Understanding the Completion Mandate Value Proposition

Summary

- Completion portfolios are custom LDI (liability-driven investing) solutions that, when combined with other fixed income mandates, seek to mitigate specific liability risk characteristics such as duration while customizing exposure along the yield curve.

- Although clearly a positive development for DB plans’ de-risking journey, the value of a completion portfolio may not be constant.

- We believe the most valuable completion mandate is always one that is within an active mandate (i.e., the bundled approach).

- This may be even truer at the end game when fixed income alpha may be a larger share of the alpha engine and the completion mandate is not lifting as much of the risk mitigation load as it did earlier in the journey.

For corporate defined benefit (DB) plans, there was a time when liability-driven investing (LDI) wasn’t part of everyday jargon. Today, however, more and more pension plan sponsors focus not only on the asset side of the equation, but also on how assets perform in concert with the underlying pension liability. As part of this increased liability awareness, the completion mandate was born. Completion portfolios are custom LDI solutions that, when combined with other fixed income mandates, seek to mitigate specific liability risk characteristics such as duration while customizing exposure along the yield curve.

Completion mandates are clearly a positive development. In this piece, however, we will seek to demonstrate that the value of a completion portfolio – although arguably positive at all points in our view – may not be constant along the de-risking journey. Said differently, there may be a point along the de-risking glide path where the completion mandate no longer punches above its weight. This doesn’t necessarily mean the completion mandate should be abandoned. It’s simply a time to assess the benefits and costs (both explicit and opportunity costs) of such an allocation.

What is a completion portfolio?

Consider a plan whose physical assets hedge 80% of the liability’s sensitivity to interest rates, but a 100% hedge is desired. The task of the completion mandate in this case is to hedge the remaining 20%. In addition to total duration, completion mandates can seek to hedge yield curve mismatches. The goal is to ensure that changes in the shape of the yield curve do not meaningfully affect a plan’s funded status. Some completion mandates go a step further and address the spread exposure embedded within the liability. When it comes to the allocation of assets to a completion mandate, two schools of thought dominate. In one, plan sponsors adopt a bundled approach to completion. In this case, the completion exposure is embedded within the active mandate of one of the plan’s LDI managers. Combined with the rest of the fixed income allocation, the mandate seeks to achieve the target hedge set by the plan sponsor. This type of completion mandate generally reduces operational burdens for plan sponsors (especially as it relates to rebalancing), lowers transaction costs, adds flexibility to target additional factors like spread duration, and, importantly, improves the ability to seek to generate alpha relative to custom benchmarks (to better match the high hurdle imposed by liability discount rate methodologies).

In the second approach, the completion mandate is set up as a separate, standalone beta-seeking portfolio (i.e., typically a Treasury- only allocation that seeks to hedge the liability’s return due to changes in Treasury rates). This typically results in assets being unbundled from the active fixed income portfolio in pursuit of beta-like returns, at the opportunity cost of forgone alpha potential and potentially cumbersome operational considerations.

Measuring the benefits of completion

Conventional wisdom, and we largely agree with it, suggests that the further a plan progresses along its glide path, the more important it is to have a custom solution to best match risk characteristics of the liability. This is simply because as plans de-risk (e.g., reduce their return seeking allocation), yield curve and spread exposure mismatches compose a larger share of the total surplus volatility. Therefore, custom solutions designed to address these risks have a larger overall risk-mitigating impact. That said, the value is not a singular measure.

Here are some ways to consider the value of a completion mandate:

- Does the completion mandate allow the plan to better achieve its target objectives (e.g., hedging more than the fixed income assets would otherwise allow)?

- Does the completion mandate improve implementation efficiency (e.g., as triggers are achieved, can the hedge be increased immediately with the completion mandate)?

- Does the completion mandate holistically hedge plan liability risks to improve funding ratio resiliency?

Depending on a plan’s location along its glide path, answers to these questions may change (or, at least, each factor’s magnitude may vary). This, in turn, alters the value a completion mandate provides – an especially important consideration because the costs of such mandates are relatively stable.

