PIMCO’s Low Duration Opportunities ESG Strategy: A Sustainability-Focused Approach to Absolute Return-Oriented Fixed Income

- PIMCO’s Low Duration Opportunities ESG Strategy is an ESG-focused, absolute return-oriented fixed income approach that aims to generate consistent excess return over financing rates.

- The strategy focuses on capital preservation and liquidity management, while seeking limited volatility.

- It harnesses PIMCO’s highest-conviction views across the global fixed income opportunity set, driven by our secular thinking, global themes, and integrated investment process.

- The strategy may be appropriate for ESG-conscious investors looking to step out of cash, as well as investors looking to take a lower-volatility approach to absolute-return-oriented fixed income.

As ESG considerations have become increasingly important to investors, PIMCO has been at the forefront of delivering ESG-focused fixed income solutions. Extending its ESG platform into the low-volatility, absolute return-oriented space, PIMCO launched its Low Duration Opportunities ESG Strategy in July 2022. In this Q&A, portfolio managers Marc Seidner (also PIMCO’s CIO Non-Traditional Strategies) and Jelle Brons, along with fixed income strategist Michael Biemann, discuss the strategy’s potential benefits and considerations for investors, as well as PIMCO’s approach to ESG investing in multi-sector fixed income.

Q: What is the PIMCO Low Duration Opportunities ESG Strategy?

Seidner: The Low Duration Opportunities ESG Strategy (LDO ESG) is an ESG-focused, absolute return-oriented fixed income strategy that aims to generate consistent excess return over financing rates with limited volatility, while focusing on capital preservation and liquidity management.

We look to achieve this by harnessing PIMCO’s highest-conviction ideas across the global fixed income opportunity set (including rates, credit, and currencies), driven by our secular thinking, global themes, and integrated investment process. Taking a benchmark-agnostic approach also allows us the flexibility to manage around traditional fixed income risks.

At the same time, we use PIMCO’s established ESG investment process and actively optimize the strategy for ESG considerations, which go beyond merely avoiding issuers misaligned with sustainability principles. Our more extensive approach includes a strategic allocation to ESG-labelled bonds; an emphasis on high-quality, improving ESG issuers; and active management of the strategy’s carbon footprint. Additionally, we seek to engage with issuers in a constructive and collaborative way to positively influence their ESG practices over time.

More tangibly, from a portfolio construction perspective, the foundation of the strategy is liquid and high-quality short- to intermediate-dated bonds (with an emphasis on ESG-labelled bonds and issuers with best-in-class ESG practices). These may take the form of developed market government bonds, investment grade corporates, or high-quality securitized positions, depending on their relative attractiveness from a risk/reward perspective (as determined by our global team of portfolio managers and analysts). We complement this foundation with tactical positions reflecting our other high conviction views, including currencies, asset-backed securities, and emerging market bonds (where appropriate from an ESG and risk perspective).

It’s also important to note that as an ESG-focused strategy with a distinct approach and opportunity set, LDO ESG’s performance may deviate over time from otherwise similar strategies without explicit sustainability objectives.

Q: What differentiates PIMCO’s approach with this strategy?

Brons: The LDO ESG Strategy combines two areas of deep expertise at PIMCO: multi-sector fixed income and ESG investing. The strategy leverages the existing capabilities we use to manage a range of sector-specific ESG-focused strategies (including investment grade credit and emerging market ESG strategies); as well as other multi-sector fixed income strategies with explicit sustainability objectives (including global aggregate-benchmarked strategies as well as strategies focused on producing income). These firmwide resources include an extensive team of ESG analysts, dedicated ESG infrastructure (such as technology to analyze climate scenarios and track issuer engagements), and a growing set of third party ESG data.

At the security level, our enhanced research process incorporates detailed ESG asset evaluation that complements traditional credit ratings assigned by analysts. PIMCO’s robust ESG frameworks span corporate, sovereign, securitized, and municipal sectors, in addition to a unique ESG-labelled bond-scoring framework to evaluate the attributes of each ESG-labelled bond issuance. We believe that our proprietary ESG scoring model offers enhanced insights, and ensures independence.

Importantly, our proprietary ESG evaluation frameworks are tailored to fit the different asset classes in a multi-sector bond portfolio, focusing on each pillar of ESG – environmental, social, and governance. As an example, PIMCO recently participated in a solar loan asset-backed security (ABS) issuance for our existing multi-sector ESG strategies. We held a positive view not only of the security’s environmental impact given its promotion of renewable energy, but also its governance and its social credentials, given reduced utility bills and the responsible long-term structure of the underlying pool of loans. Of course, similar to other securities we evaluate, we also required a positive view on its valuation and fundamental credit quality.

