Good News for Retirement Income

Summary

- Yields on bonds and stocks increased meaningfully in 2022, providing stronger conditions for generating portfolio income versus a year ago.

- Generating a 4%-5% yield from a portfolio of high-dividend-yield stocks and bonds appears achievable without the need to take excessive market risk.

- A balanced stock/bond portfolio can be useful in both providing a high level of current income and preserving the long-term purchasing power of assets.

Retirees today may have something to smile about. While 2022 was a rough year for markets, bond yields are currently at their highest in years, and equity dividends are generally higher, which means more income-earning potential for those in retirement.

The last time the yield on the U.S. Bloomberg Aggregate Index (core bonds) was in the 4%–5% range was in early 2009. Since then and until recently, generating reliable income from invested assets was challenging. This problem was particularly acute for retirees, who typically have lower risk tolerance, and thus tend to lean naturally toward fixed income.

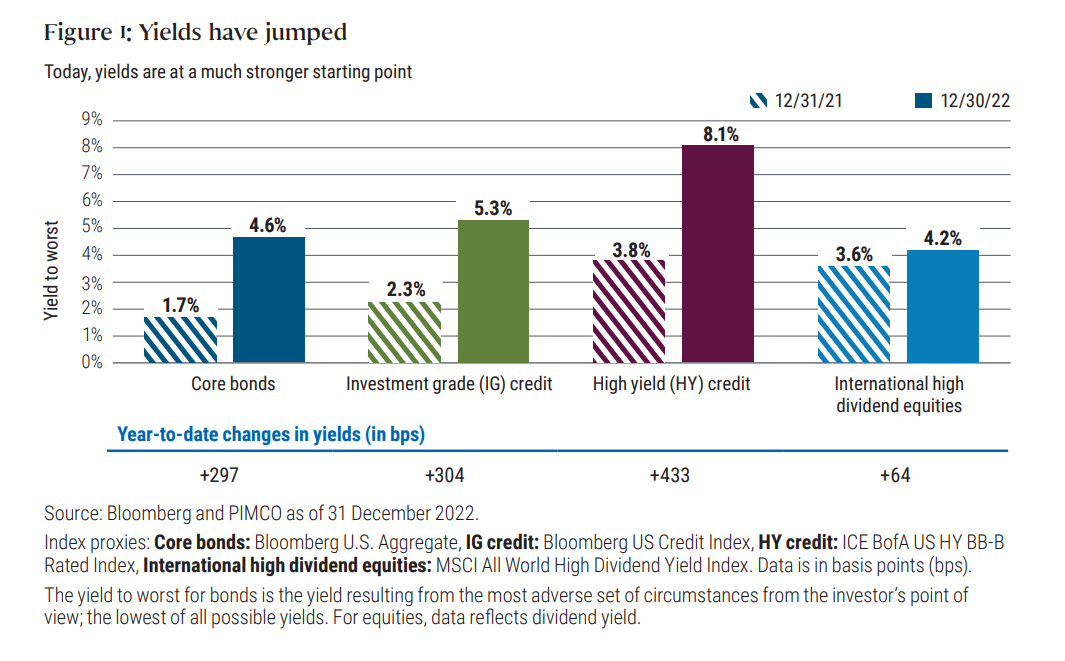

The preference for yield is understandable. It can help individuals seek a replacement to the “paycheck” received during their working years with periodic proceeds expected from dividend payments.Footnote1 According to the 2022 PIMCO Defined Contribution Consulting Study,Footnote2 86% of consultants say that their clients want to withdraw about 4%–5% annually from their investment portfolio to fund living expenses. For the first time in over a decade, the target distribution yield is a realistically achievable goal (see Figure 1). Yields on core bonds and corporate credit more than doubled last year. Dividend yields on stocks also have risen to more attractive levels.

When yields are higher as they are today, meeting retirement income goals is considered more attainable. For illustrative purposes, let’s say we have a retirement account balance of $500,000. If rates are 2%, retirement savings would generate only $10,000 of annual income. However, if rates are 5%, a portfolio invested with the same level of risk would generate $25,000 annually.

Why is an income orientation important?

In theory, whether income comes organically (from dividends and bond coupons) or via the realization of capital gains may make little difference: The investor could produce the same level of portfolio “income”.Footnote3 However, in an income-oriented approach, consumption increases when the level of organic income is high, and vice versa. This is consistent with the tendency of retirees to anchor their annual expenditures to income (see the Employment Benefit Research Institute’s (EBRI) 2018 studyFootnote4). The income-oriented approach has three important potential advantages in retirement.

- First, it can allow for a simpler way to spend portfolio income because dividend and coupons arrive in the investor’s account at regular intervals. Investors don’t necessarily need to generate income by selling assets at regular intervals.

- Second, converting savings into a stream of monthly “paychecks” to support consumption and postponing the start of Social Security benefits has historically resulted in a payment increase of about 8% for each year benefits are delayed up to the age of 70, according to the Social Security Administration.

- Third, an income orientation can create an automatic spending-adjustment mechanism that may consequently help enable those spending primarily from income to counter sequence-of-returns risk. This is the risk of crystallizing portfolio losses by spending from principal following poor market performance.