Completion mandates at early stages of the LDI adoption glide path

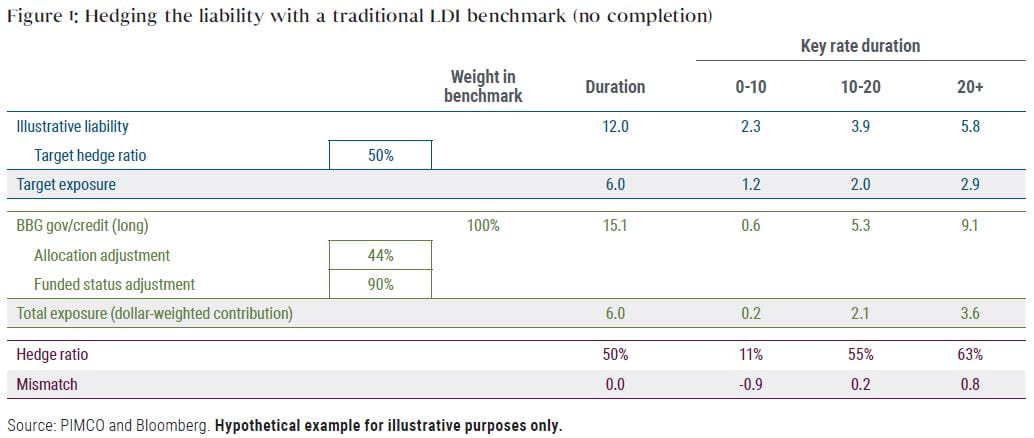

For this scenario, we’ll define “early stages of LDI adoption” as a below-average allocation to fixed income. The plan outlined in Figure 1 is 90% funded with a 44% allocation to fixed income assets, which achieves a 50% hedge of the liability’s sensitivity to U.S. Treasury rates.

The balance of assets is allocated to return-seeking investments (e.g., the MSCI ACWI Index for purposes of this paper). We estimate the surplus volatility is just under 9%. The two largest drivers of volatility are exposure to return-seeking assets and the interest rate sensitivity mismatch relative to liabilities.

If the plan sponsor is comfortable with the overall hedge ratio (i.e., 50% in this example), the primary advantage of a completion mandate would be to potentially improve the yield curve mismatch versus the liability. Note, there is about one year of curve mismatch relative to the desired hedge ratio between the front-end and long end. This suggests a discrepancy of about 100 basis points (bps) between the expected and realized funded ratios, under a scenario with 100 basis points (bps) of flattening or steepening of the yield curve.

In this scenario, the improvement to surplus volatility from a completion mandate ranges from small to perhaps unnoticeable because the volatility is dominated by the return-seeking assets and general exposure to rates. If, however, the plan desired a higher hedge ratio than the 50% provided by the current fixed income allocation, a completion mandate that allows the use of U.S. Treasury futures would most likely decrease surplus volatility and better align outcomes of the fixed income portfolio with those of the liabilities, thus improving the value proposition of the completion mandate.