Q: How does ESG fit into PIMCO’s top-down analysis, and how does PIMCO manage ESG risks?

Seidner: PIMCO’s investment process emphasizes rigorous analysis of broad secular trends that will impact the global economy and financial markets, many of which are directly related to environmental, social, or governance concerns. The firm’s annual Secular Forums are devoted to identifying and analyzing these longer-term trends, and we have assessed a number of ESG themes that are likely to have a profound impact, such as inequality and the climate transition.

Our 2022 Secular Outlook, “Reaching for Resilience”touches on our expectation that the brown to green energy transition will cause energy prices to be higher and more volatile over the secular horizon, and also that greater government support will be needed in many areas, including food security, healthcare, and climate risk mitigation. The combination of these forces will likely have a meaningful impact on inflation and fiscal spending, and supports a cautious view on the long end of major yield curves.

Specific to climate risks, our portfolio risk management framework leverages PIMCO’s climate tools, which include climate stress testing and scenario analysis. The insights these tools provide help us better manage and mitigate climate-related credit risks in specific sectors and issuers.

Q: How does PIMCO encourage issuers to align debt issuance with ESG objectives?

Brons: As a significant lender of capital, PIMCO is well-positioned to leverage its scale and long-standing relationships with many issuers’ senior management to exert meaningful influence. PIMCO is committed to supporting the evolution of the ESG bond market, and the issuance of ESG bonds continues to be one of our primary engagement goals.

Our engagement with a European commercial real estate firm provides an illustrative example. PIMCO engaged the issuer first on its green bond program, and subsequently on its sustainability-linked bond framework, encouraging the company to include an explicit link to ambitious greenhouse gas (GHG) emissions reduction targets. Insights gained through engagements like these also inform our issuer ESG evaluations, and the individual ESG bond scores.

PIMCO also engages with other entities on the evolving market for green securitizations, including housing finance providers on broadening access to credit.

Q: In what ways do ESG considerations inform the positioning of the Low Duration Opportunities ESG Strategy?

Seidner: Bottom-up security selection is driven by ESG evaluation, among other factors. In particular, the strategy emphasizes issuers with higher ESG scores as well as a core allocation to short- to intermediate-dated ESG-labelled bonds.

Corporates with leading ESG practices are emphasized, as well as issuers that are actively engaging on ESG topics and demonstrating progress towards their ESG goals. On the securitized side, residential mortgage-backed securities that support homeownership and promote responsible lending are in focus, as well as commercial mortgage-backed securities that leverage industry-standard green certifications and have a tangible positive impact on their communities. Government exposures are focused on sovereigns that score well on PIMCO’s proprietary sovereign ESG evaluation, which includes an evaluation of climate and environmental practices, civil and political rights, and institutional frameworks.

ESG exclusions mean the strategy is void of such sectors as military weapons, coal manufacturing, and tobacco. The strategy also has no exposure to issuers engaged principally in the oil industry, although green and sustainable bonds from issuers in this sector may be considered.

Q: What role could the LDO ESG Strategy play in an investment portfolio?

Biemann: With its diverse set of potential return drivers and strong focus on liquidity management and capital preservation, the Low Duration Opportunities ESG Strategy may be an attractive solution for ESG-conscious investors looking to step out of cash, as well as investors looking to take a lower-volatility approach to absolute-return-oriented fixed income. The strategy emphasizes capital preservation and makes full use of PIMCO’s proprietary risk analytics toolkit with rigorous and regular stress testing alongside daily monitoring of liquidity targets.

