Developed market central banks have likely reached the end of their rate-hiking cycles, yet a soft landing is far from assured. Looking ahead, two possible alternative scenarios emerge: inflation remains above central bank targets as growth fades into recession, and – potentially more dangerous – inflation rekindles. Amid this uncertainty, we believe it’s critical to design portfolios capable of performing well across a range of inflationary scenarios, which could include an allocation to real assets.

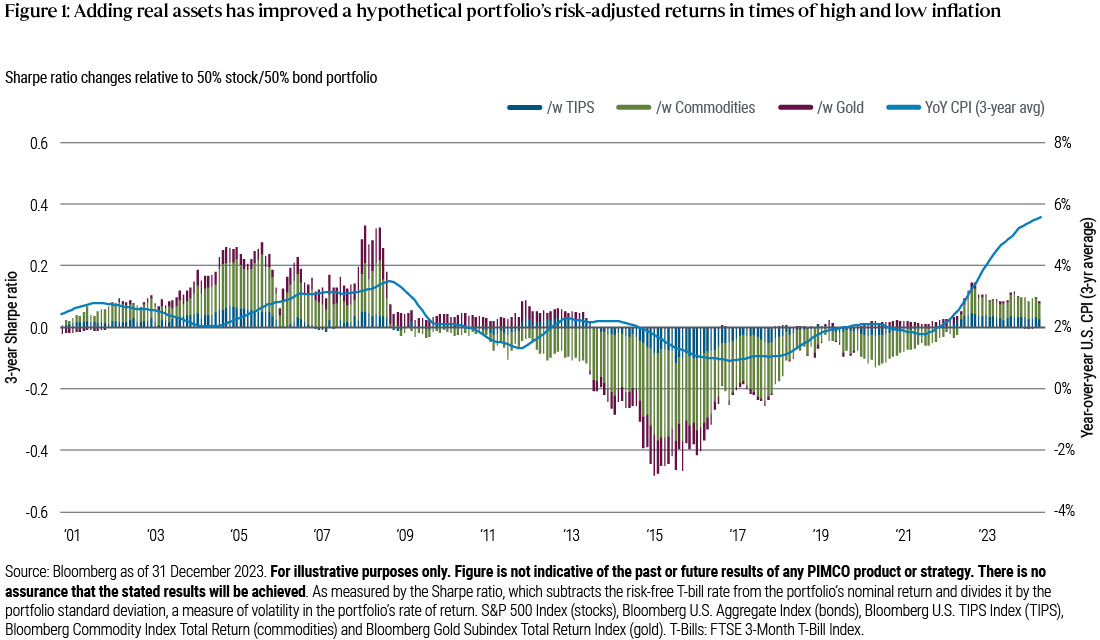

To this end, it is worth examining how adding real assets – which tend to appreciate with inflation – can help improve portfolio resilience. Our analysis starts with a hypothetical 50% stock, 50% bond portfolio and then adds a mix of real assets – Treasury Inflation-Protected Securities or TIPS (10%), broad commodity exposure (5%), and a dedicated gold allocation (2%).Footnote1, Footnote2

We then measure the improvement in inflation-hedging properties based on the increase in portfolios’ inflation betas (defined as the sensitivity of an asset’s return to inflation surprises). The initial stock/bond portfolio has an inflation beta of -2.1, while the new portfolio with real assets has an inflation beta of -1.3, meaning that the negative inflation sensitivity was cut significantly with an allocation to real assets.

Not surprisingly, during the recent inflation surgeFootnote3, the new hypothetical portfolio with real assets outperformed the initial 50/50 portfolio by 62 basis points, with less volatility, over the three-year period that ended 31 December 2023.

Less commonly known, however, is that the benefits of real assets do not require an inflation spike to occur. The inflation-hedged portfolio is generally advantageous even during more mild periods of inflation – when inflation runs at or above the Federal Reserve’s (Fed) 2% target, as we expect it to do this year.

Real assets – a hedge against inflation

Indeed, in the decade leading up to the global financial crisis, it was not uncommon for the consumer price index (CPI) to exceed 2%. During this 10-year period – from 28 February 1998 – the data show on average a 1.20% increase in annualized portfolio returns and a meaningful improvement in risk-adjusted returnsFootnote4 in the portfolio with an allocation to a basket of TIPS, gold, and broad commodities (see Figure 1). Inflation hedging proved valuable as inflation expectations rose, followed by an increase in actual inflation and central bank tightening. During this period, nominal bond and equity prices became positively correlated – declining in unison – while the real assets appreciated, providing valuable diversification.

Will inflation return to pre-COVID lows?

While we expect inflation will decline through 2024, dipping into the 2%-3% range across developed markets (DM), we think it is unlikely to return to the historically low levels of the decade leading into the pandemic, when it ran stubbornly below 2% (for more, see our latest Cyclical Outlook, “Navigating the Descent”). Several forces may apply an upward bias to inflation over the next five years:

First, responding to pandemic-era supply shortages, nations are moving manufacturing closer to home to make supply chains more reliable. The trend of globalization was a dominant factor in the disinflationary environment of the last 25 years; the momentum of its reversal could bring an upward bias to inflation.

Similarly, tensions with China are expected to increase trade frictions and thus the cost of goods consumed in the U.S. Geopolitical hotspots around the globe, including Ukraine, Gaza, and the Red Sea, all carry inflationary risks.