Completion mandates at middle to later stages of the LDI adoption/glide path

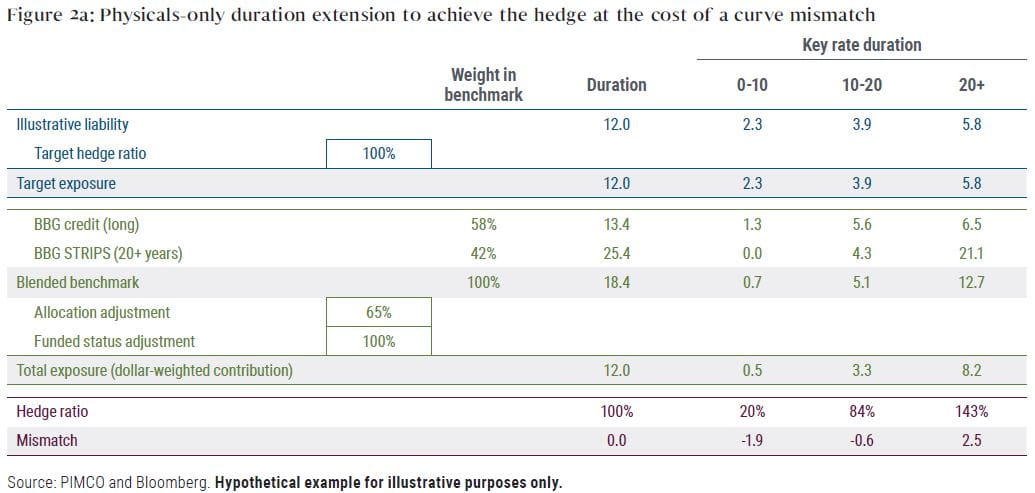

For this scenario, we’ll define “middle to later stages of LDI adoption” as an average or above-average allocation to fixed income. The plan in Figure 2a is 100% funded with a 65% allocation to fixed income assets that target a 100% hedge ratio. We estimate that the surplus volatility of this plan is just over 4%.

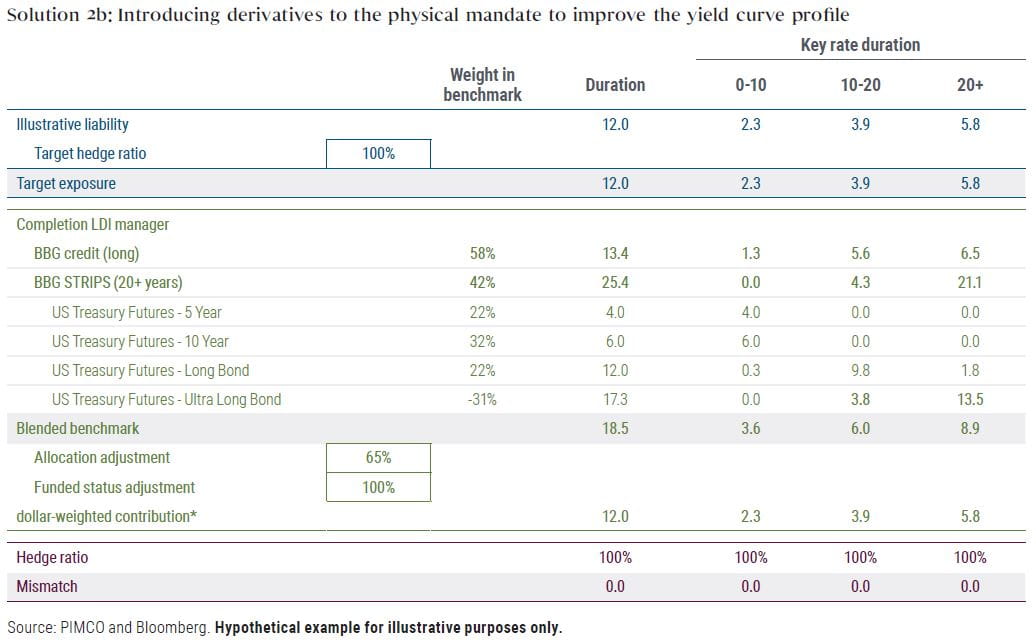

To achieve the 100% hedge target, we customize the fixed income benchmark using only physical assets. As a result, the benchmark is significantly longer in duration than the liability (18.4 years versus 12 years), and this leads to a substantial yield curve mismatch. As noted in the last row of Figure 2a, the portfolio’s contribution to duration in the 20+ key rate duration (KRD) bucket is 2.5 years longer than that of the liability. The exposure to the front end of the curve is 1.9 years short versus the liability. Thus, if the yield curve steepens, the assets will underperform the liability. As an example, if the 10s/30s curve steepens by 100 bps, the funded status may deteriorate by about 250 bps (versus an expectation of no funded status impact, given the 100% hedge ratio target). This is a substantial impact compared with the surplus volatility estimate of the plan. Said differently, fixing the yield curve mismatch is more impactful in a scenario where the plan targets a high hedge ratio and the key rate duration profile of the fixed income assets is meaningfully different than that of the liabilities. In this scenario, a completion mandate that allows the use of derivatives would enable the plan sponsor to achieve its desired hedge target without needing to compromise on the yield curve match, and as such, the value of a completion approach for this plan and at this stage of the glide path journey is significant. See Figure 2b for a sample completion solution.

