municipal Bond Index measures the non-investment grade and non-rated U.S. tax-exempt bond market. It is an unmanaged index made up of dollar-denominated, fixed-rate municipal securities that are rated Ba1/BB+/BB+ or below or non-rated and that meet specified maturity, liquidity, and quality requirements. The Bloomberg Taxable Municipal Index represents a rules-based, market-value weighted index engineered for the long-term taxable bond market. For inclusion in the Index, bonds must be rated investment grade quality or better, have at least one year to maturity, have a coupon that is fixed rate, have an outstanding par value of at least $7 million, and be issued as part of a transaction of at least $75 million. The Intermediate Municipal subsector groups together securities with an average maturity between one to 10 years. The Bloomberg 1-10 Year Municipal Bond Index is an unmanaged index considered to be generally representative of investment-grade municipal issues having remaining maturities from 1-10 years and a national scope. The Bloomberg Muni Short (1-5) Index is the Muni Short (1-5) component of the Bloomberg Municipal Bond Index. It is not possible to invest directly in an unmanaged index.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for information purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

CMR2022-0107-1980215