When High Alpha Met Low Beta

Summary

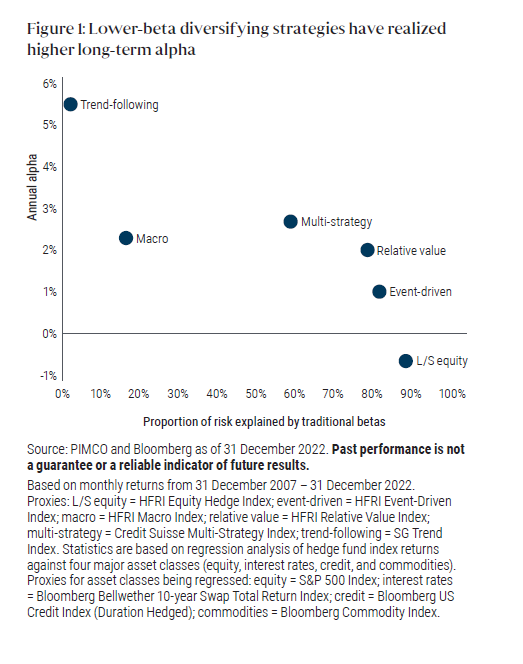

- An in-depth analysis of hedge fund performance demonstrates that, over the past 15 years, lower-beta hedge fund styles have generally achieved higher alpha, aligning with investors' objectives of maximizing returns and diversification.

- Within the hedge fund landscape, multi-strategy, macro, and trend-following strategies have delivered meaningful alpha while maintaining lower exposure to traditional market betas.

- The persistence of heightened market volatility may further extend this long-term trend, increasing the appeal for hedge fund strategies that offer the potential for both meaningful defensiveness and alpha.

More specifically, investors have historically tended to seek low beta strategies to diversify traditional asset classes and high alpha approaches in seeking to generate significant excess returns after controlling for traditional market exposures. Although many may assume a trade-off between alpha and diversification potential, that hasn’t been the case: Over the past 15 years, lower-beta hedge fund styles have realized higher alpha.

There are many potential explanations for this counter-intuitive result and each strategy has its own story (see our Featured Solution from March, “Modern Macro,” for a deeper dive). However, one pattern that emerges is that strategies with stronger “crisis alpha” during equity market drawdowns – precisely the scenario investors fear today if recession strikes – have also generated the highest long-term alpha.

Hedge fund strategy performance in 2022 provides the latest striking example. In 2022, while broad hedge fund indices declined 4.1% and $55 billion of capital fled the industry,Footnote1 lower-beta strategies such as multi-strategy, macro, and trend-following delivered positive performance and much-needed diversification.

Widening the aperture, hedge fund industry assets have doubled from $1.9 trillion in 2007 to $3.8 trillion today, despite cumulative net flows of only $42 billion. In other words, hedge fund assets have seemingly grown steadily thanks primarily to long-term performance, but investors need to look under the hood to evaluate which strategies are driving the growth and where capital is flowing. For example, long/short equity has shrunk from 37% to 28% of hedge fund assets since 2007, whereas relative value, macro, and event-driven categories have all grown.

Looking forward, many investors are asking which hedge fund styles are more likely to prosper in an environment of heightened volatility and prolonged higher interest rates to combat inflation (see our Cyclical Outlook from April, “Fractured Markets, Strong Bonds”).

Our framework for evaluating the historical performance of underlying strategies helps explain these trends. As in 2022, periods of high volatility have often coincided with stock market weakness – punishing hedge fund strategies with higher equity beta relative to lower-beta strategies including trend-following and macro.

Winning on both fronts: Positive alpha and increased diversification

The appeal of hedge funds has generally relied upon alpha generation and diversification from traditional asset classes. These are easily quantified with a simple model that regresses hedge fund returns against four major asset classes (equity, interest rates, credit, and commodities). The results show what proportion of a hedge fund’s historical returns is explained by traditional betas versus alpha.

It turns out that over the 15 years ending December 2022, strategies with lower beta to traditional markets – such as multi-strategy, macro, and trend-following – have also generated higher alpha (see Figure 1). This is a compelling “double-whammy” for allocators. Moreover, these results highlight the potential danger of evaluating hedge funds based on total returns alone. For example, a higher-beta strategy may have a greater total return than a lower-beta strategy during a bull market, but the composition of the lower-beta strategy’s return may have significantly more alpha. In a total portfolio context, investors are understandably unwilling to pay hedge fund fees for returns that can be replicated in traditional liquid markets.