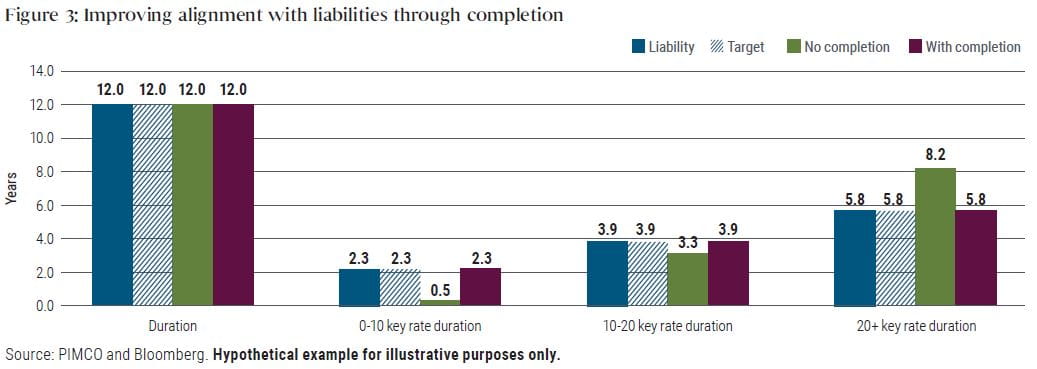

Figure 3 shows a comparison of key risk metrics for an allocation with and without completion. The largest corrections are in the key rate mismatches in the 0-10 year and 20+ key rate buckets.

Completion mandates at the end game

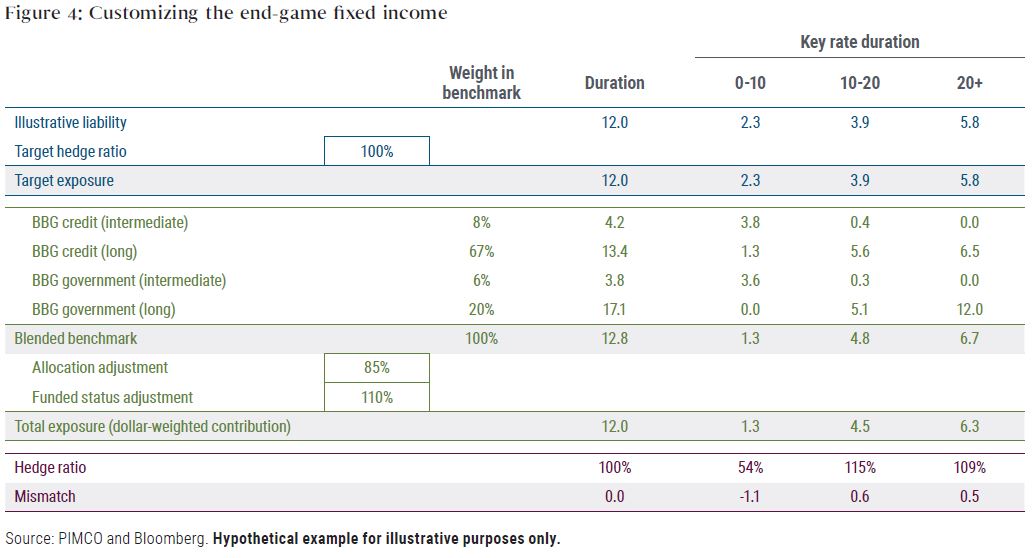

For this scenario, we’ll define “end game” as a plan that is at the end of its glide path journey. Specifically, Figure 4 shows a plan that is 110% funded with an 85% allocation to fixed income assets targeting a 100% hedge ratio. We estimate surplus volatility of this plan is just over 2.5%.