Finally, we think over the coming years DM central banks targeting 2% inflation will be willing to tolerate “2-point-something” percent as part of a strategy in which they expect a shortfall in demand during a future recession to return inflation to target. (For more, see our latest Secular Outlook, “The Aftershock Economy.”)

TIPS appear undervalued

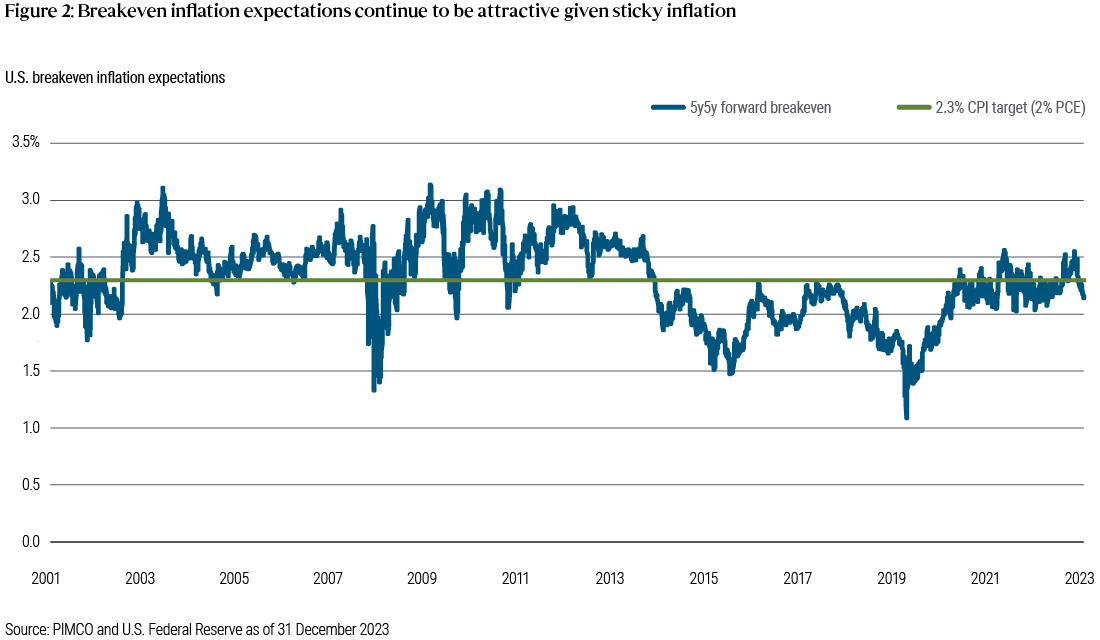

TIPS valuations appear compelling amid generous real yields – a bond’s nominal yield minus the expected rate of inflation – and what we believe are the market’s unrealistically low inflation expectations.

Real yields have climbed to their highest levels since 2009. Following a long period at very low or even negative levels, real yields appear compelling near 2%, particularly as the restrictive policy environment likely gives way to Fed rate cuts in the months ahead. Fed officials have been clear in describing current policy as restrictive, and that a reduction toward a neutral policy stance will eventually be appropriate.

Inflation expectations still reside below DM central bank targets by most measures (see Figure 2). These expectations, reflected in TIPS prices, can be thought of as the hurdle rate for TIPS to outperform nominal bonds. Given the structural risks we see to higher inflation, the market seems to undervalue the U.S. inflation protection these assets can provide a portfolio – both through unforeseen shocks, and during what may well be normal times ahead.

Conclusion

Historical returns underscore the importance of portfolio construction, emphasizing the need for inflation-hedging assets in traditional asset allocations. Our analysis suggested that the hypothetical portfolio’s returns and volatility may still benefit when adjusting the real asset allocations down to 5% and up to 30%. With TIPS near their most attractive valuations in 15 years and commodities still buoyed by geopolitical factors and supply constraints, investors could potentially benefit from an inclusion of real assets.

1 S&P 500 Index (stocks), Bloomberg U.S. Aggregate Index (bonds), Bloomberg U.S. TIPS Index (TIPS), Bloomberg Commodity Index Total Return (commodities) and Bloomberg Gold Subindex Total Return Index (gold). TIPS allocation sourced from bonds, commodities and gold allocations sourced pro-rata from stocks and bonds. Return to content

2 For this hypothetical scenario, we selected 50/50 as the baseline allocation ratio for the stock/bond mix (i.e., 50% S&P 500 and 50% Bloomberg U.S. Aggregate Index). For illustrative purposes, this 50/50 selection balances between the 60/40 stock/bond ratio typical in many U.S. portfolios and the 40/60 ratio common in Europe.

The allocation chosen is hypothetical, but the analysis was tested across a range of weights for real assets. The analysis suggested that portfolio return and volatility may benefit when real asset allocations ranging between 5% to 30% were added to the original 50/50 stock/bond portfolio (sourced as described in footnote 1). Return to content

3 As calculated from 31 December 2020 through 31 December 2023. Return to content

4 As measured by the Sharpe ratio, which subtracts the risk-free T-bill rate from the portfolio’s nominal return and divides it by the portfolio standard deviation, a measure of volatility in the portfolio’s rate of return. For the purposes of this blog we used the FTSE 3-Month T-Bill Index. Return to content↩