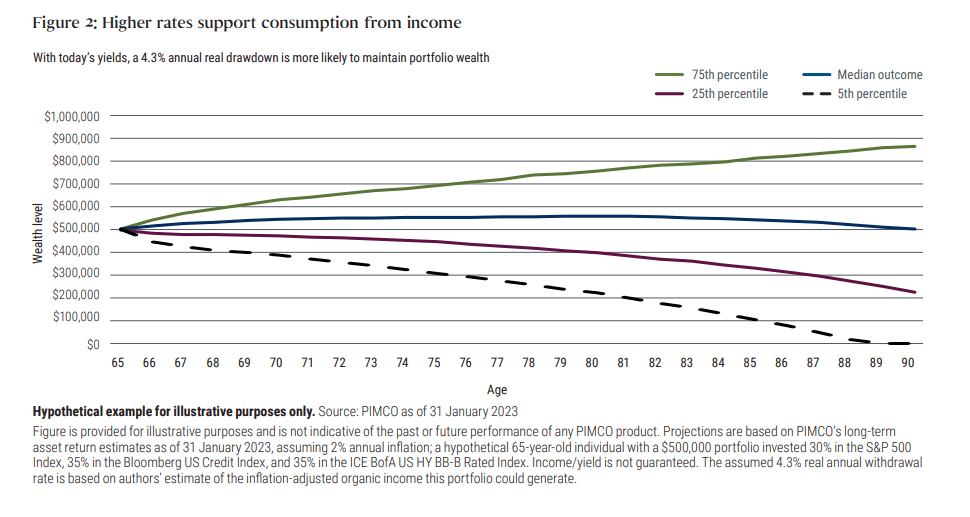

We think higher yields today may be able to support annual withdrawals of 4%–5% per year (after inflation), and this holds for a diversified bond portfolio and for a stock/bond portfolio. The higher-yielding environment today should be a tailwind for both.

In the median (blue line) in Figure 2, wealth remains basically steady even at age 90, so withdrawals sustain consumption while principal remains untouched. Only a severe scenario for returns, such as in the 5th percentile case (the black dashed line), leads to depletion of principal at age 89. This kind of extreme outcome is expected only rarely. Projections for a 4.3% annual drawdown at today’s yields are based on PIMCO’s supersecular (greater than 10 years) asset return estimates, which include our estimate of 2% annual inflation.

Benefits of a stock/bond portfolio approach to retirement income

Of course, savings today are meant to support consumption in the future, and the last few years have shown that inflation can occur quickly and unexpectedly and deliver a devastating blow to the purchasing power of savings. Therefore, we believe consumption should be viewed in inflation-adjusted (real) dollars. A stock/bond (balanced portfolio) approach to retirement income, one that combines high-dividend stocks and yield-oriented bonds, can be useful in providing a high level of current income while also preserving long-term purchasing power of assets.

Stocks, especially high-dividend equities, can be a useful source of income and capital appreciation over time. Furthermore, as stocks represent a claim on a company’s earnings, they may be helpful in keeping up with inflation in the long run, as earnings should eventually adjust to the overall inflation rate in the economy. Thus, with higher dividend yields in 2022, certain stocks may distribute a high level of current income and facilitate potential future real income growth and thus potentially align nicely with a retirement-income objective. Of course, combining stocks and bonds can often lead to stronger risk-adjusted results due to diversification benefits from combining less-than-perfectly correlated assets, but all investments contain risk and may lose value.

A simple path to retirement income

Anchoring spending to income is a relatively straightforward way for retirees to help preserve their assets. It can also mitigate the likelihood of running out of money, even decades after they have started to live off their savings. EBRI’s research shows us that is what many people actually do. And those who take it a step further and defer Social Security to maximize payments may meaningfully increase their guaranteed real income.

Today, with higher yields and dividends on bonds and stocks, we believe the ability of an investment portfolio to generate organic income is improved. Generating a 4%–5% yield from a portfolio of high-yielding stocks and bonds appears achievable without taking on excess risk compared with one or two years ago.

1 Investment products contain risk and may lose value. There is no guarantee that an investment product will be successful in producing income. Investors should consult their investment professional prior to making an investment decision. Return to content

2 All responses were collected from 4 January 2022 through 7 March 2022. The study results contain the opinions of the respondents and not necessarily those of PIMCO. The data contained within the report is not related to any PIMCO product or strategy and should not be relied upon for any investment decision. Return to content

3 Assumes investments are held in a non-taxable account Return to content

4 Sudipto Banerjee, “Asset Decumulation or Asset Preservation? What Guides Retirement Spending?” EBRI Issue Brief, no. 447 (Employee Benefit Research Institute, 3 April 2018). Return to content

Featured Participants

Disclosures

The analysis included here is not based on any particular financial situation, or need, and is not intended to be, and should not be construed as a forecast, research, investment advice or a recommendation for any specific PIMCO or other strategy, product or service. Investors should consult their investment professional prior to making an investment decision.

The analysis contained in this paper is based on hypothetical modeling. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Figures are provided for illustrative purposes and is not indicative of the past or future performance of any PIMCO product.

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Diversification does not ensure against loss.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

It is not possible to invest directly in an unmanaged index.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO

Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 | 800.387.4626

CMR2023-0308-2775436