The key at this stage of the glide path is that, relative to earlier, middle, and even later stages, the large allocation to fixed income and the overfunded nature of the plan allow for physical fixed income assets to be allocated such that hedging objectives (inclusive of yield curve exposure) are largely achieved without the need for much (if any) allocation to a completion mandate. For example, at this end-state stage, the residual 20+ KRD mismatch (before any completion exposure) is less than a quarter of what it is in the middle stage (0.5 years versus 2.5 years).

Furthermore – and perhaps an even larger consideration than volatility impacts – a bigger share of (if not the entirety of) the allocation to fixed income could be actively managed to seek better return outcomes if the reliance on (and allocation to) the completion portfolio is reduced. This is far from trivial for two important reasons. First, at the end state, when return-seeking asset allocations are at their lowest levels, alpha from the fixed income allocation is a large contributor to plan-level returns; second, the high hurdle imposed by liability discount rate methodologies suggests that a meaningful amount of excess return over a passive LDI implementation is required to properly match liabilities.

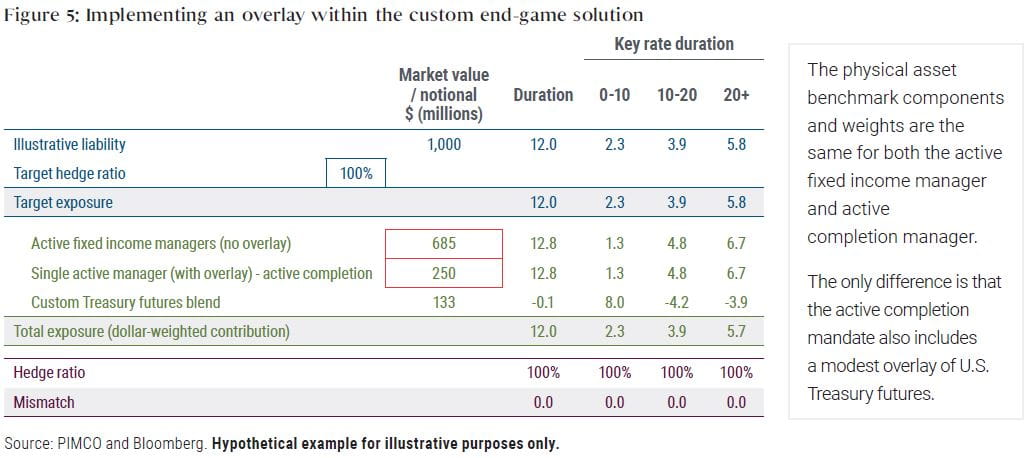

As noted, this doesn’t necessarily mean that plan sponsors should abandon the completion mandate at the end state. However, it may mean that the cost-benefit analysis doesn’t quite add up for certain types of completion mandates (e.g., the beta approach) as the benefits of such an approach at the end state decline while costs remain the same. If plan sponsors still need a bit of yield curve management at the end state, a more capital-efficient solution would bundle an overlay within an actively managed fixed income mandate as opposed to a standalone beta exposure that compromises that magnitude of excess return potential (see Figure 5).

Conclusion

Completion mandates are an extremely useful tool, and arguably have positive value in most plan scenarios. However, their value is not a constant figure and should be assessed at each point along the glide path journey.

Early in the journey, completion mandates can be valuable to plans seeking to hedge more of their interest rate risk than the physical allocation allows. For plans well along their path, and seeking higher hedge ratios, they may add value from a yield curve management perspective. But there may come a point in time when the value proposition of the completion mandate (especially a beta-style completion mandate) is less compelling, especially when its cost is taken into consideration. At the end of the glide path, plans tend to be overfunded with large allocations to fixed income. These fixed income allocations, if benchmarked appropriately, can achieve the hedging objectives of the plan, leaving less work for the completion mandate.

We would suggest that the most valuable completion mandate is always one that is within an active mandate (i.e., the bundled approach). This is even truer at the end game when fixed income alpha is a larger share of the alpha engine and the completion mandate is not lifting as much of the risk mitigation load as it did earlier in the journey.

Featured Participants

CMR2022-0708-2284406