European Outlook: Less Downside Now, But Caution Still Warranted

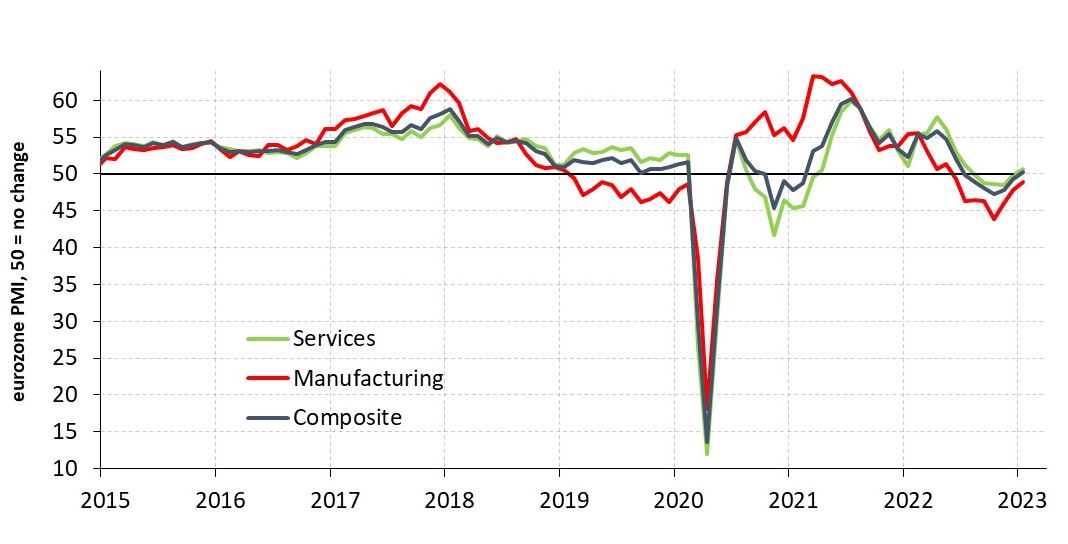

In recent weeks evidence has mounted that the eurozone economy is proving resilient in the face of large shocks from higher energy prices and tighter financial conditions. After hitting a low of around 47 in October, the Eurozone Composite PMI climbed back to over 50 in January (see Figure 1), pointing to stagnation rather than outright contractions in activity.

German industrial output, meanwhile, rose in November despite large falls in new orders during the month, reflecting the large order backlog built during the pandemic period. Impressively, the release of the preliminary German annual GDP print for 2022 implies that the economy expanded slightly in the final quarter of 2022, against broad-based expectations of a decline until recently.

Figure 1: Eurozone PMI

Source: PIMCO, Markit. As of 24 January 2023.

While the precise drivers of this resilience are unclear, we would point to the following factors: production being supported by significant pent-up demand and order backlogs from the pandemic period; pent-up household savings cushioning the blow from higher inflation; resilient labor markets, likely reflecting corporate caution over staff dismissals, given recent global labor supply shortfalls; and finally, a sharp turn in wholesale gas prices softening the energy price shock on households and, especially, corporates.

Lower recession risk but issues persist

While our expectation has been that a recession would be mild in Europe, recent data implies we may avoid recession altogether. But while that may be good news in the near term, it doesn’t come without issues.

In the December release, eurozone core inflation rose to a record 5.2% year-over-year (y/y), according to Eurostat. Some of this reflects price categories that are affected by global supply-side conditions and that will likely disinflate even if the economy is resilient. This would include core goods prices and service sector prices such as travel and accommodation, which are strongly affected by the post-pandemic re-opening. Still, for inflation to drop back to the European Central Bank (ECB) target of 2%, some cooling in the economy and in the labor market is likely required.

To get a sense of how much cooling we need, assume that wage growth (measured by negotiated wages, per ECB data) moves from its current 3% y/y to 4%–4.5% ahead – a reasonable expectation given recent wage agreements. With trend productivity growth at around 1%, this would imply that unit labor cost (ULC) growth could settle at 3%–3.5%.

To get to a level consistent with the ECB’s inflation target, ULCs and “sticky” core inflation must slow by 1 to 1.5 percentage points. Using data spanning back to the 1960s across 14 developed markets, we estimate that such a slowing in core prices could require an increase in the unemployment rate of 0.7 to 1.0 percentage points. However, so far, the unemployment rate has not moved at all, staying at a record low level of 6.5% in the eurozone in November.

Granted, we still expect weakening activity ahead, as some of the support from order backlogs fades and as tighter monetary policy feeds into the economy. But if the recent underlying resilience persists, the prospect of the ECB having to hike more than is currently priced in the market (which is for a peak policy rate of around 3.5%) becomes very real. In investment portfolios, we believe upping quality and liquidity when taking risk and exercising caution around the most economically sensitive areas of the market makes sense.

For details on our outlook for the global economy and investment implications for 2023, please read our latest Cyclical Outlook, “Strained Markets, Strong Bonds.”

Nicola Mai leads PIMCO’s sovereign credit research in Europe.

Participants en vedette

Déclarations

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-0119-2689217