Cyclical outlook favors lower-beta diversifiers

For investors reconsidering their hedge fund allocations, we believe it is critical to assess how the risk of elevated volatility and interest rates could affect various hedge fund strategies. As Figure 2 shows, lower-equity-beta strategies such as trend-following and macro (which had betas of -0.10 and 0.07 since December 1999, respectivelyFootnote2 ) have done better in periods of high volatility when stocks tend to struggle. In addition, trend-following and macro have outperformed during higher cash-rate regimes – likely, in part, because those strategies have more unencumbered cash available to invest at higher market rates.

Follow the trend

The data indicate that the composition of investor hedge fund portfolios is changing – and for good reason. Investors are discerning about where they will pay hedge fund fees, and are gravitating toward styles that are hitting on both alpha and diversification objectives. Elevated volatility and interest rates may prolong this long-term trend, increasing the demand for strategies with superior defensiveness and alpha potential.

1 Performance proxied by the HFRI Fund Weighted Composite Index and flows proxied by total industry data from HFR. Return to content

2 Proxies: Trend-following = SG Trend Index; macro = HFRI Macro Index Return to content

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Hedge fund and other alternatives strategies involve a high degree of risk and prospective investors are advised that these strategies are suitable only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. Performance could be volatile; an investment in a fund may lose money.

Beta is a measure of price sensitivity to market movements. Market beta is 1.

The correlation of various indexes or securities against one another or against inflation is based upon data over a certain time period. These correlations may vary substantially in the future or over different time periods that can result in greater volatility.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

The HFRI Equity Hedge Index is an unmanaged index that consists of a core holding of long equities hedged at all times with short sales of stocks and/or stock index options. Some managers maintain a substantial portion of assets within a hedged structure and commonly employ leverage. Where short sales are used, hedged assets may be comprised of an equal dollar value of long and short stock positions. Other variations use short sales unrelated to long holdings and/or puts on the S&P 500 index and put spreads. Conservative funds mitigate market risk by maintaining market exposure from zero to 100 percent. Aggressive funds may magnify market risk by exceeding 100 percent exposure and, in some instances, maintain a short exposure. In addition to equities, some funds may have limited assets invested in other types of securities.The HRFI Macro Index is an unmanaged index that involves investing by making leveraged bets on anticipated price movements of stock markets, interest rates, foreign exchange and physical commodities. Macro managers employ a “top-down” global approach, and may invest in any markets using any instruments to participate in expected market movements. These movements may result from forecasted shifts in world economies, political fortunes or global supply and demand for resources, both physical and financial. Exchange-traded and over-the-counter derivatives are often used to magnify these price movements. The HRFI Relative Value Arbitrage Index is an unmanaged index that attempts to take advantage of relative pricing discrepancies between instruments including equities, debt, options and futures. Managers may use mathematical, fundamental, or technical analysis to determine misvaluations. Securities may be mispriced relative to the underlying security, related securities, groups of securities, or the overall market. Many funds use leverage and seek opportunities globally. Arbitrage strategies include dividend arbitrage, pairs trading, options arbitrage and yield curve trading. The Credit Suisse Liquid Alternative Beta - Multi-Strategy Index reflects the combined returns of the individual LAB strategy indices – Long/Short, Event Driven, Global Strategies, Merger Arbitrage and Managed Futures – weighted according to their respective strategy weights in the Credit Suisse Hedge Fund Index. The SG Trend Index calculates the net daily rate of return for a group of 10 trend following CTAs selected from the largest managers open to new investment. The SG Trend Index is equal-weighted and reconstituted annually and has become recognized as the key managed futures trend following performance benchmark.

It is not possible to invest directly in an unmanaged index.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, Corso Vittorio Emanuele II, 37/Piano 5, 20122 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited Unit 3638-39, Phase II Shanghai IFC, 8 Century Avenue, Pilot Free Trade Zone, Shanghai, 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other) | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (110) Jin Guan Tou Gu Xin Zi No. 020 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Av. Brigadeiro Faria Lima 3477, Torre A, 5° andar São Paulo, Brazil 04538-133. | No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023 PIMCO.