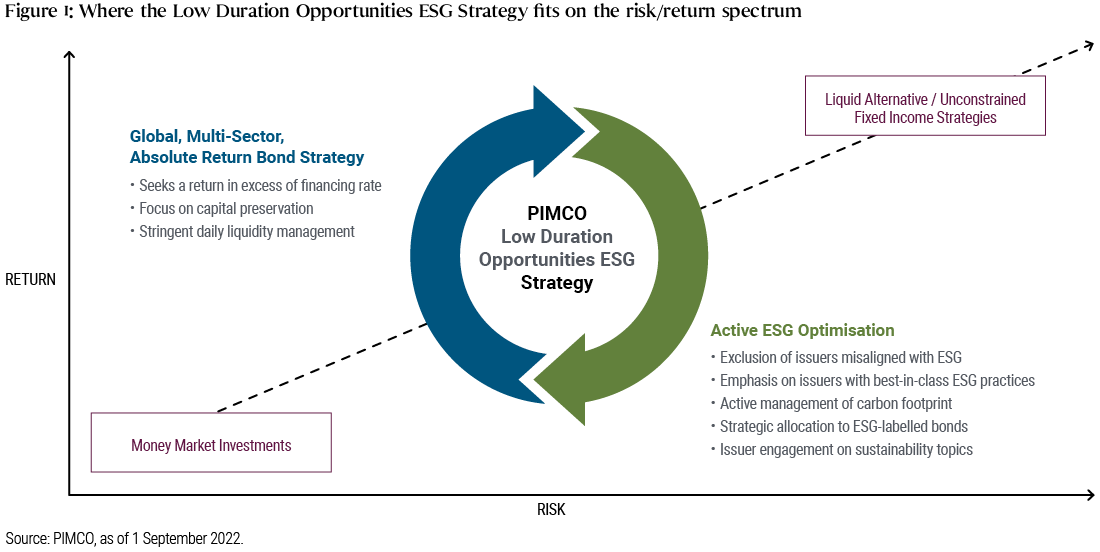

The strategy’s flexible multi-sector approach also allows it to navigate a range of market environments, while its core exposure to fixed income risk factors may offer diversification against equity and alternative allocations. From a risk/return perspective, the strategy sits between money market investments and more full-risk liquid alternative or unconstrained fixed income strategies.

Investors looking to structurally incorporate ESG into their allocations will also benefit from the strength and rigor of PIMCO’s established ESG platform, which is built on the three building blocks of exclusion, evaluation, and engagement. Learn more about ESG investing at PIMCO on our dedicated webpage.

Featured Participants

Disclosures

Marketing Communication

This is a marketing communication. This is not a contractually binding document and its issuance is not mandated under any law or regulation of the European Union or the United Kingdom. This marketing communication does not include sufficient detail to enable the recipient to make an informed investment decision. Please refer to the Prospectus of the UCITS and to the KIID before making any final investment decisions.

Additional Information/Documentation

A Prospectus is available for PIMCO Funds and Key Investor Information Documents (KIIDs) are available for each share class of each the sub-funds of the Company.

The Company’s Prospectus can be obtained from www.fundinfo.com and is available in English, French, German, Italian, Portuguese and Spanish.

The KIIDs can be obtained from www.fundinfo.com and are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the UCITS Directive).

In addition, a summary of investor rights is available from www.pimco.com .The summary is available in English.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. PIMCO Global Advisors (Ireland) Limited can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.”

All investments contain risk and may lose value. Investing in the bond market and/or investing in bond strategies is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.

Opinion and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

PIMCO is committed to the integration of Environmental, Social and Governance ("ESG") factors into our broad research process and engaging with issuers on sustainability factors and our climate change investment analysis. At PIMCO, we define ESG integration as the consistent consideration of material ESG factors into our investment research process, which may include, but are not limited to, climate change risks, diversity, inclusion and social equality, regulatory risks, human capital management, and others. Further information is available in PIMCO's Environmental, Social and Governance (ESG) Investment Policy Statement.

•At PIMCO, we define ESG Integration as the consistent consideration of material ESG factors into our investment research process to enhance our clients’ risk-adjusted returns. Material ESG factors may include but are not limited to: climate change risks, social inequality, shifting consumer preferences, regulatory risks, talent management or misconduct at an issuer, among others.

•We recognize that ESG factors are increasingly essential inputs when evaluating global economies, markets, industries and business models. Material ESG factors are important considerations when evaluating long-term investment opportunities and risks for all asset classes in both public and private markets.

•Integrating ESG factors into the evaluation process does not mean that ESG information is the sole or primary consideration for an investment decision; instead, PIMCO’s portfolio managers and analyst teams evaluate and weigh a variety of financial and non-financial factors, which can include ESG considerations, to make investment decisions. The relevance of ESG considerations to investment decisions varies across asset classes and strategies.

•The Fund’s ESG investing strategy may select or exclude securities of certain issuers for reasons other than financial performance. Such strategy carries the risk that the Fund’s performance will differ from similar funds that do not utilize an ESG investing strategy. For example, the application of this strategy could affect the Fund’s exposure to certain sectors or types of investments, which could negatively impact the Fund’s performance. •There is no guarantee that the factors utilized by the Investment Advisor will reflect the opinions of any particular investor, and the factors utilized by the Investment Advisor may differ from the factors that any particular investor considers relevant in evaluating an issuer’s ESG practices.

•Future ESG development and regulation may impact the Fund’s implementation of its investment strategy. In addition, there may be cost implications arising from ESG related due diligence, increased reporting and use of third-party ESG data providers.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the managers and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.